USD/JPY Talking Points:

- It was a little over a month ago that the market seemed very bearish on USD/JPY despite the stalling showing around the 140.00 level.

- The week of the FOMC rate cut, USD/JPY opened with a failed breakout at 140.00, followed by the initial build of higher-lows to go along with RSI divergence. Now a month and 1,000 pips later, the mood seems very bullish in the pair despite the expectation for the Fed to continue cutting rates through the end of next year.

- I look into USD/JPY from both short and long-term perspectives in the Tuesday webinar each week, which you’re welcome to join: Click here for registration information.

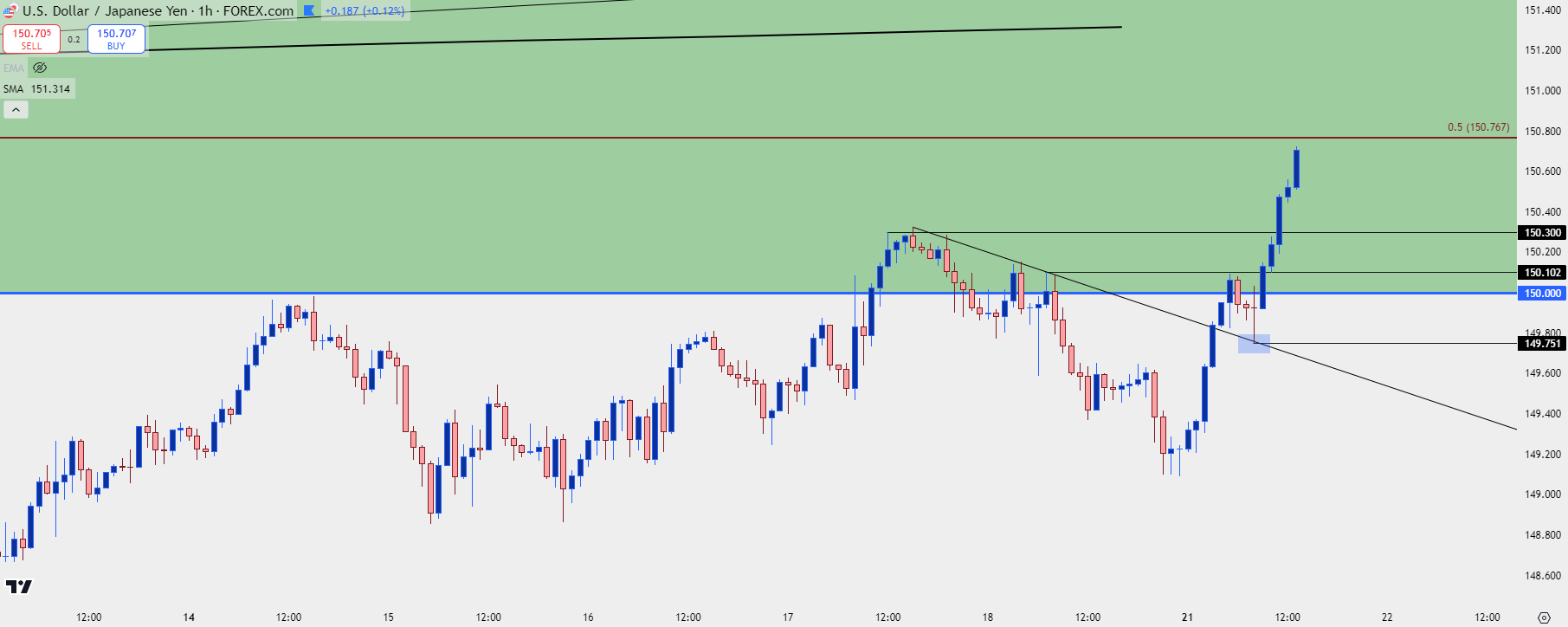

USD/JPY had showed defense of the 150.00 level last week as sellers came in before a test at that level a week ago. By Thursday, bulls were willing to take the chance, but their gambit was short-lived, as prices dipped again on Friday to close the week below the big figure. Even after this week’s open, prices held below 150.00.

It was after this morning’s US open that the pair started to show strength above the big figure, and that move has largely continued since.

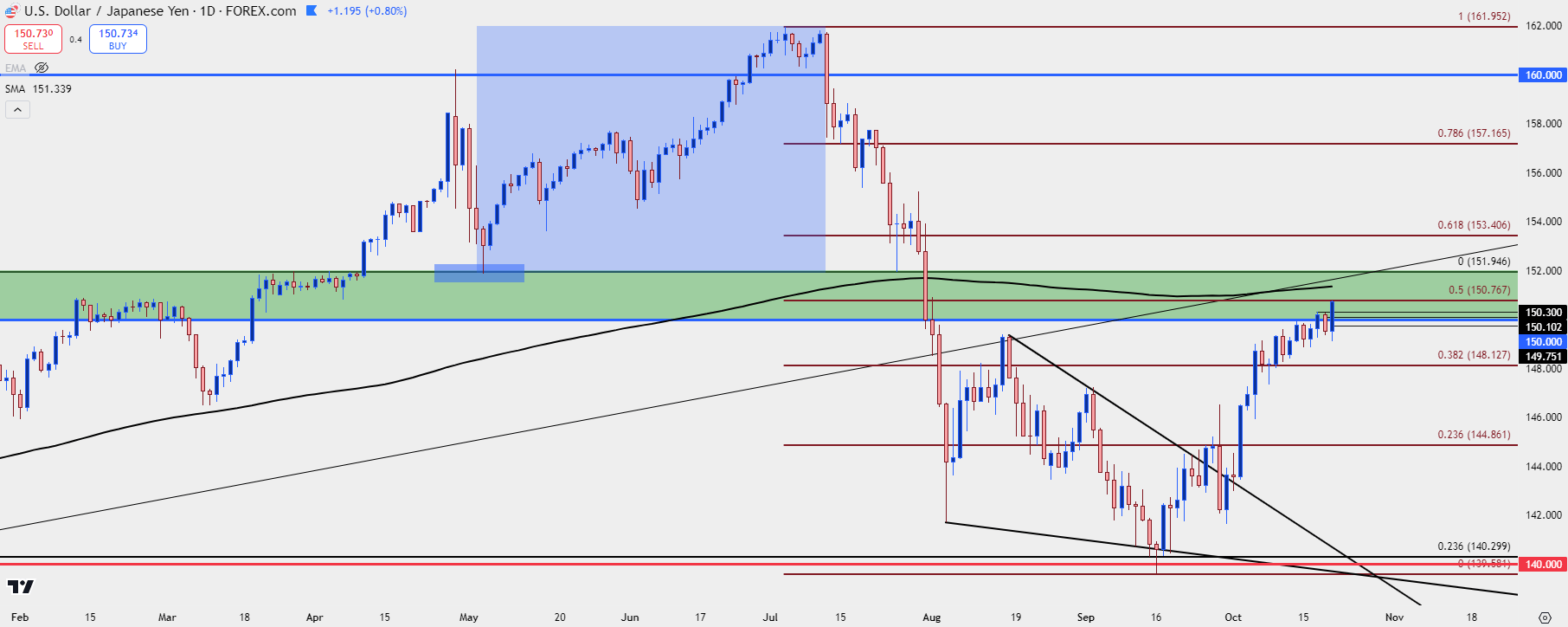

At this point, the pair is fast approaching the Fibonacci level at 150.77, which is the 50% mark of the July-September sell-off in the pair. Above that is the 200-day moving average, which currently projects to around 151.30. And above that is a major level at 151.95, which has held the highs for each of the past two years in USD/JPY.

For bullish continuation, chasing could be challenging giving proximity to that resistance and just how entrenched the short-term move has become. There are prior price swings at 150.30 and 150.10 that could be of interest for continuation scenarios.

USD/JPY Hourly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/JPY Prices Driving Narrative

It was just a little over a month ago that sentiment around USD/JPY seemed really bearish. With the Fed expected to push heavy into a cutting posture, the pair opened the week of the FOMC rate decision with a test below the 140.00 level. Even before that, the bearish move had started to show signs of stall, first with a case of RSI divergence before a big zone of support came into play shortly after.

But that failed as sellers dried up and prices started to bounce. A higher-low showed shortly after, with another after the actual FOMC rate cut announcement and that’s around the time that bulls started to take back over in USD/JPY.

A month later, longer-dated US yields are surging, and many are proclaiming the return of the carry trade. Perhaps that’s true but at this point, markets are still expecting the Fed to cut heavily through the end of next year, with 150 bps of rate cuts priced-in through the end of next year.

But as I’ve been pointing out in these articles around USD/JPY for more than a month – fundamentals are not a direct push-point for price. Price is driven by buyers and sellers and while there can share a relationship between fundamental and headline flow, that’s not always the case. And at this point the concern with the long side of USD/JPY is re-test of the same price that turned around the pair back in Q4 of 2022 and 2023. That’s at 151.95, and it sits just overhead.

Before that comes into play, there’s a couple of other areas of interest, such as the 200-day moving average that currently plots around 151.30; along with the 50% mark of the sell-off at 150.77.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist