US banks kick off earnings season with Q4 and full-year results from the major banks:

January 15 Citigroup, JP Morgan

January 16: Bank of America, Goldman Sachs, Morgan Stanley

What to expect:

With U.S. investment banks trading around all-time highs, there is Little River for error in the upcoming results. Shareholders will expect nothing but clear optimism amid hopes for tax cuts and a deal-friendly White House under President Trump.

Trading volumes have been elevated across the quarter, and deal-making is strong, offsetting lower net interest income.

Meanwhile, the outlook is upbeat as economic data points to a solid US economy where the Fed may not cut rates again until later in the year. The market enters what is expected to be a renewed period of deal marking and new listings under looser regulation from Trump's administration. As an early sign of the changes to come, Michael Barr, the Federal Reserve's vice president of supervision, is stepping down and paving the way for regulatory tree changes and positive catalysts.

However, any signs of hesitancy could hit the share price hard.

JP Morgan Q4 earnings preview

Wall Street expects JP Morgan to post Q4 EPS of $4.08, a 2.8% year-on-year rise, while revenue is expected to increase 4.8% to $41.9 billion. Total trading revenue is expected to rise 13.2% to $6.6 billion, while loan net interest income is expected to decline 4.7% to $22.9 billion.

Guidance will also be in focus. Q1 revenue is forecast to rise 1.8% to $43.3 billion, and earnings are expected to decline 6.6% to $4.32 a share. Net income interest is expected to drop 2.7% to $22.5 billion.

Add list rates JP Morgan as a moderate buy, with 11 of the 18 analysts giving the Stock Ratings buy, six hold, and one a sell. The average target price is $258.

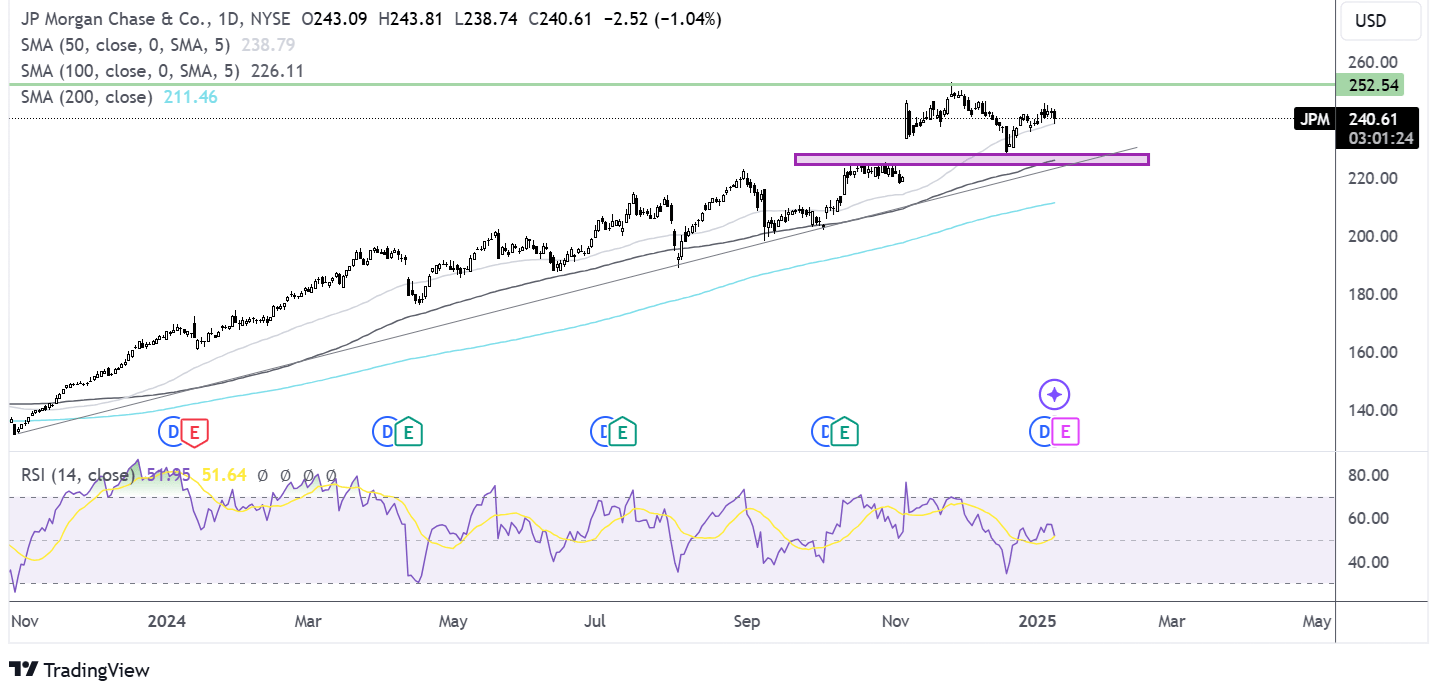

How to trade JPM earnings?

JP Morgan reached an ATH of 253 in November 2024 before correcting lower to support around 225-230. The price has since recovered to hold above the 50 SMA. The uptrend dating back to November 2022 remains intact, although it is losing momentum. Buyers will look to rise above 245, the 2025 high, to extend gains.

Sellers must break below the 225-230 zone to create a lower low and expose the 200 SMA at 210.

Bank of America Q4 earnings preview

Wall Street is expecting the nay just second-largest bank to report EPS of 0.79, up 12.9% from the same quarter a year earlier. The company has beaten Wall Street's estimates for the last four quarters. Meanwhile, for fiscal 2024, BAC is expected to post EPS of 3.27, down 4.4% from 3.42 in fiscal 2023. However, EPS is expected to rebound with growth of 12.2%, reaching 3.67 in fiscal 2025.

The earnings come as Bank of America has gained 30% over the past year, outperforming the S&P 500 and the financial sector SPDR over the same period.

In the previous quarter, BAC recorded better-than-expected Q3 earnings of $0.81 owing to strong capital market results, a 24.5% increase in underwriting income, and an 11.7% rise in sales and trading revenues. Title deposit balances rose 2.4% annually to $1.9 trillion, highlighting continued growth in core banking operations.

Analysts covering Bank of America are cautiously optimistic, with 22 covering the stock, 13 recommending a strong buy, three suggesting a moderate buy, and six giving be a see a hold rating. The average analyst target price is $48.65

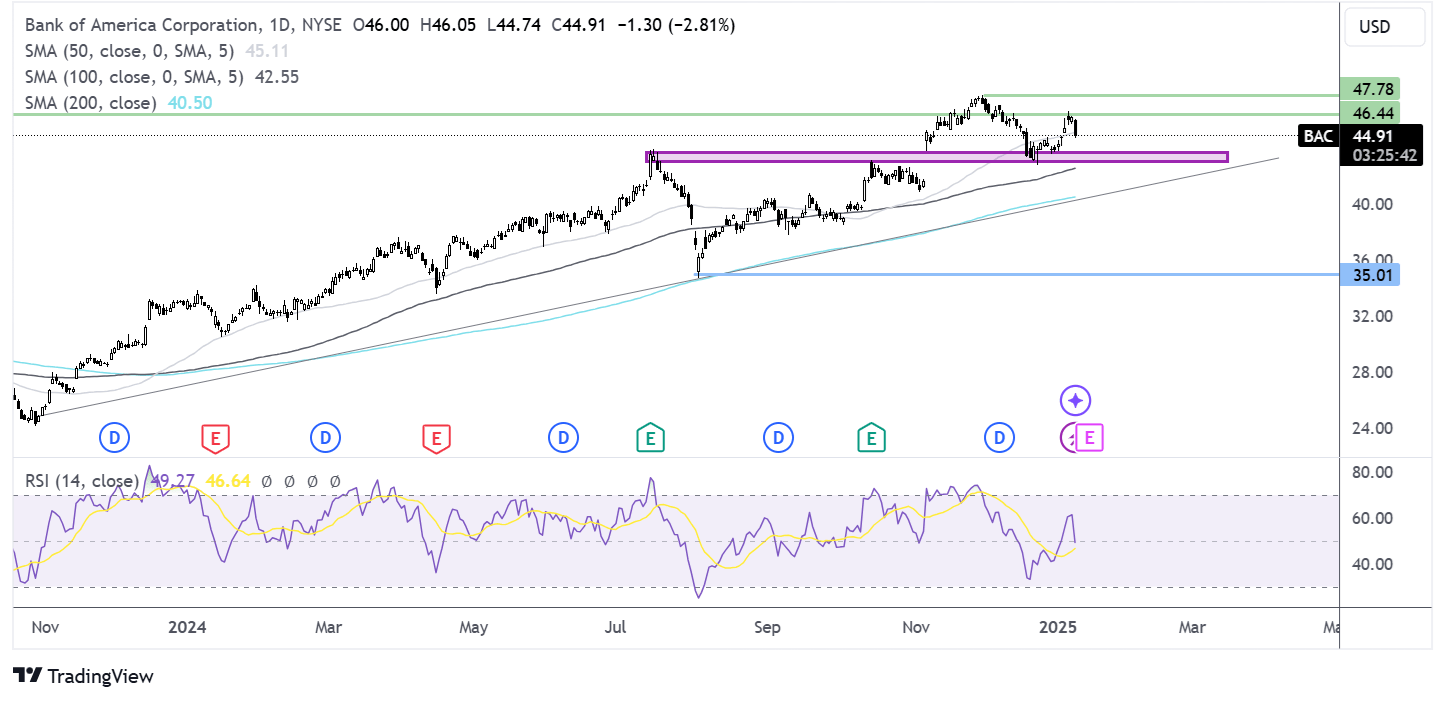

How to trade BAC earnings?

After reaching an all-time high of $47.80, BAC corrected lower, finding support in the 43 -43.70 zone.

Buyers will look to continue the bullish run that started in Q4 2023. A rise above 46.30, the 2022 and 2025 high, is needed to bring 47.80 back into focus.

Sellers would need to break below the 43 -43.70 zone to negate the near-term uptrend, exposing 40.50, the 200 SMA, and rising trendline support.

Goldman Sachs Q4 earnings preview

In Q3, Goldman Sachs posted a 45% jump in profits compared to the previous year, with a rise in dealmaking in stock trading boosting the bank's numbers. Net income came in at almost $3 billion, up from $2 billion in the third quarter of 2023, and investment fees rose 20% year on year to $1.8 billion as companies issued more debt. Another strong earnings period is expected; however, shares are up 50% over the past year alone, outpacing the sector as well as the S&P 500, so fundamentals will need to support the higher valuation.

The analysts covering Goldman Sachs are cautiously optimistic. Seventeen cover the stock, 12 recommend a strong buy, and five suggest a hold rating. The average analyst target price is $630.75.

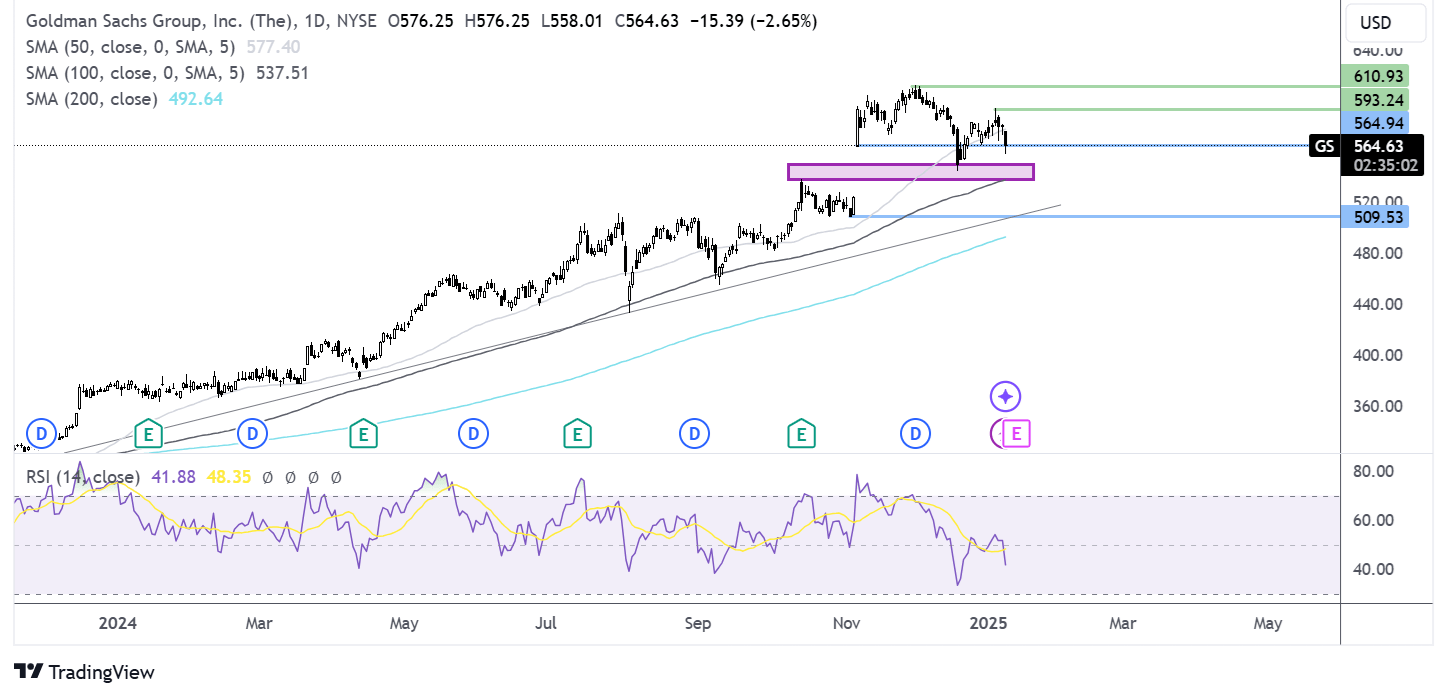

How to trade GS earnings

Similar to the other charts, GS rose to a record high of $601 at the beginning of December before dropping sharply to $544 and creating a higher low. The RSI is below 50.

Sellers are testing 563 support with a break below here, opening the door to the 550 support zone. A break below here creates a lower low, bringing 510 support into play.

Buyers must rise above 593 to bring 610 into play and fresh record highs.