Volatility has been mostly lower ahead of today’s highly anticipated meeting. And that is usually the case as traders square up positions to mitigate risk and liquidity thins out. But this liquidity (and along with it, volatility) is likely to return following the meeting, which could create some interesting moves across major asset classes such as currencies and commodities.

So, in today’s video we look at key levels for WTI and gold, then highlight the potential for the Russel 2000 to carve out a deeper retracement.

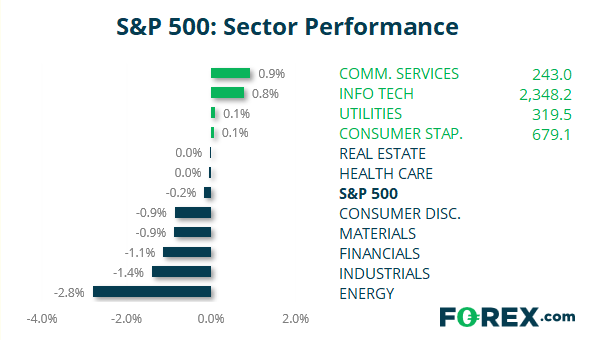

S&P 500 (-0.16%) 16 March 2021

- The index closed -0.19% below its 52-week high

- 287 (56.83%) stocks advanced and 215 (42.57%) declined

- Communication Services (0.93%) was the strongest sector and Energy (-2.8%) was the weakest

- 6 out of the 11 sectors outperformed the index

- 88.32% of stocks closed above their 200-day average

- 86.73% of stocks closed above their 50-day average

- 79.6% of stocks closed above their 20-day average

View recent videos:

Nasdaq holding support, copper feeling its own weight

Gold to shine again? Euro stalls below 1.20

Nasdaq to close the gap with Wall Street peers?

Record high for the Dow, euro perks up ahead of ECB