A more hawkish-than-expected FOMC meeting provides two issues for copper; a stronger US dollar and the increased likelihood that the US will begin to remove stimulus (which has been a supporting feature to the ‘great recovery’ and higher commodity prices). So we take another look at market positioning on coper futures and key levels of the front contract. We also look at a pivotal level on the S&P 500 over the near-term, then update our analysis on gold after its epic break lower yesterday.

S&P 500: Market Internals

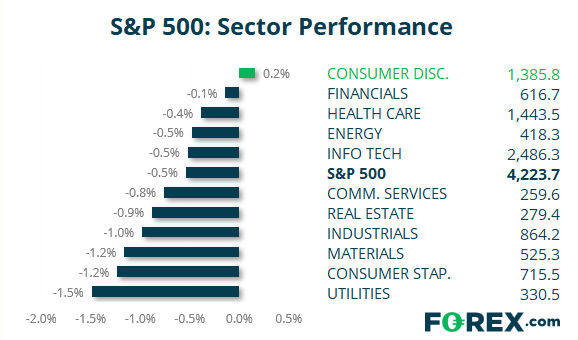

S&P 500: 4223.7 (-0.54%), 16 June 2021

- Consumer Discretionary (0.16%) was the strongest sector and Utilities (-1.49%) was the weakest

- 10 out of the 11 sectors traded lower on the S&P 500

- 101 (20.00%) stocks advanced and 404 (80.00%) declined

- 89.5% of stocks closed above their 200-day average

- 55.64% of stocks closed above their 50-day average

- 41.19% of stocks closed above their 20-day average

Outperformers:

- + 4.90% - Enphase Energy Inc (ENPH.OQ)

- + 4.59% - Occidental Petroleum Corp (OXY.N)

- + 3.74% - Centene Corp (CNC.N)

Underperformers:

- -7.22% - Willis Towers Watson PLC (WLTW.OQ)

- -5.59% - Oracle Corp (ORCL.N)

- -3.89% - Take-Two Interactive Software Inc (TTWO.OQ)

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM

Yesterday 07:48 PM