When will Snap release Q3 results?

Snap is scheduled to release third quarter earnings after the market closes on Thursday October 21.

Snap Q3 earnings preview: what to expect from the results

Data from Bloomberg shows analysts are expecting Snap to add 9.1 million daily active users in the third quarter to take the total to 302.1 million. That would compare to the 15 million users added in the first quarter and 13 million added in the second.

Meanwhile, average revenue per user is forecast to come in at $3.63 in the third quarter – which would mark a new record high and an improvement from $3.35 in the previous quarter. That would be impressive considering engagement may have waned as people spend less time online and head back outside and would be testament to Snap’s direct-response ads platform.

However, Snap’s newer features such as Spotlight, launched last year and designed to take on the likes of TikTok and Instagram Reels by showing the top snaps submitted by users in a feed that people can swipe and tap through, could help drive engagement and impressions. Spotlight DAUs jumped 49% in the last quarter and average daily content submissions more than tripled, with engagement in the US rising by an impressive 60% from the first quarter.

Investors will also be keen to see how its rising investment in content, from the release of new Snap Originals to its new Discover Channels launched in partnership with Sony, has fared with users and impacted profitability as it ramps up spending on content.

Snap is targeting revenue of $1.070 billion to $1.085 billion and adjusted Ebitda of $100 million to $120 million in the third quarter. Notably, Snap has beaten expectations for the last four consecutive quarters, and analysts are expecting it to do this again this week.

Wall Street is expecting Snap to outperform when it comes to revenue with forecasts of $1.1 billion, marking a 62% jump from the $678.7 million delivered the year before and the first time its topline has breached the $1.0 billion threshold. Although still a hugely impressive rate of growth, it will mark a slowdown from the 116% year-on-year growth delivered in the second and bring it closer to the 66% growth reported in the first.

Analysts also expect Snap to beat earnings guidance with forecasts for adjusted Ebitda of $136.9 million, marking a large jump from just $56.3 million last year.

Analysts expect Snap to remain in the red at the bottom-line with a net loss forecast of $143.4 million. That would be narrower than the $199.9 million loss seen last year and also shrink from the losses booked in the first two quarters of 2021.

Importantly, analysts think Snap could escape the red in the final quarter of 2021 with the consensus currently pencilling in its first-ever net profit of $15.7 million. However, they currently expect it to return to the red during the first half of 2022 before starting to deliver sustainable profit from the second half onwards.

Snap shares have rallied over 52% since the start of 2021 but has lost some steam since hitting an all-time high on September 24 of $83.33. Still, brokers are extremely bullish on Snap shares with an average Buy rating and target price of $86.19, which is some 13.7% above the current share price.

One of the biggest weights on Snap’s prospects will be the increased regulatory pressure surrounding social media use by children, with Snap predominantly known for being popular with younger clientele. We have already seen Facebook delay the rollout of Instagram Kids, designed for children under the age of 13, after facing questions about the product’s effect on mental health.

Where next for the Snap share price?

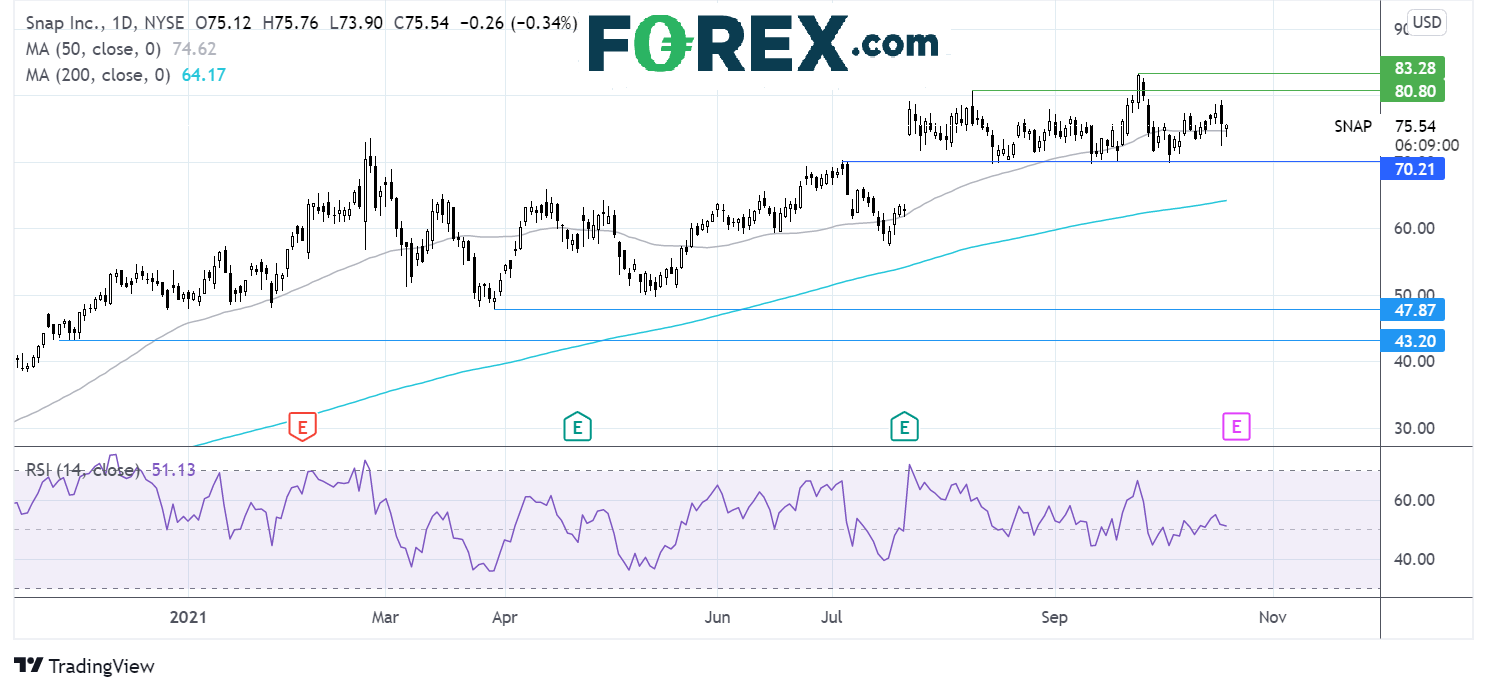

The Snap share price has been trading in a holding pattern since late July. The share price has been supported by $70.20 on the downside and $80.80 on the upside.

The share price sits on the flat 50 sma and the RSI is also neutral at 50 awaiting clues from earnings.

Buyers might look for a move over $80.80 to target $83.35, all time high.

Meanwhile, on poor numbers or outlook, sellers might look for a move below $70.20 to cement a bearish outlook and open the door to $64.34, the 200 sma.

How to trade Snap shares

You can trade Snap shares with Forex.com in just four steps:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for ‘Snap’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade