Monday’s financial markets were dominated by the agreement between Saudi Arabian and Russian officials on extending the OPEC-led cut in crude oil output up to March 2018. This announcement sent crude oil prices surging, with Brent crude rising above $52 while West Texas Intermediate neared the $50 handle. This sharp surge propelled energy stocks, helping to push US stock indices (S&P 500 and Nasdaq) up to new record highs.

Also surging on Monday was the euro, only slightly more than a week after Emmanuel Macron won the French presidential election. The shared currency has continued its recovery run from late last week against the US dollar, Japanese yen, and British pound, after having initially dipped in the aftermath of Macron’s win.

As for the pound, focus this week is shifting towards the UK currency as key data releases, especially regarding inflation, will take front and center in an otherwise relatively light week for major economic data. In the run-up to these releases, the pound has remained reasonably well-supported in its recent rise against the dollar, euro, and yen.

Tuesday’s UK Consumer Price Index (CPI) data will be a key test as to whether UK inflation is continuing to trend higher. The previous two months saw higher-than-expected inflation increases of 2.3% on a year-over-year basis. Markets are expecting an even higher y/y CPI reading of 2.6% for April. On Wednesday, key UK employment data will be released, including the unemployment rate, claimant count change, and the average earnings index. This latter data point is also a key indicator of consumer inflation, and the previous month saw a higher than expected increase in this earnings index. Consensus forecasts point to a potential 2.4% increase in average earnings on Wednesday. And finally, Thursday brings UK retail sales numbers for April, which will be watched closely, as the March data was a deep disappointment at -1.8%. Markets are expecting around a +1.2% increase in April retail sales.

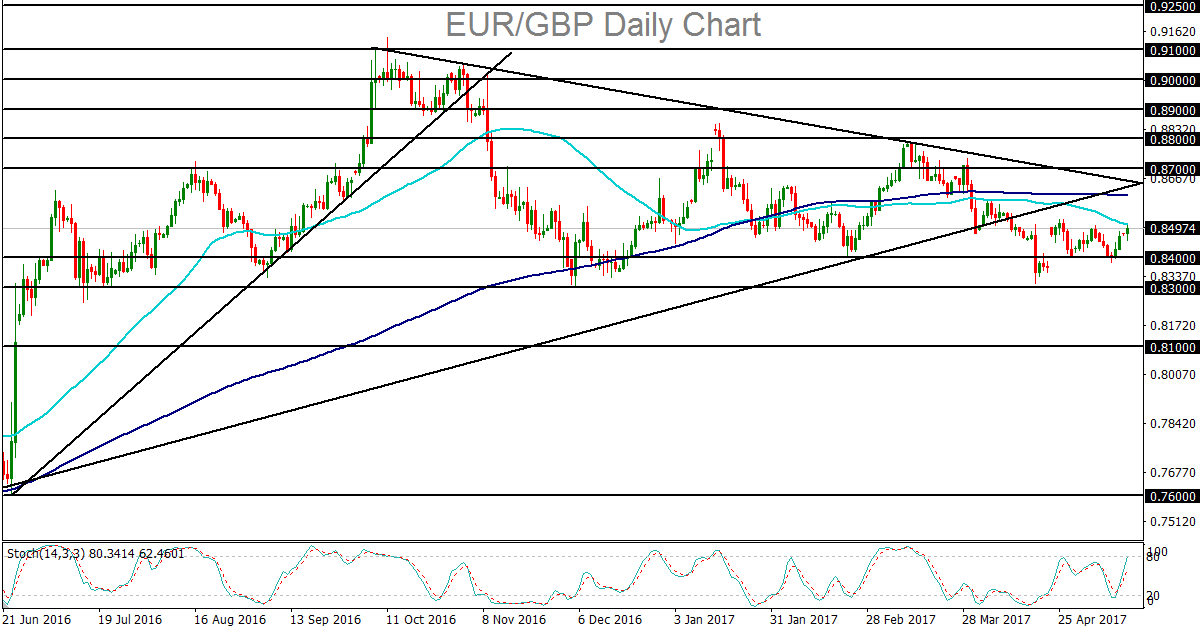

Ahead of these key UK data releases, EUR/GBP has continued to consolidate in a tight trading range, as it has for more than a month now, below its key 200-day and 50-day moving averages. In mid-April, the currency pair broke down below a long-term uptrend line extending back to the late 2015 lows. Since the October highs above 0.9000, EUR/GBP has been generally falling in a medium-term downtrend. This week’s critical UK economic data could help set the tone for whether EUR/GBP continues this downtrend going forward. The generally bearish trend bias for EUR/GBP will, of course, be helped along by any UK data this week that meets or exceeds expectations. If the pair remains under its key moving averages, the clear downside target is at the major 0.8300 support level, last approached in mid-April. In the event of a further breakdown below 0.8300, a breakdown of the long-term uptrend will have been confirmed, with the next major downside target around 0.8100 support.

Also surging on Monday was the euro, only slightly more than a week after Emmanuel Macron won the French presidential election. The shared currency has continued its recovery run from late last week against the US dollar, Japanese yen, and British pound, after having initially dipped in the aftermath of Macron’s win.

As for the pound, focus this week is shifting towards the UK currency as key data releases, especially regarding inflation, will take front and center in an otherwise relatively light week for major economic data. In the run-up to these releases, the pound has remained reasonably well-supported in its recent rise against the dollar, euro, and yen.

Tuesday’s UK Consumer Price Index (CPI) data will be a key test as to whether UK inflation is continuing to trend higher. The previous two months saw higher-than-expected inflation increases of 2.3% on a year-over-year basis. Markets are expecting an even higher y/y CPI reading of 2.6% for April. On Wednesday, key UK employment data will be released, including the unemployment rate, claimant count change, and the average earnings index. This latter data point is also a key indicator of consumer inflation, and the previous month saw a higher than expected increase in this earnings index. Consensus forecasts point to a potential 2.4% increase in average earnings on Wednesday. And finally, Thursday brings UK retail sales numbers for April, which will be watched closely, as the March data was a deep disappointment at -1.8%. Markets are expecting around a +1.2% increase in April retail sales.

Ahead of these key UK data releases, EUR/GBP has continued to consolidate in a tight trading range, as it has for more than a month now, below its key 200-day and 50-day moving averages. In mid-April, the currency pair broke down below a long-term uptrend line extending back to the late 2015 lows. Since the October highs above 0.9000, EUR/GBP has been generally falling in a medium-term downtrend. This week’s critical UK economic data could help set the tone for whether EUR/GBP continues this downtrend going forward. The generally bearish trend bias for EUR/GBP will, of course, be helped along by any UK data this week that meets or exceeds expectations. If the pair remains under its key moving averages, the clear downside target is at the major 0.8300 support level, last approached in mid-April. In the event of a further breakdown below 0.8300, a breakdown of the long-term uptrend will have been confirmed, with the next major downside target around 0.8100 support.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM