The Week Ahead: RBA meeting, ISM surveys and Nonfarm payroll in focus

The RBA meet on Tuesday in what could be Governor Lowe’s final meeting, so will he go out with a 25bp bang of fade away with a pause? Employment data for the US includes Nonfarm payrolls, ADP and claims data, and traders also have ISM manufacturing and services reports to look forward to.

The week that was:

- The ECBs forum on central banking was another platform for the Fed, ECB and BOE to warn of higher for longer interest rates

- The US with jobless claims fell at its fastest pace in 20 months

- And the same can be said for Australia, with job vacancies still 89% above pre-pandemic levels

- US Treasury Secretary Janet Yellen said that US inflation remains ‘too high’

- Australia’s monthly inflation data came in quite far below expectations, yet remains elevated at 5.8% and market pricing and economists remain divided over whether the RBA will hike or pause next week

- Tokyo CPI came in slightly softer than expected, which lowers expectations for Japan’s nationwide CPI out later in July

- Volatility levels were generally lower in Q3 for global markets overall, and we now head into July which can be a particularly quiet month in the absence of an unexpected catalyst

- US PCE inflation is the main report later today (Friday 30th June), so we’ll update the summary of that important data set over the weekend.

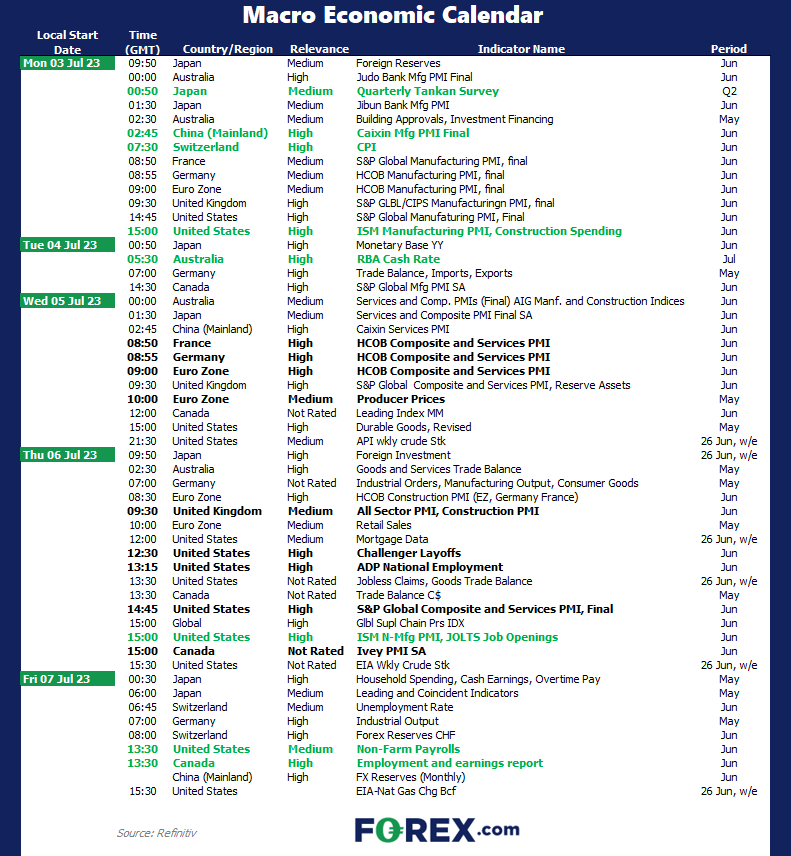

The week ahead (calendar):

Please note the long weekend for US Canada due to Independence Day on July 4th.

The week ahead (key events and themes):

- US employment data (non-farm payroll, ADP employment, jobless claims)

- RBA cash rate decision

- ISM manufacturing and services reports

US employment data (non-farm payroll, ADP employment, jobless claims)

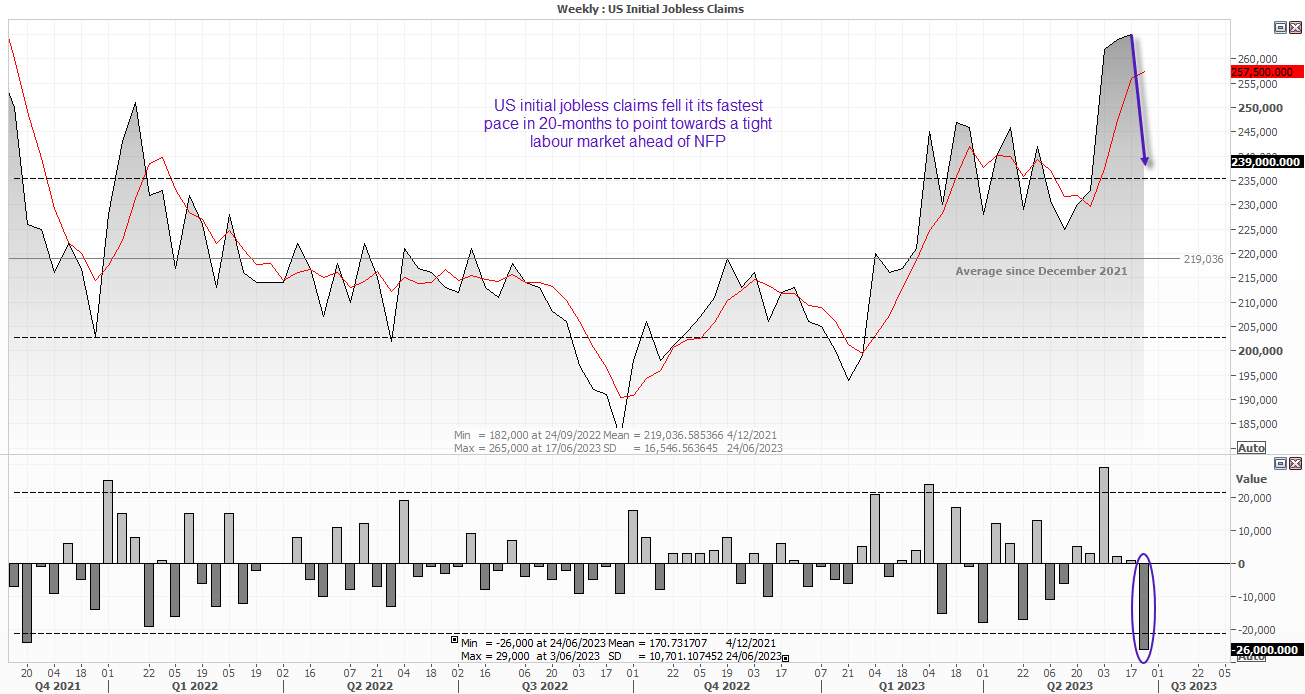

Each time markets think that the Fed are exaggerating with their level of hawkishness, yet more data arrives out to justify the Fed’s concerns. And recent employment data has been no different. Jobless claims data plunged at its fastest pace in 20 months to serve as a stark reminder that the US employment market remains very tight. And that’s a green flag for more hikes whilst inflation remains ‘too high’.

And if we’re to see further strength in next week’s various employment reports, it could further supports the US dollar as it tracks treasury yields north.

Both ASP and NFP came in around the 270-280k mark, which is quite admirable given the level of policy tightening. If we were to see a sudden drop in the ADP figures on Thursday then it could generate some excitement that NFP could follow suit on the Friday and weigh on the US dollar.

Market to watch: USD/JPY, EUR/USD, GBP/USD, S&P 500, Nasdaq 100, WTI crude oil, gold

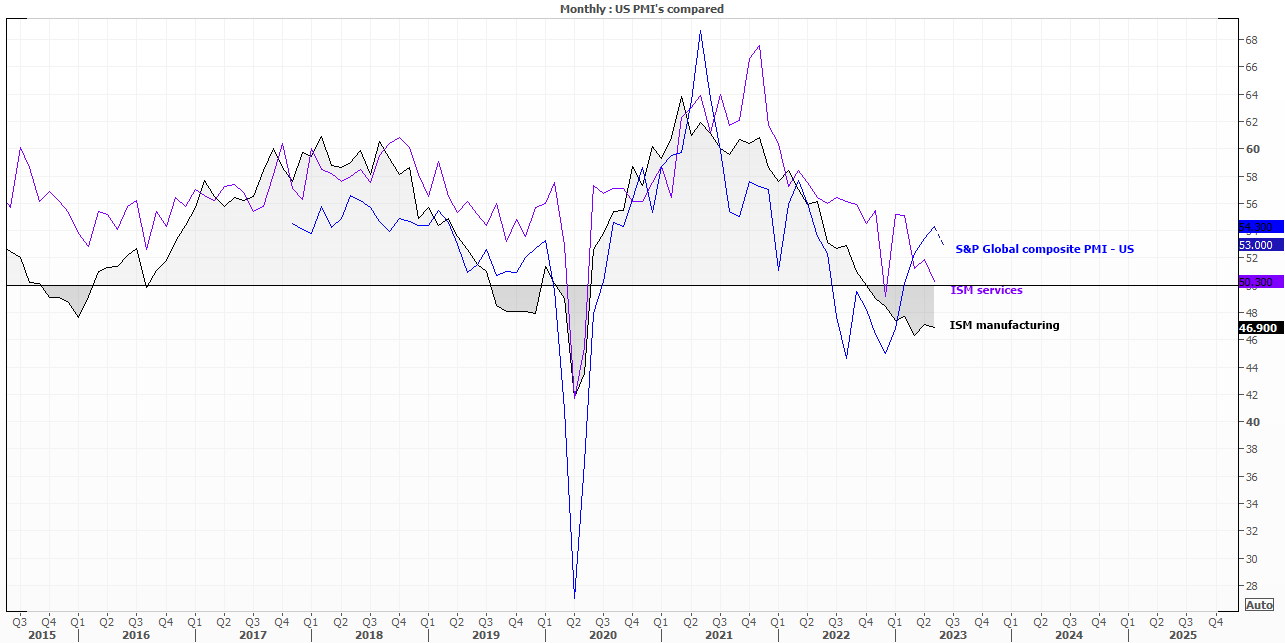

ISM manufacturing and services reports

Surveys such as the ISM and PMIs provide a forward look at growth potential, and their leading quality always catches the attention of traders and economists. You can see that the ISM manufacturing survey peaked in Q1 2021, followed by the S&P global survey and then later in the year the ISM services followed suit. Ultimately, they have trended lower and growth has followed. Whist manufacturing has contracted for 7 month and showing slight signs of stability, new orders have contracted at their second fastest pace since the pandemic om April. Furthermore, the ISM services survey is on the cusp of contraction – and as we now live in a services-led economy, it could spark some volatility should the services measure dip below 50 next week. A silver lining would be if we see prices paid continue to slow for services and fall faster for manufacturing. And an eventual upside to PMI downside is that recessions are deflationary, if somewhat unpleasant.

Market to watch: USD/JPY, S&P 500, Nasdaq 100, Dow Jones, WTI crude oil, gold

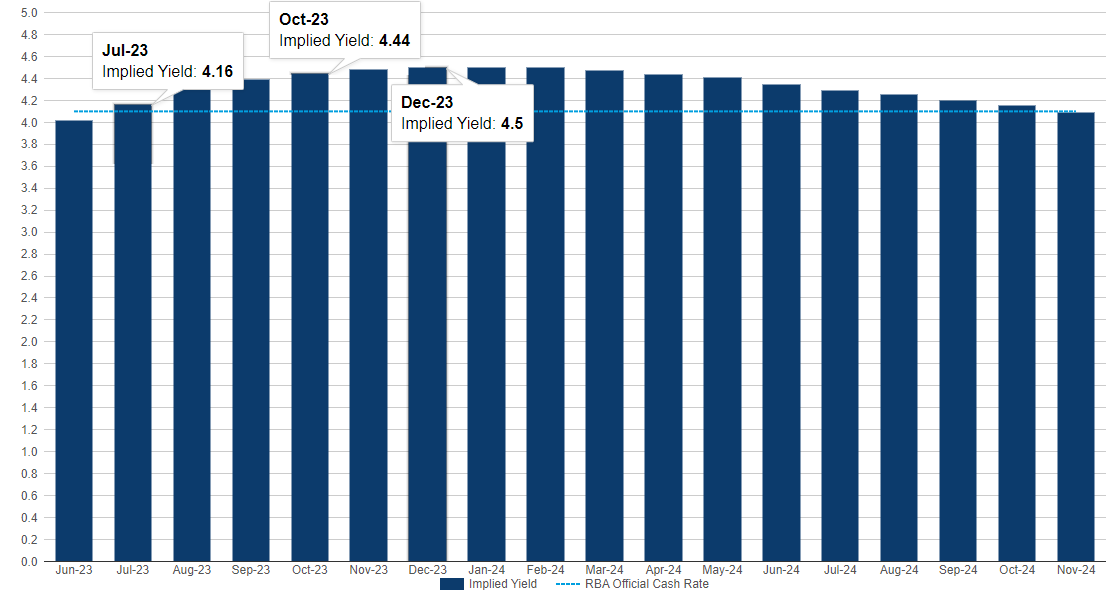

RBA cash rate decision

Money markets and economists remain divided over the RBA’s next course of action, with cash rate futures implying a 72% chance of a pause on Tuesday whilst many banks forecasts continue to favour a hike. On this occasion I’m backing a hike, given that inflation remains ‘too high’ and the employment market too tight. Sure, the monthly inflation report shows that headline inflation cooled to 5.8% versus 6.1% expected (or 5.6% weighted CPI) and it remained flat at 0% m/m. But is it really a cause for celebration when it’s still nearly twice the upper band of the RBA’s 2-3% target range? Retail sales exceeded expectations and job vacancies remain ~89% above their pre-pandemic level and wages are rising. It could also be Governor Lowe’s last meeting so perhaps he’ll decide to go out Market to watch: USD/JPY with a 25bp bang.

As things stand, cash rate futures have fully priced in a 25bp hike by September, and imply a high likelihood of 50bp hikes by December. But with a new governor potentially taking over, we could see some repricing – especially if inflation continues to misbehave.

Market to watch: AUD/USD, AUD/JPY, AUD/NZD, EUR/AUD, ASX 200

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge