It is no surprise cruise lines have been struggling to stay afloat. NCLH is down 77% since the start of the pandemic after a slight recovery off March lows. Cruise operators will only be able to offer cruises in the U.S. starting in November. With no customers due to the pandemic, how are the cruisers staying afloat? Analysts are anticipating a massive second quarter loss per share of $2.29 vs a gain of $1.30 a year ago on revenue of $42.8 million compared to $1.7 Billion in the same period last year. It will be interesting to see how the balance sheet looks and if they have enough cash to survive the pandemic.

The front-month options contracts on NCLH are anticipating a move of 6.4% up or down. The last time NCLH reported, the stock jumped 4.4%.

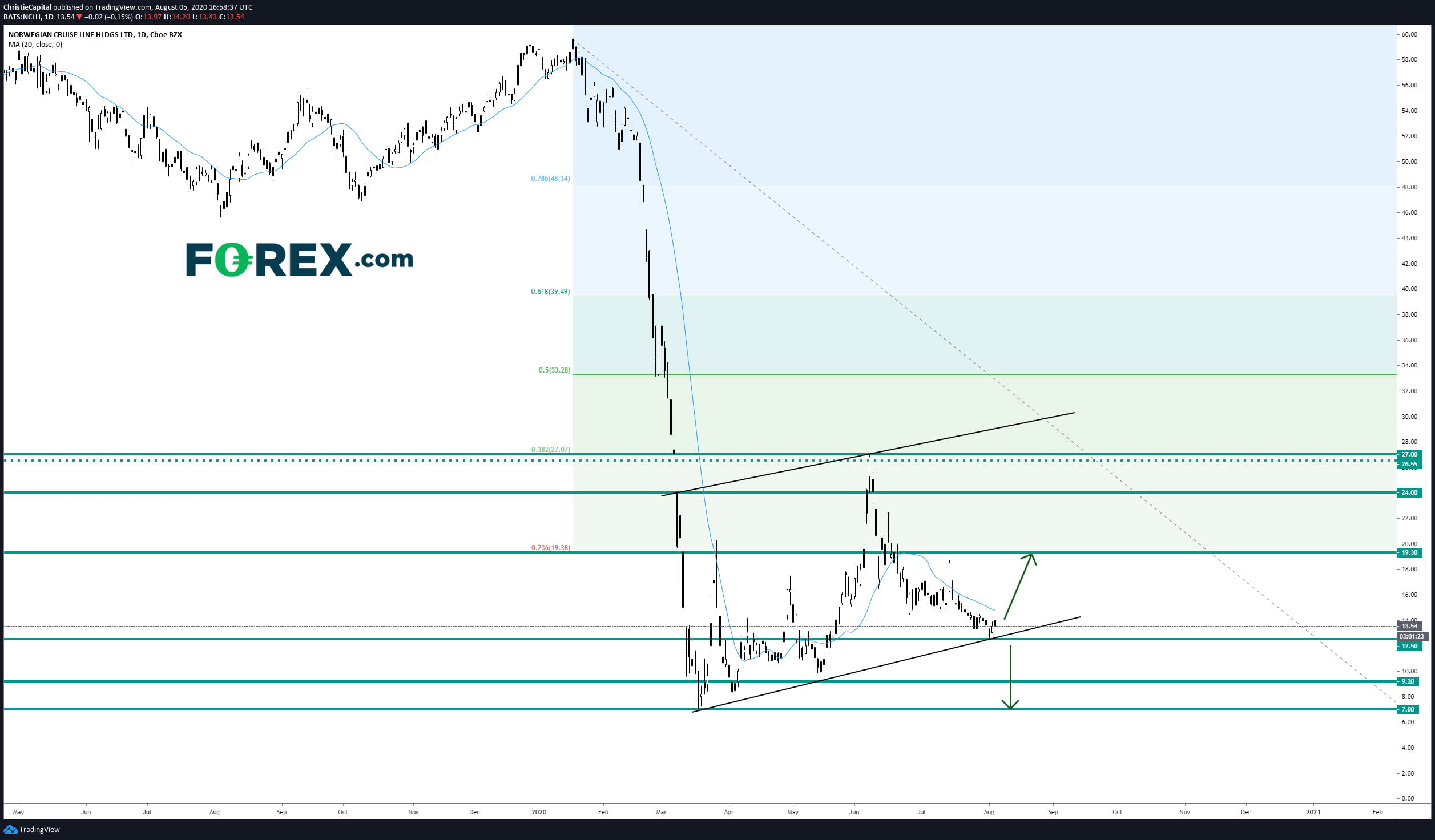

Looking at the chart from a technical perspective, Price action is trying to remain above a rising trend line in place since the March low at $7. The preference is for a rebound towards 19.30 if the earnings loss is better than expected. If $12.50 doesn't hold, look for a retest of the $7 March low.

Source: GAIN Capital, TradingView

Happy Trading