The Iranian President all but confirmed a deal with the US will be made, although European heads have pushed back against its likelihood and the US is yet to confirm any such deal. Therefore, if a deal fails to materialise, oil prices are at risk of ripping higher. But in today video we look at WTI futures to highlight key levels for a bearish scenario, would likely requires confirmation of some sort of deal (or simply the concerns to remain that one is around the corner).

We also take a look at spot silver prices, which are trying to build another level of support in its bullish channel. Then we wrap upon NZD/JPY as this is one to watch should appetite for risk sour for whatever reason. The technicals suggest a top may be forming, but we just need a catalyst to push it lower.

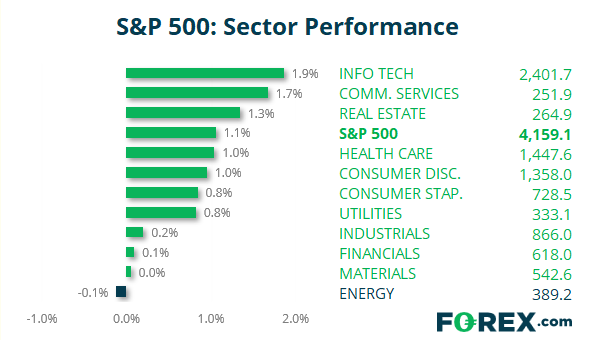

S&P 500: Market Internals

S&P 500: 4159.12 (1.06%), 20 May 2021

- Information Technology (1.86%) was the strongest sector and Energy (-0.12%) was the weakest

- 3 out of the 11 sectors outperformed the S&P 500

- 1 out of the 11 sectors traded lower on the S&P 500

- 355 (70.30%) stocks advanced and 150 (29.70%) declined

- 91.68% of stocks closed above their 200-day average

- 69.7% of stocks closed above their 50-day average

- 49.9% of stocks closed above their 20-day average

Outperformers:

- + 8.53% - Enphase Energy Inc (ENPH.OQ)

- + 7.37% - Hormel Foods Corp (HRL.N)

- + 4.61% - ViacomCBS Inc (VIAC.OQ)

Underperformers:

- -7.01% - Ralph Lauren Corp (RL.N)

- -4.06% - Discovery Inc (DISCK.OQ)

- -4.01% - Gap Inc (GPS.N)