Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

As of Tuesday 16th November:

- Traders trimmed long exposure to the US dollar by -$0.59 billion, according to data from IMM. Net long-exposure now sits at $17.9 billion, and long $.6 billion against emerging markets.

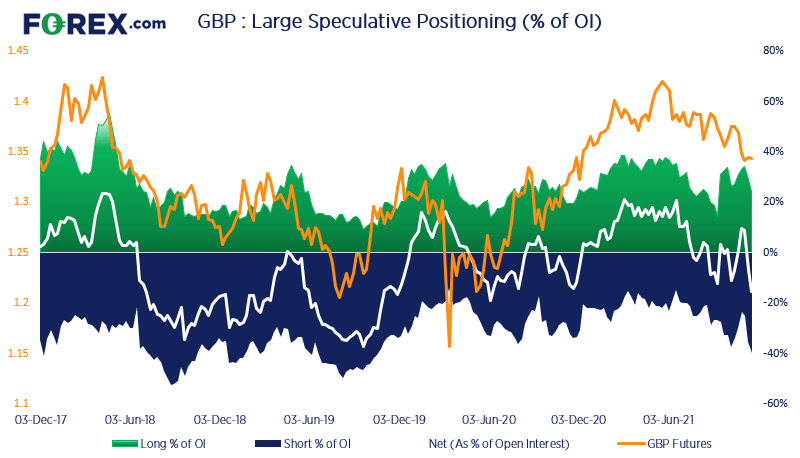

- Large speculators are now aggressively short GBP futures, with net-short exposure now at its most bearish level since June 2020.

- The pound saw the largest weekly change among FX majors, with traders increasing net-short exposure by 19.5k contracts.

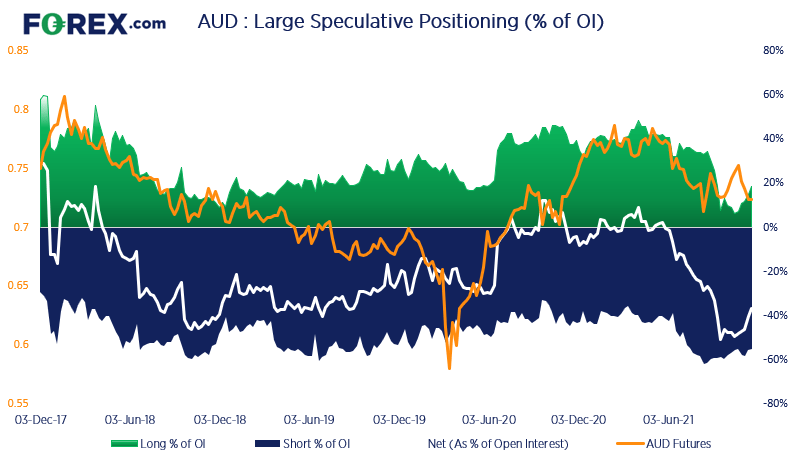

- Net-short exposure to AUD futures fell to a 2-month low.

- Net-short exposure to the 10-year treasury note is at its most bearish level since February 2020.

British pound futures

Traders are now aggressively short British pound futures, with the net-short positioning now sitting at its most bearish level since June 2020. However, it is worth noting that the report was compiled before traders began to strongly suspect that the BOE will hike at their next meeting following strong inflation data and a decent employment report. We therefore may find that some of these shorts have since been closed out and we may see bearish exposure reduced Friday’s report.

Australian dollar futures

Whilst plenty of bears remain short AUD futures, bulls have increased their gross-long exposure to the Aussie for a fifth consecutive week which as taken the net-short index to its lowest level since August. It may take RBA to be a lot less dovish to shake off some of these bears though as they remain adamant that no rate hike can be expected until 2023/2024.

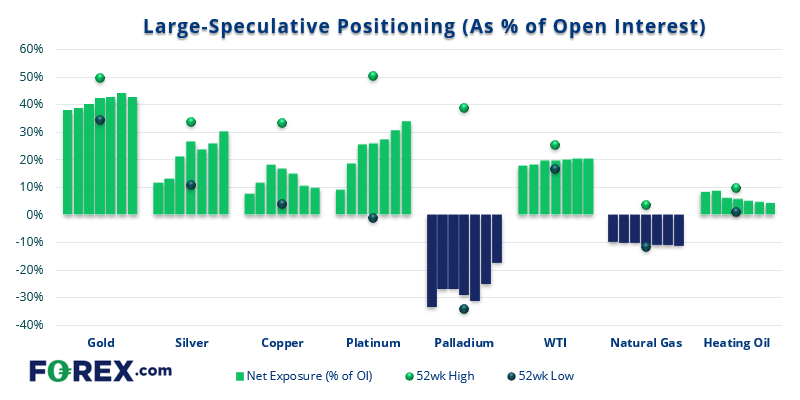

Large speculative positioning on commodities:

As of Tuesday 16th November:

- Large speculators increased net-long exposure to platinum for a sixth consecutive week and are now at their most bullish level since March.

- Net-long exposure to silver futures are at their highest level since June.

- Traders continued to close both long and short contracts on WTI futures.

- Futures trimmed net-long exposure to copper futures for a fourth week.

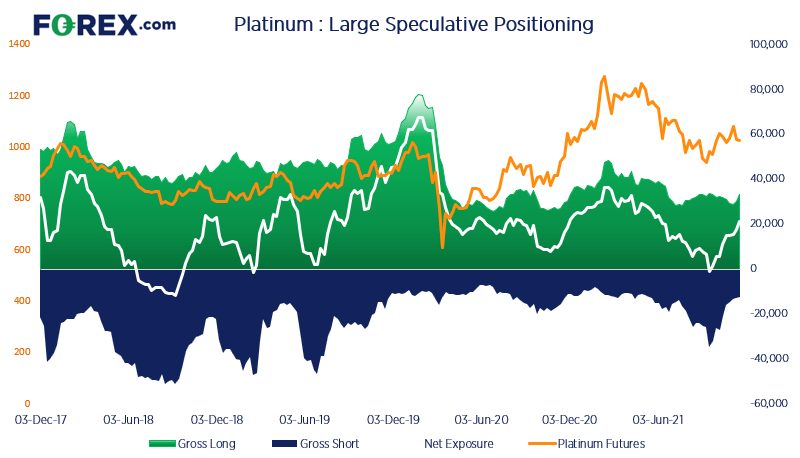

Platinum futures

Traders have been shedding their short contracts since the middle of September, but it is worth noting that longs have increased for two consecutive weeks. So, what began as short covering has now turned into a healthy bullish trend. That said, prices closed lower last week so it appears that platinum prices are now in a corrective phase, but as long as prices hold above the September low then we will seek new bullish setups.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.