Wednesday provided the ideal combination of factors for WTI crude oil bulls to regain their footing. US stockpiles fell much faster than expected with US driving season in full swing over the summer, but we also had a weaker US dollar following more dovish comments from two Fed members ahead of the media blackout period this coming Saturday. Furthermore, the Fed’s beige book was released which points to the ideal ‘soft landing’ scenario of slowing inflation with slight economic growth.

This saw WTI crude oil futures rise 2.6%, and the path of least resistance could pave the way for a retest of $85 over the foreseeable future.

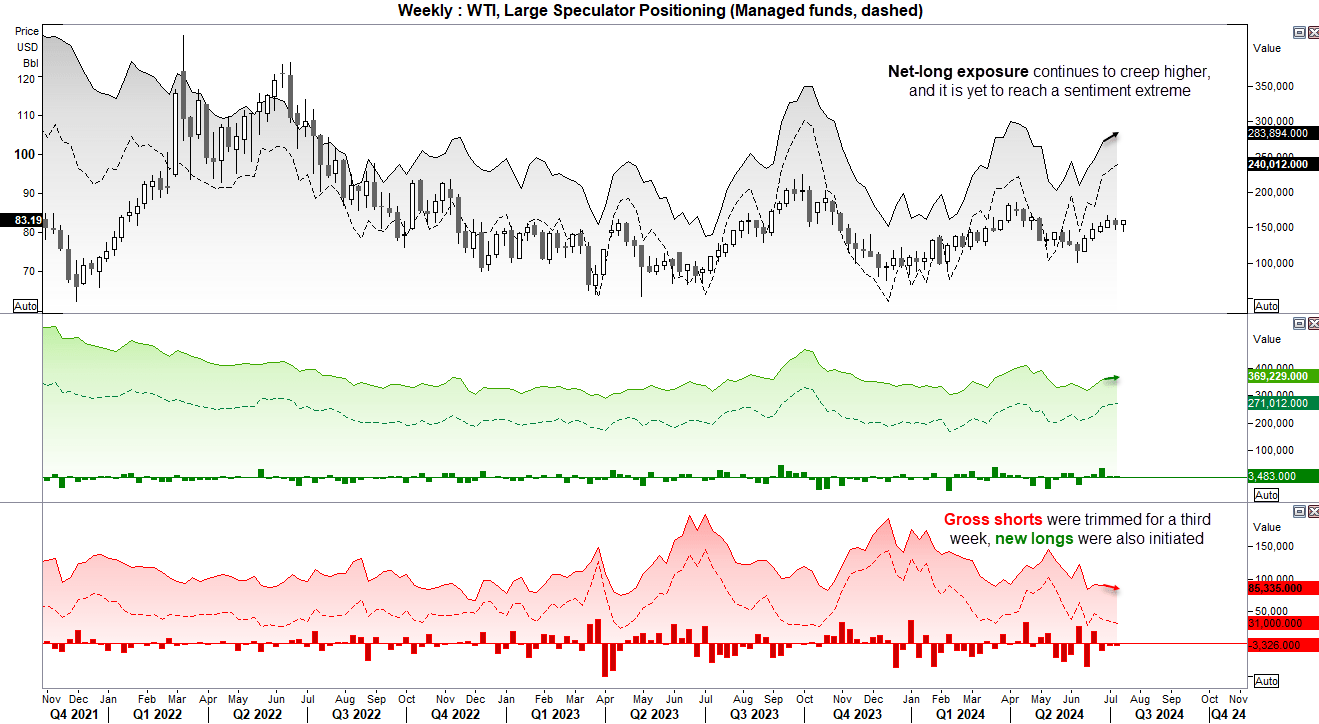

Crude oil market positioning – COT report

Large speculators and managed funds remained net long WTI crude oil futures, according to the latest commitment of traders (COT) report. In both cases, gross shorts were trimmed for a third week and gross longs were effectively flat. Whilst it was not a notably bullish week for positioning, it remains healthily bullish overall and not at a sentiment extreme.

Looking at prices, momentum is now turning higher on the weekly char after a two-week consolidation, so we can assume some of the more reserved bulls are returning to the table.

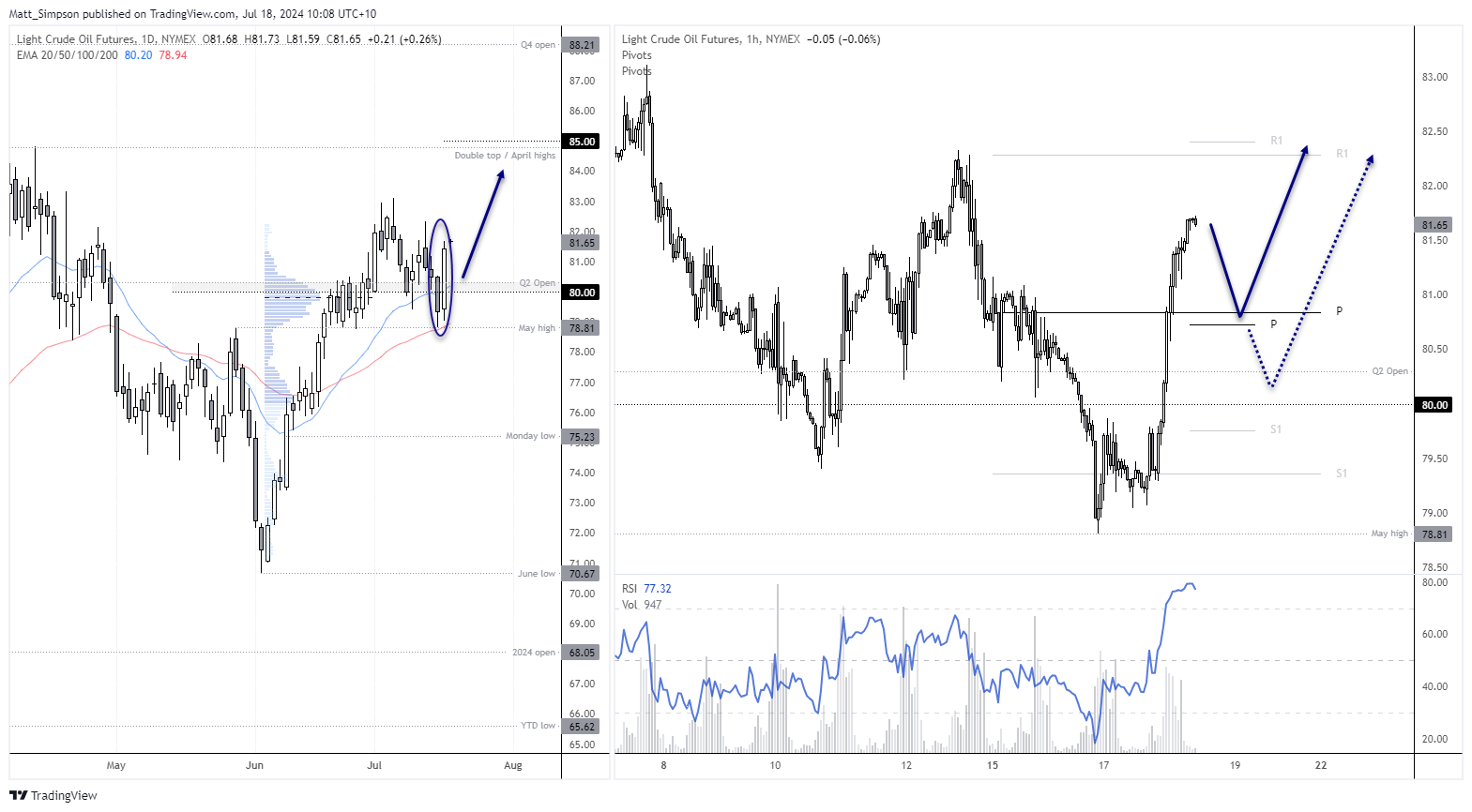

WTI crude oil technical analysis:

A strong rally emerged from the June low to send WTI crude oil 17.6% higher by the month-to-date high. A classic 3-wave correction ensued, which found support at the May high and 50-day EMA. A clear bullish range expansion candle formed on Wednesday to take prices back above the $80 handle, Q2 open and 20-day EMA.

Given the strong rally and bull-flag nature of the daily trend structure, a move towards the April highs around $85 could now be on the cards. A pullback towards $80 would be welcomed for traders on the daily timeframe to increase the potential reward to rise for bullish setups.

The 1-hour chart shows that volumes were high at the beginning of the strong rally. And with the RSI (14) curling lower from a high oversold level, bulls may want to see if prices can retrace a little before assuming further gains. The next major support level on the 1-hour chart sits around 80.80 near the daily and weekly pivot points. The July 24th high makes a viable target on this timeframe, given the weekly and daily R1 pivot points reside in the area.

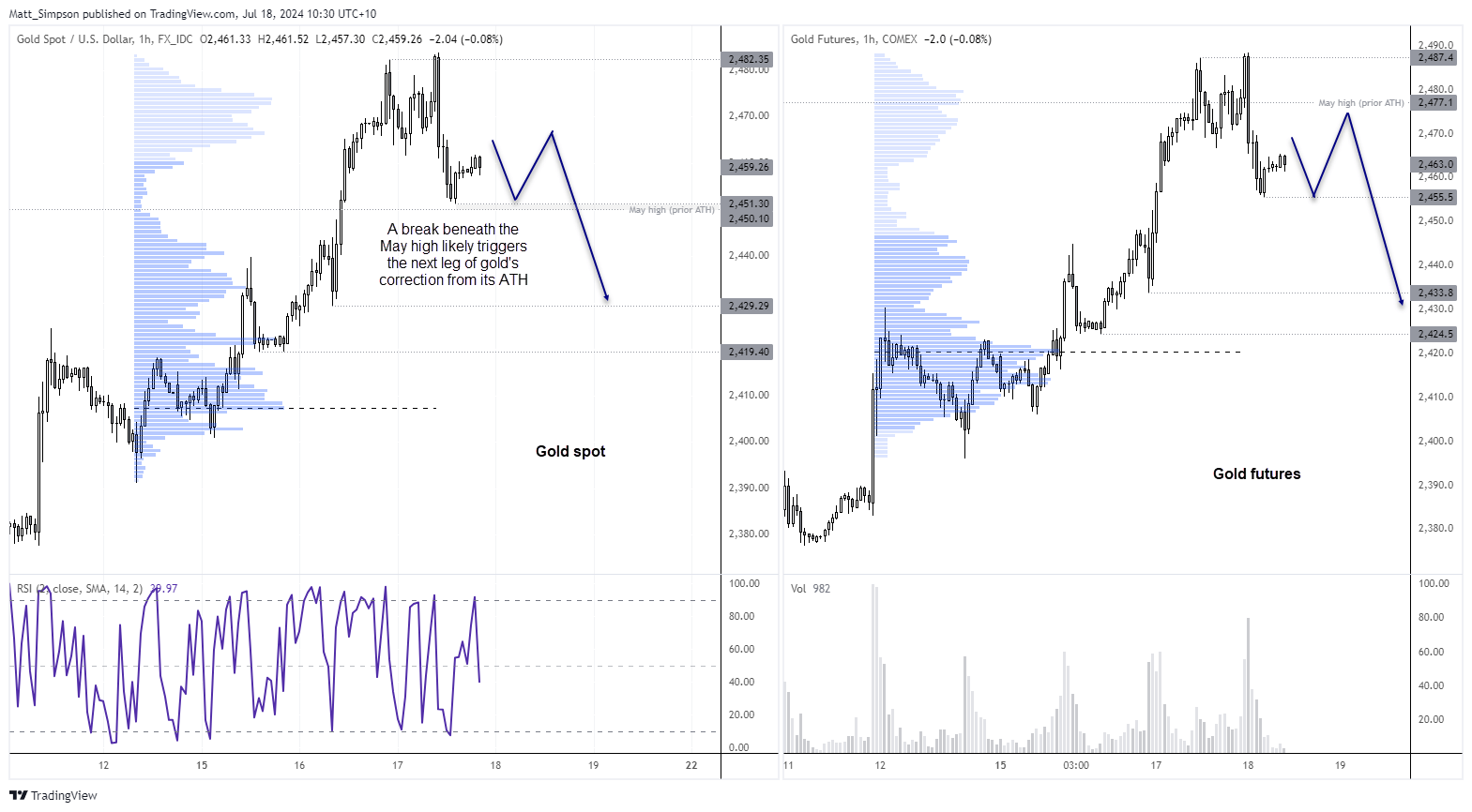

Gold technical analysis:

Whilst spot gold prices reached a record high on Tuesday, I also noted that gold futures hesitated and failed to break above its own record high set in May. And that served as a warning to not expect runaway gains on spot gold prices, which turned out to be a worthy observation.

Despite gold futures printing a record high on Wednesday, bulls failed to hold on to gains and closed the day with a false break of the May high. The fact that the daily volume of futures were at a 5-day high, yet the candle range was less than half the prior day’s bullish range to me suggests a potential ‘change in hands’ from bulls to bears. Ultimately, caution is likely still required from bulls at these highs in all the time gold futures remain hesitant to break convincingly to their own record high.

Support for spot gold (left) sits around the prior ATH high set in May at 2450. This allows for around $8 of retracement for intraday traders to play with over the near-term. The big question is whether we’ll see gold prices rebound from the May high and drag futures higher. My guess is that it is not quite ready to.

The 1-hout chart better shows the bearish momentum shift from gold’s record high. The bias is for at least one more leg lower before bulls return with any conviction. If pot gold breaks beneath the May high, the next leg lower is then assumed. Therefore, the bias is to fade into rallies within yesterday’s range for a move to intraday support levels around 2430.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge