Tesla Q3 earnings preview

Tesla is due to report Q3 earnings after the bell on Wednesday, just weeks after its disappointing Robotaxi unveiling event, which lowered the share price.

Quarterly revenue is expected to rise to $25.41 billion, up from $23.35 billion in the same period a year earlier. Meanwhile, EPS is expected to ease to $0.48 cents, down from $0.53 cents in Q3 2023.

Tesla's third-quarter deliveries rose by 6% but still missed expectations, dampening hopes of a robust rebound. Tesla delivered 462,890 vehicles globally in the three months to September, Wall Street expectations of 463000.

The earnings also come following the Robotaxi event, which saw the Tesla share price drop 8% as Tesla showcased its Cyber cab and a larger-capacity Donovan. The stock dropped amid a lack of details, and questions remain unanswered.

How to trade Tesla earnings?

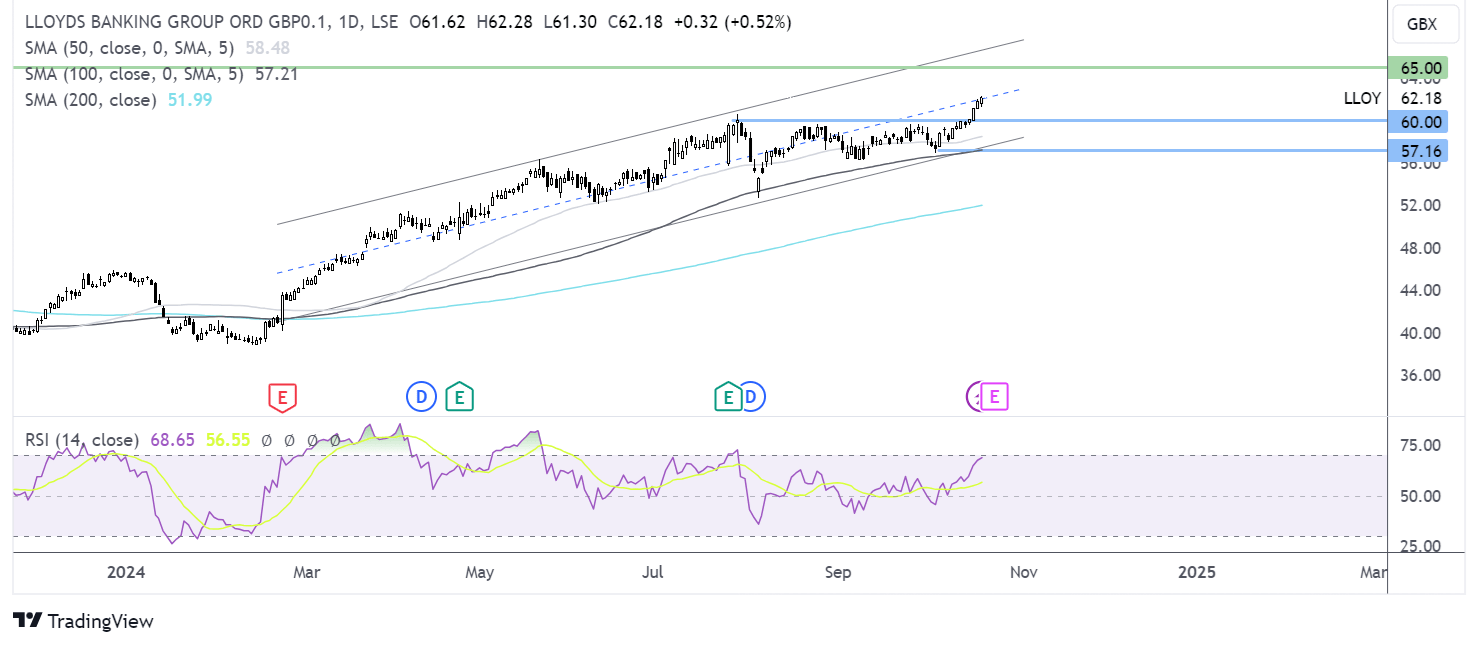

On the weekly chart, Tesla rose above the falling trendline dating back to 2021 before running into resistance around 270, creating a possible double-top pattern. The price has broken below the 200 SMA.

205 is key support on the downside. Sellers will look to take out the 100 SMA and falling trendline. Below 184, the August low comes into play ahead of 138.

Buyers will need to rise above the 200 SMA at 238 to extend the recovery towards 270.

Barclays Q3 results

Barclays Bank is due to report earnings on 24 October before the market opens. Results come after a solid reporting season for U.S. investment banks, which is expected to positively impact investment banking-focused European stocks such as Barclays.

US big banks saw a strong performance in both equities and investment banking divisions, which is expected to be replicated in Barclays. European investment banks are expected to perform better than US peers within fixed-income, currencies, and commodity units.

The results also come in the wake of the BoE rate cut. The move is expected to help boost the mortgage market, making mortgages more affordable. Although we are only one rate cut in, the changes may not be large, so guidance will be essential.

The market will keep a close eye on bad loan provisions for further clues into the health of the economy. However, with more rate cuts coming, growth showing resilience, and an improving investment banking division, the earnings could support the strong rally in the share price that we’ve seen this year.

How to trade Barclays results?

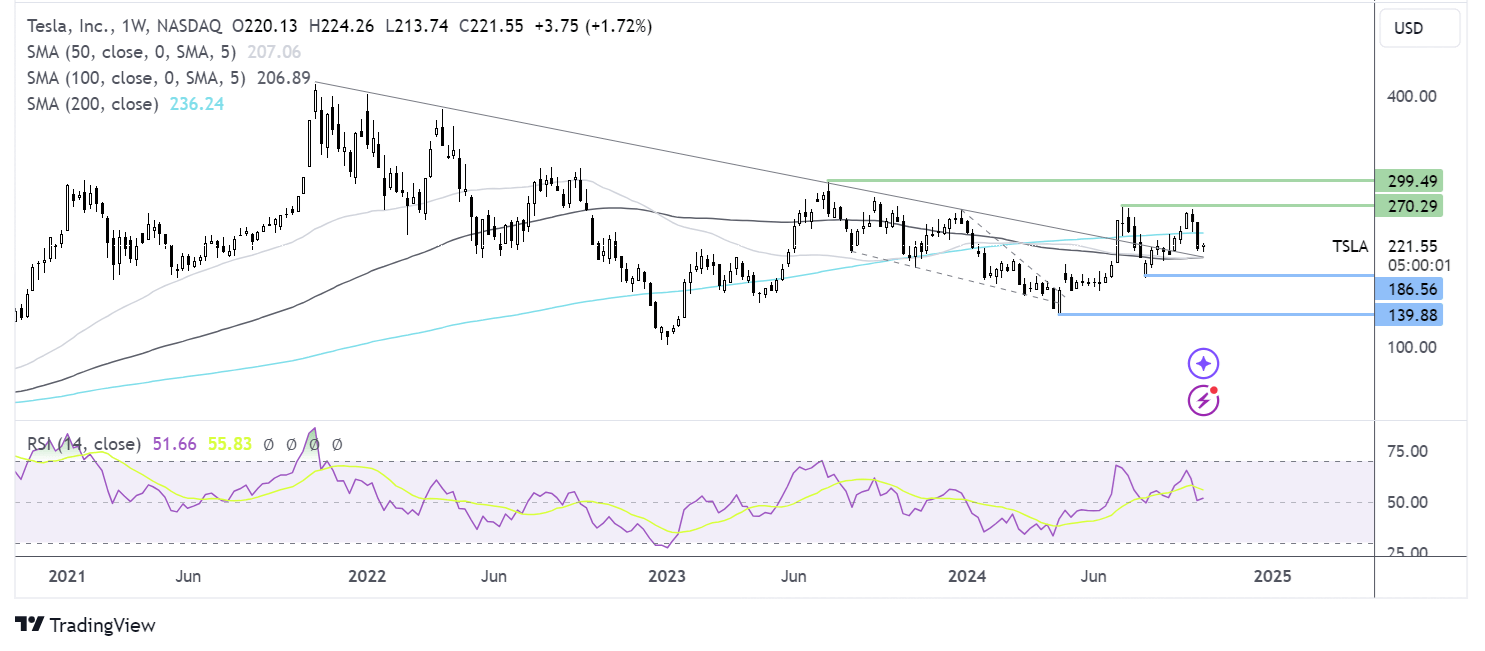

Barclays has traded in a rising channel since February, forming a series of higher highs and lower lows. Buyers will look to push towards 250p and 265p, the upper band of the rising channel. On the downside, support can be seen at 220p, the October low. A break below here breaks the price out of the rising channel and creates a lower low.

Lloyds Q3 results

Lloyds, the UK's largest lender, will release its Q3 results on Wednesday, October 23rd, ahead of the market opening. The share price is 29% higher this year, outperforming the broader market.

The group delivered solid first-half results, with lower-than-expected bad loan provisions and pre-tax profits ahead of forecast despite booking a 14% decline.

After the BoE cut interest rates in August and another rate cut is expected in November, the housing market is expected to start improving, which would be good news for the lender. Lower interest rates mean that mortgage demand will likely ramp up as mortgages become more affordable. Bad loan provisions could fall further as UK wage growth continues to outpace inflation.

However, interest rate income may have peaked and could start to ease as interest rates fall.

Expectations are for pre-tax profit to be £1.6 billion in Q3, down from £1.9 billion a year earlier. In Q2, the pre-tax profit was £1.7 billion, which was above the £1.6 billion generated in Q2 2023.

Lloyds is forecast to pay a dividend of over 3p a share, which it added to its declared £2 billion buyback, giving a total of £3.9 billion for 2024.

How to trade LLOY earnings

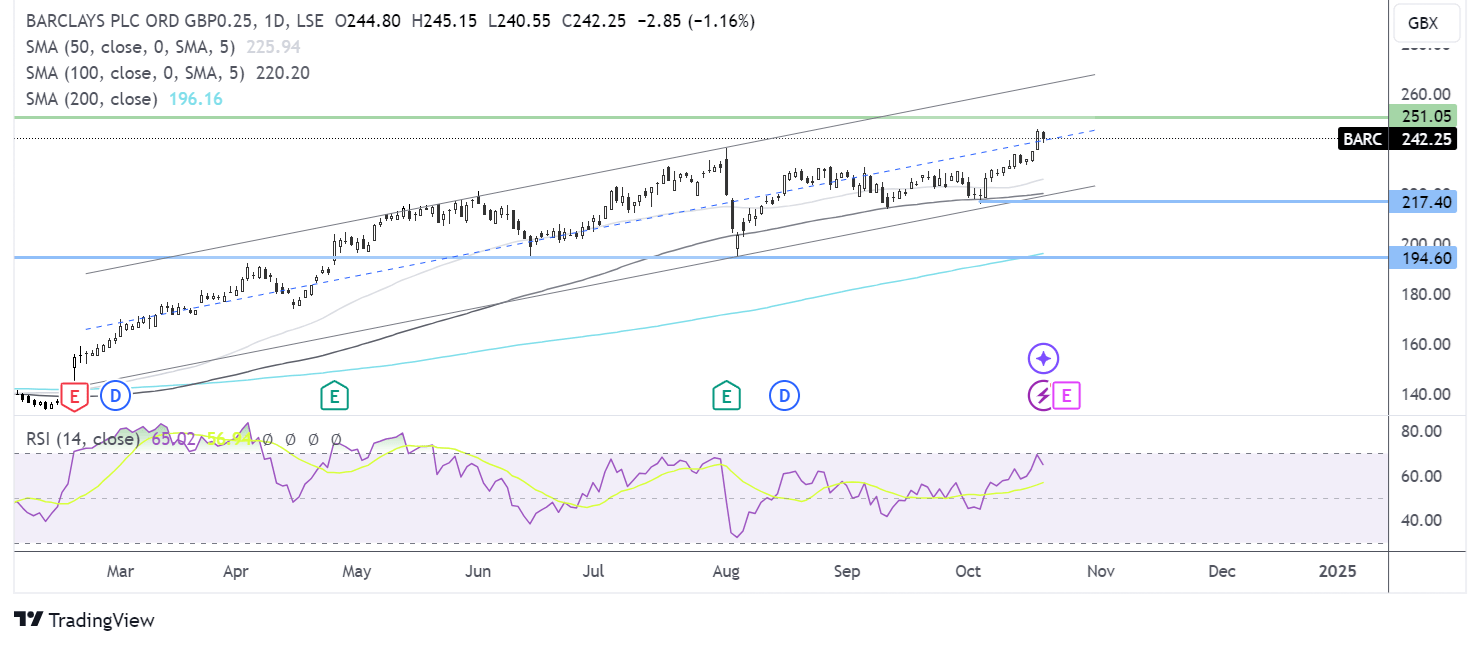

Lloyds trades within a rising channel dating back to the start of the year. The price is testing 62p, a level last seen 4.5 years ago. Buyers will need to rise above here to bring 65p into focus, a level last seen in 2008.

On the downside, support can be seen at 57p, the 100 SMSA, and the lower band of the rising channel. A break below here creates a lower low.