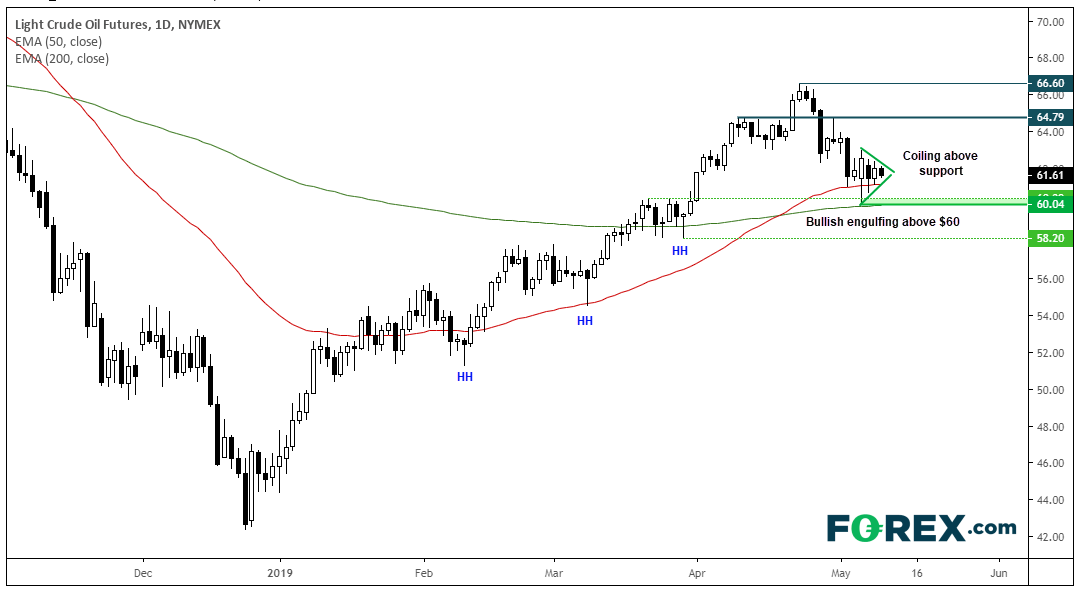

We’re cautiously bullish on WTI over the near-term and suspect it could be due, at the very least, a minor bounce.

Despite slipping from its highs, the trend structure remains bullish and prices have found support above the 50-day and 200-day averages. Furthermore, the 50-day average remains above the 200 and a bullish engulfing candle formed at $60 to form a likely swing low. With prices now coiling above this support zone, we think it could be due a bounce higher.

It’s touch and go as to whether price can fully recover and break to new highs, although the pivotal level around 64.80 makes a likely bullish target. If bullish momentum returns in full force, then this target can of course be revised higher for a potential break to new highs. Yet we remain hesitant to become too bullish given the pick-up of volatility on bearish candles, and slight shift in sentiment in last week’s COT report.

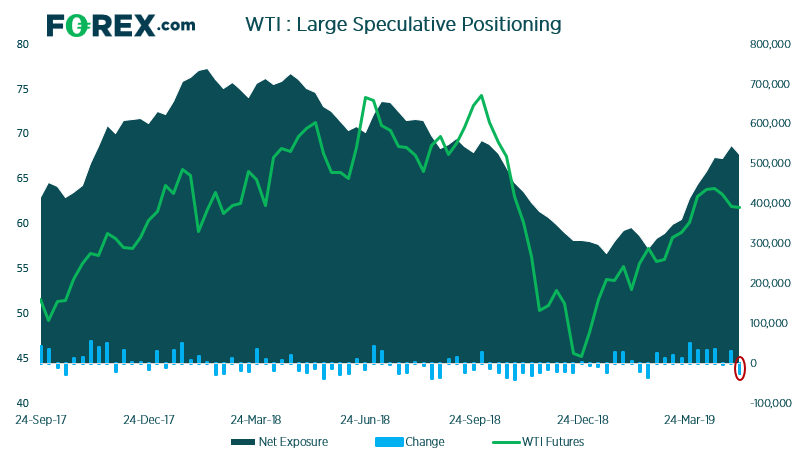

Although traders remain overwhelmingly net-long WTI, net-long exposure saw its largest weekly reduction since early February and the move was driven by an increase of short bets (+16.9k contracts) and a reduction of longs (-6.4k contracts). Whilst this doesn’t yet point to a change in trend, it could point towards a deeper correction. So this is why momentum needs to be assessed, as a minor break higher runs the risk of bears fading it to new lows. Either way, path of least resistance appears to be higher over the near-term.

The coiling formation can mostly be explained by tension over trade talks. If a deal is reached and China’s tariffs are removed, it will be a major boost for sentient and risk assets are likely to rally. WTI is just one of the markets we’d expect to benefit, although do keep an eye on yen pairs as we’d expect a sharp reversal of losses as yen bears close out.