Perhaps for those used to trading the latest NFT or meme stock, the chart of USD/TRY may not look to unusual…but for FX traders, the ongoing collapse in the currency of a country in the top 20 of GDP is a truly astounding development.

What are Emerging Market economies?

Last week, my colleague Joe Perry identified the pair’s fresh record high on the back of geopolitical tensions and surging inflation, but the catalyst for the latest swoon in the lira is even more alarming. In a late-night decree on Thursday, Turkey’s President Recep Tayyip Erdogan dismissed several more of the central bank’s deputy governors, including the only one who opposed last month’s surprising interest rate cut.

In other words, traders’ fears that the nominally independent central bank is becoming hopelessly politicized are being realized, causing a widespread loss of confidence in the lira. According to central bank data, foreign investors held just $6B in government bonds at the halfway point of the year, down more than 90% from the $61.5B in Turkish bonds that foreign investors held as recently as 2013.

Trade USD/TRY now: Login or open a new account!

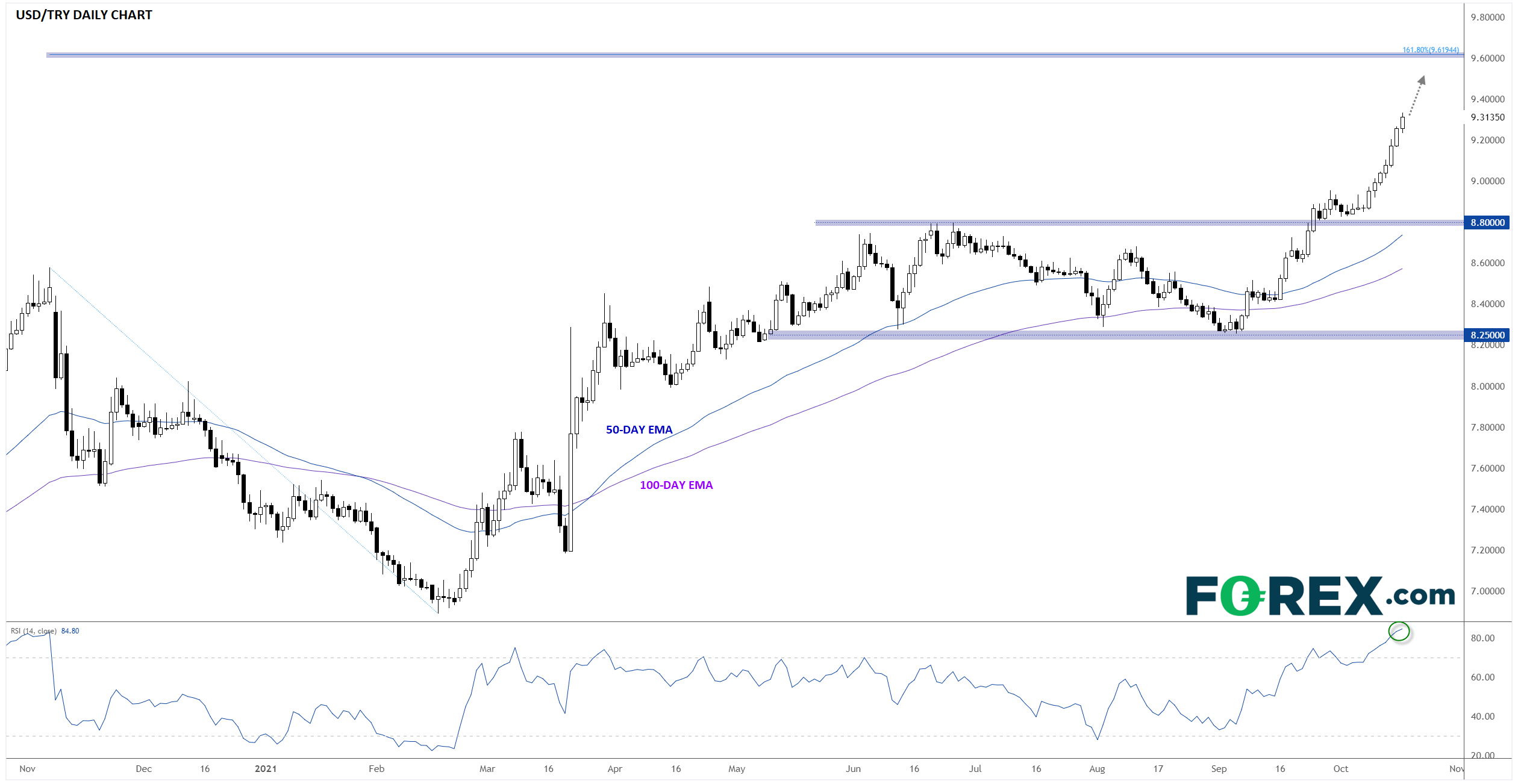

Turning our attention to the chart, USD/TRY is working on its seventh consecutive daily gain after blasting through the 9.00 level last week. With prices at a fresh record high, there are no levels of previous resistance nearby, though the 161.8% Fibonacci extension of the 3-month pullback that started this time last year looms up near 9.60 as a logical next target for bulls. Beyond that, the psychologically-significant 10.00 level may come into play next.

Source: StoneX, TradingView

It is notable that the 14-day RSI indicator is above 80, at an area that has previous marked short-term peaks in the USD/TRY exchange rate. That said, the country’s economic and monetary policy outlook hasn’t been this precarious before, so rates could certainly continue to surge regardless of an overbought reading on a technical indicator.

The next hurdle for the beleaguered currency is another CBRT monetary policy meeting on Thursday. Based on last week’s actions and the recent price action, investors a bracing for another interest rate cut, further deterioration in the value of the lira, and continued inflation in the country.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.