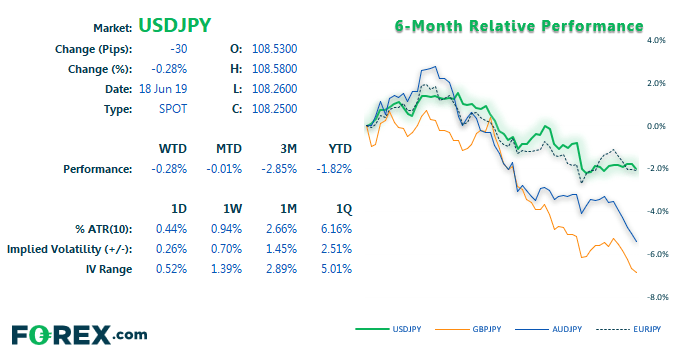

We’ve been patiently monitoring corrective price action on USD/JPY in hope of it confirming a swing high. With an FOMC meeting on tap, the meeting could spark the volatility required to make or break the bearish bias.

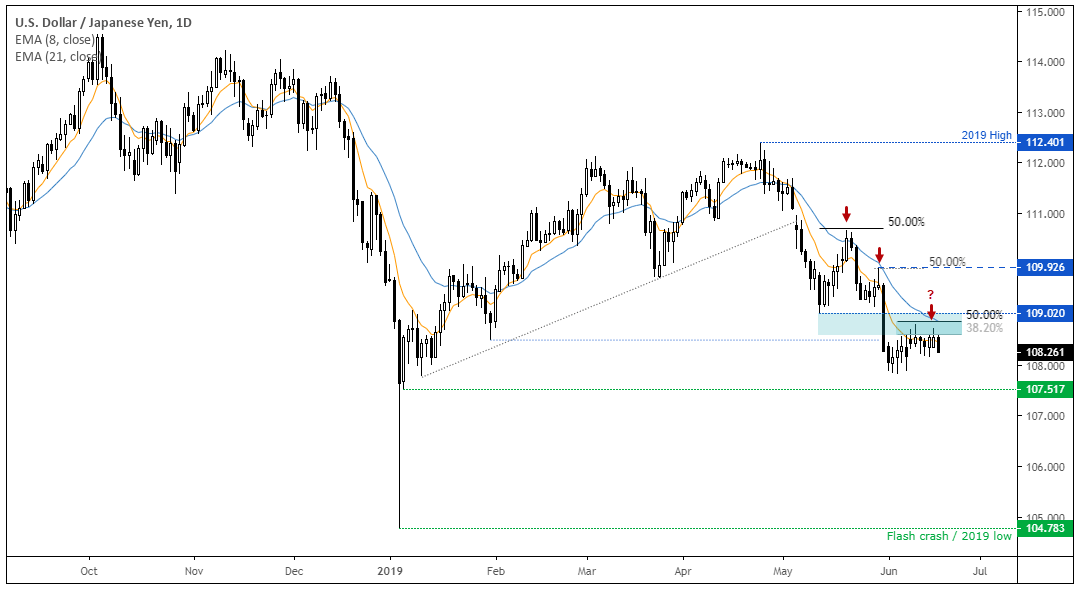

We can see on the daily chart the USD/JPY has had a decent relationship with the 50% retracement level during its downtrend. On the 7th June, ahead of the NFP report, we noted that we could use the area between the 38.2% - $50 retracement as a resistance zone to consider fading into. Indeed, whilst the correction has dragged on a little, the area continues to hold as resistance. Furthermore, we’ve seen a few upper spikes within the zone to show a reluctance to push higher.

Of course, we have the FOMC meeting and this is currently capping volatility. As my colleague Fawad Razaqzada pointed out in his Week Ahead report, a consensus is growing they’ll use tomorrow’s meeting to guide markets towards a July cut. At the time of writing, markets are pricing in a 20.8% chance of a cut tomorrow and a 67.9% chance of a cut in July. And, with USD/JPY rising into resistance, the FOMC meeting could provide the catalyst for a swing trade short if they deliver a dovish hold tomorrow.