As of Tuesday 1st February 2022:

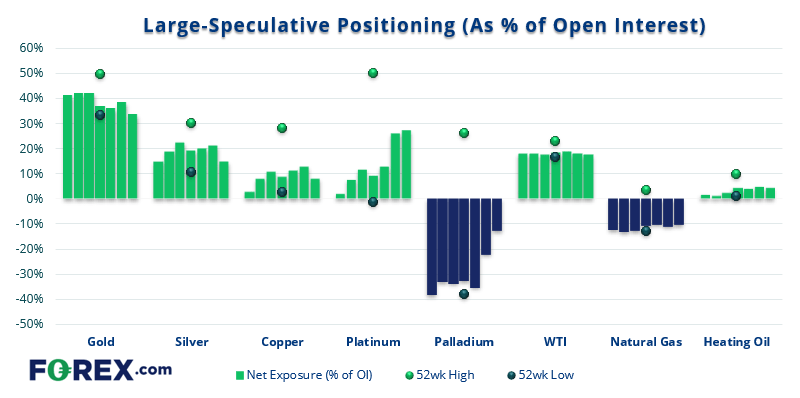

- Net-long exposure to gold fell at its fastest weekly rate in nearly 3-years

- Silver traders reduced net-long exposure to a 6-week low

- Traders were their most bullish on palladium in 10-weeks

- Net-short exposure to palladium futures fell to 5-month low

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

AUD futures:

Being short AUD futures is by no means a new idea, as traders have been met-short the currency since May last year and at a record amount in October 2021 and January 2022. Whilst gross shorts remained effectively flat last week, gross longs increased for a second consecutive week with around 9.7k contracts added over this period. Whilst this may not be an ideal long signal, it does warrant caution being short the Aussie at such extreme levels.

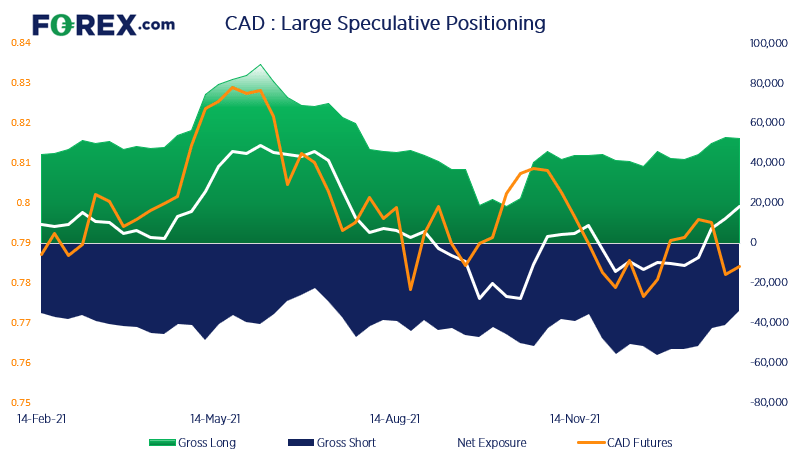

CAD futures:

Traders increased net-long exposure to Canadian dollar futures to a 28-week high and has been mostly a function of short-covering. Gross shorts were trimmed for a fourth straight week by -6.7k contracts to a 29-week low. Yet longs were also trimmed very slightly by -473 contracts. So that is not a compelling bull-case as we really want to see fresh longs initiate, but there is even less reason to short and plenty of room for longs to increase, looking at the data.

As of Tuesday 1st February 2022:

- Net-long exposure to gold fell at its fastest weekly rate in nearly 3-years

- Silver traders reduced net-long exposure to a 6-week low

- Traders were their most bullish on palladium in 10-weeks

- Net-short exposure to palladium futures fell to 5-month low

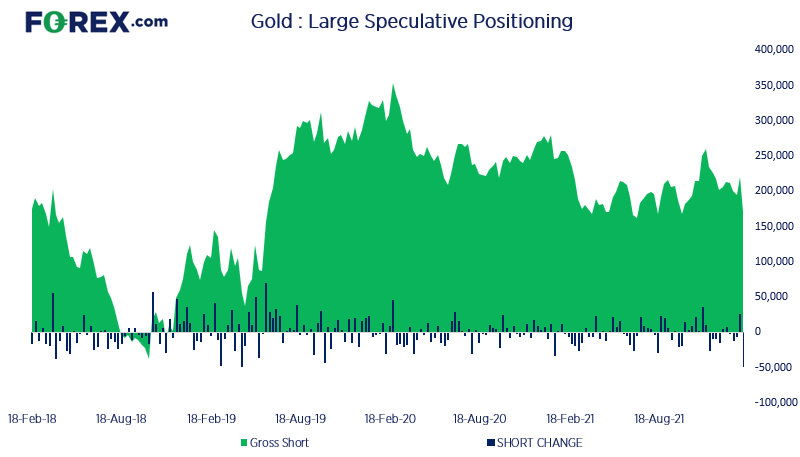

Gold futures:

Net-short exposure to gold futures fell at their fastest weekly rate in nearly 3-years last week. And it is worth noting that the move was fuelled by 34.4k long contracts being closed (fastest rate in 27 months) and 10.6k short contracts added. Given gold has only grinded higher following its hard fall from $1850 then we retain the view that this is a corrective bounce.

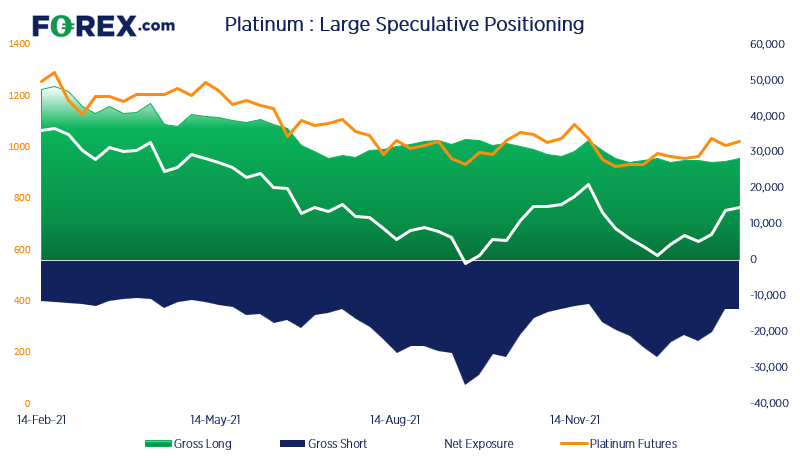

Platinum futures:

We noted in Friday’s video that over 6,000 gross short contracts were closed two weeks ago, which is its most aggressive week of bearish capitulation since July 2020. Whilst just 47 short contracts were closed last week there was a slight increase in net longs by 742 contracts. We therefore remain hopeful that price can remain supported above the 200-day eMA and break ad head towards $1100.