Key Events for the Week Ahead

- PMI data across EU, UK, and US (Monday)

- BOJ Governor Ueda Speech (Tuesday)

- US Unemployment Claims and Durable Goods Orders (Thursday)

- Fed Powell and Treasury Secretary Yellen Remarks at Treasury Market Conference (Thursday)

- Tokyo Core CPI (Friday)

- US Core PCE Inflation (Friday)

US Dollar Index – Weekly Time Frame

Source: Tradingview

Beyond the Fed’s recent 50bps rate cut, the US Dollar Index (DXY) has managed to hold its ground above its December 2023 lows, briefly dipping toward July 2023 levels. On the weekly chart, the Relative Strength Index (RSI) is bouncing back from the oversold zone, providing support for the dollar above the 100.50 level, maintaining its stability for now.

This stability, combined with the BOJ’s rate hold on Friday (driven by easing inflation risks), has led to a positive rebound in the USDJPY pair. The stabilized dollar is also allowing precious metals like silver to maintain their upward momentum, with silver prices pushing back towards their July 2024 highs, above the $31 mark.

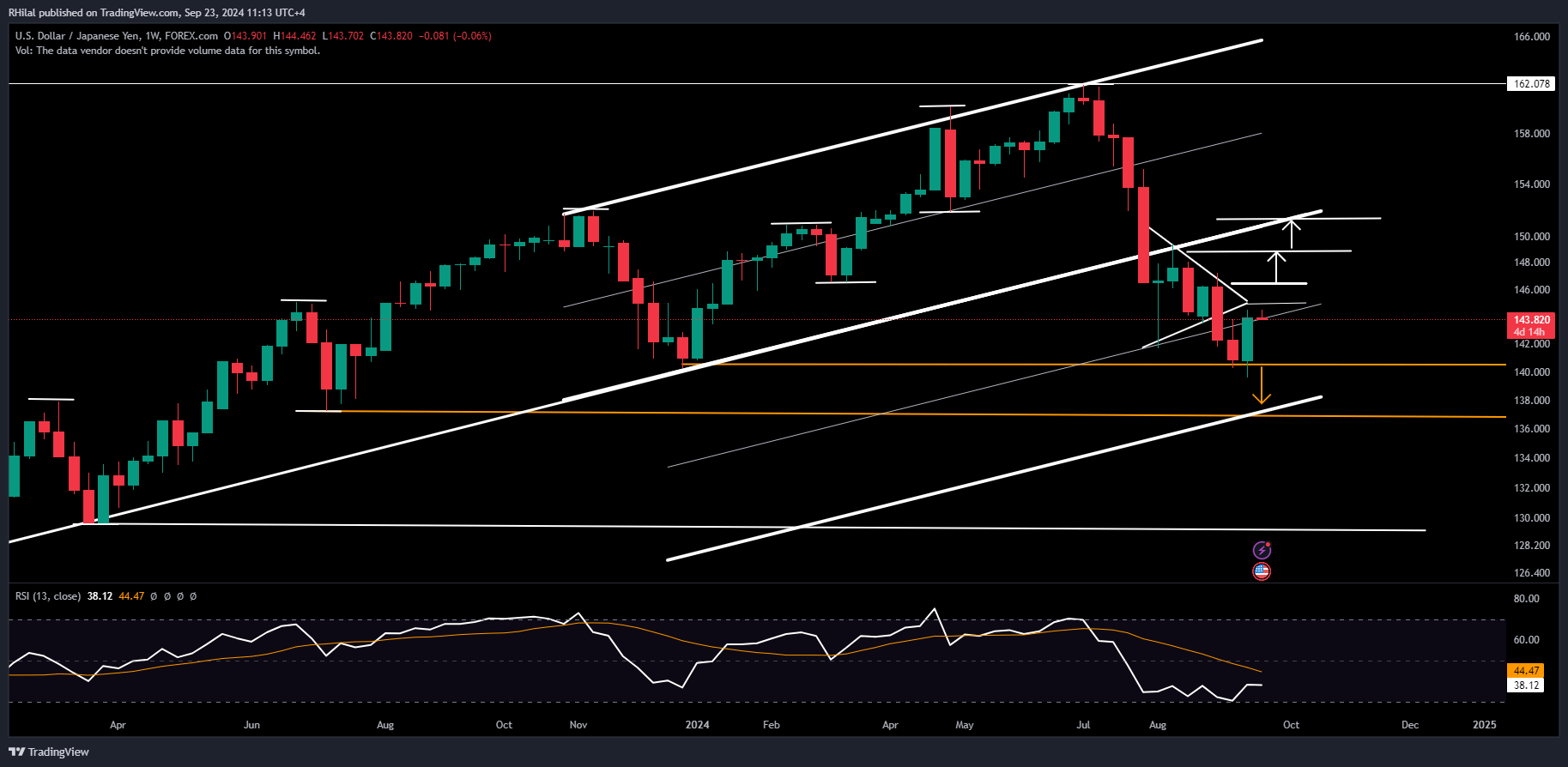

USDJPY Analysis – Weekly Time Frame

With the dollar stabilizing, the USDJPY is continuing its rebound above the 140 level, which aligns with:

- The 0.618 Fibonacci retracement level of the trend between the January 2023 low (127.20) and the July 2024 high (161.95)

- Positive divergence in the weekly RSI, rebounding from oversold territory

- The December 2023 low, acting as further support

This week, the USDJPY is likely to be influenced by several economic indicators, including PMI data, durable goods orders, and key remarks from Fed Chair Powell and Treasury Secretary Yellen at the Treasury Market Conference.

Additionally, Friday’s PCE deflator will offer more insight into inflation trends. While the recent Fed rate cut signals the potential for aggressive easing, upcoming data on inflation and employment could still impact the trajectory of the dollar and USDJPY.

On the Yen side, the Tokyo CPI will be closely watched, having surged to near 2024 highs in August. Technically, the USDJPY’s rebound could face resistance at the trendline connecting the March and December 2023 lows, with potential targets at the 149 and 151 levels if it closes above the key 146 barrier. On the downside, support is expected near the July 2023 low at 137.

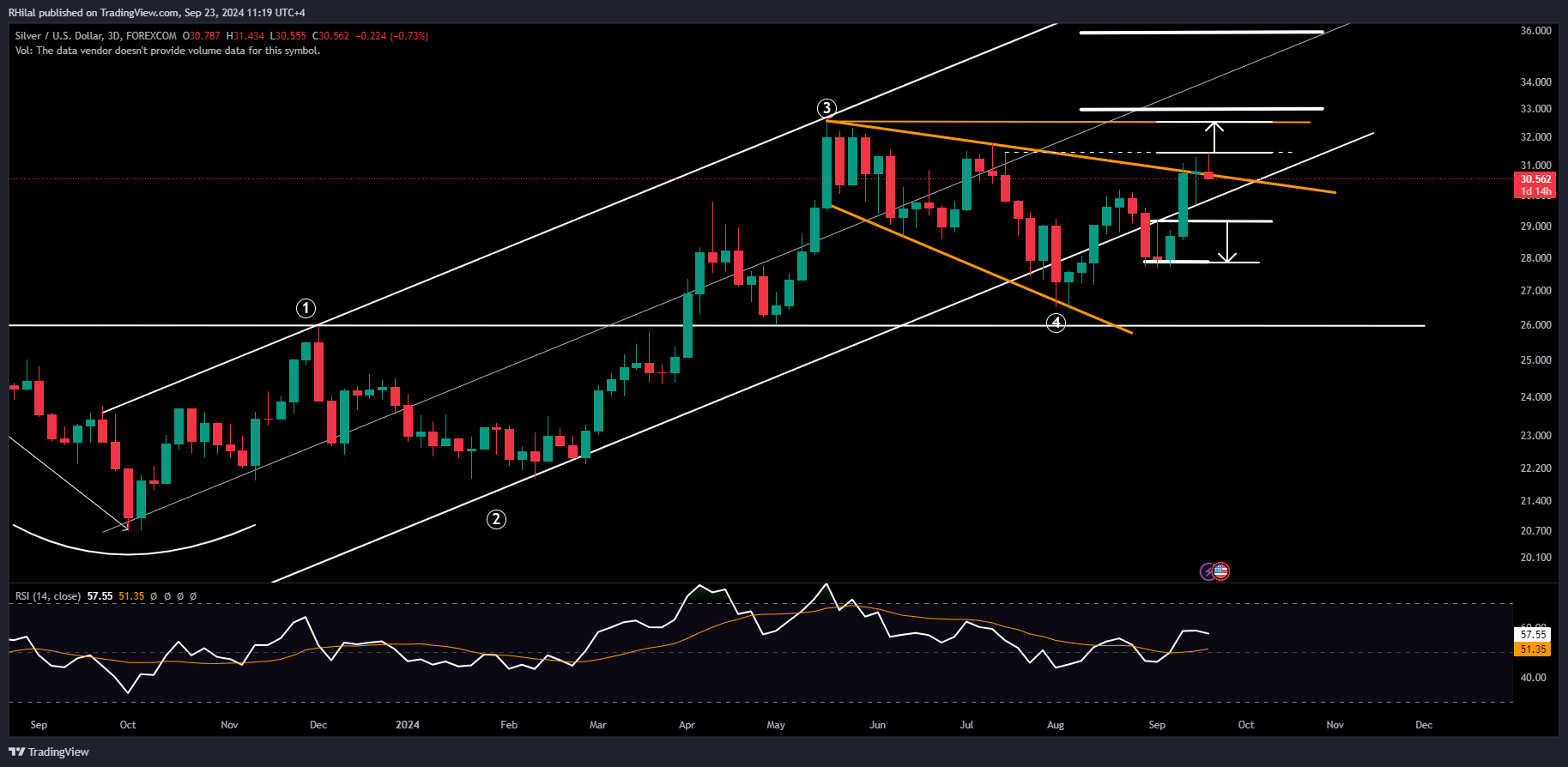

Silver Analysis – 3 Day Time Frame

Source: Tradingview

With a stable dollar, for now, and rising geo-political tensions in the Middle East, precious metals are on the rise with rising haven demand. Gold is tracing fresh record highs above the 2600-mark, Gold is nearing fresh record highs above the $2,600 mark, while silver continues its ascent towards 2024 highs.

Currently, silver is in a corrective phase, retreating from the previously mentioned resistance at $31.50. However, the broader uptrend is expected to resume after finding support, with key levels anticipated between $29.20 and $30, along the lower border of the primary bullish channel.

On the upside, a breakout above the $32.50 high could lead to further gains, with resistance levels at 33, 35, and potentially 37.

--- Written by Razan Hilal, CMT – on X: @Rh_waves