A summary of the weekly Commitment of Traders Report (COTS) from CFTC to show market positioning among large speculators.

- Among FX majors, JPY saw the largest weekly change as bears increased their net short exposure by 11.7k contracts. Volume changes were fairly-light elsewhere for FX majors (all below 10k).

- Traders are net-short EUR at their most aggressive level since December 2016. Meanwhile, 84% of large speculators are long on DXY (US Dollar Index).

- As of the 5th March, long bets accounted for 84.8% of positions on the S&P500. Given the subsequent sell-off last week, we expect this to have dropped into Friday.

JPY: Net short exposure is its most bearish in 8 weeks. Although there was also a slight increase of long bets, new short bets overpowered the bulls by a ratio of 3:1 and gross shorts are at their highest level since mid-January. It appears net exposure has seen cycle high around mid-February, which could see JPY remain under pressure over the coming weeks.

EUR: Net short exposure is at its most bearish level since December 2016. We’ve seen a healthy increase of bearish bets, which has pushed gross short exposure to its highest level since December 2016 whilst gross longs have mostly tracked sideways this year. The 1 and 3-year Z-Scores are only -1.3 and -0.8 respectively, so we do not yet think we’ve reached a sentiment extreme.

Copper: Net long exposure is at its most bullish level since July 2018. Its breakout 3-weeks ago was fuelled by an increase of long bets and notable drop in short bets. Although prices have consolidated for the past two weeks, short-covering has continued which sees short bets at their lowest level since October 2018.

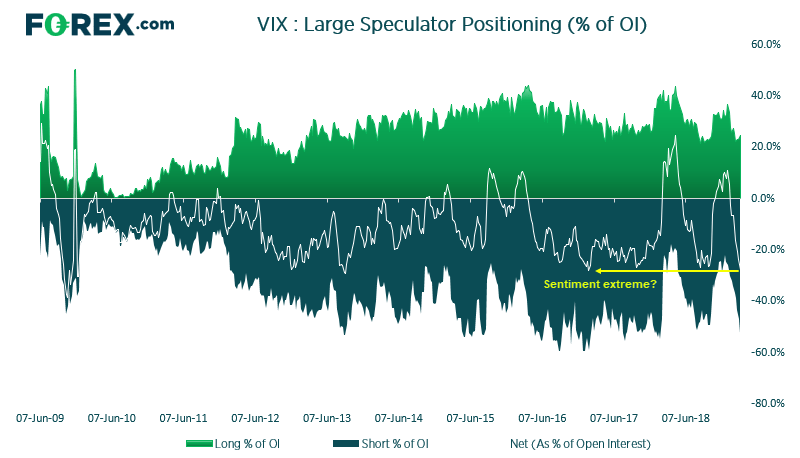

VIX: Net-short exposure is at its most bearish level since October 2018. However, adjusted for open interest, this is the most bearish large speculators have been since 2016. Given the increase of volatility and sell-off on the S&P500, this could leave a lot of short-VIX traders exposed if the decline is to continue which suggests short-VIX could be at a sentiment extreme.