US Dollar Outlook: USD/JPY

USD/JPY continues to pull back from the monthly high (158.88) to keep the Relative Strength Index (RSI) below 70, and the oscillator may show the bullish momentum abating as it moves away from overbought territory.

USD/JPY Pulls Back to Keep RSI Below Overbought Zone

USD/JPY initiates a series of lower highs and lows following the kneejerk reaction to the 256K rise in US Non-Farm Payrolls (NFP), and the exchange rate may struggle to retain the advance from the December low (148.65) should it fail to defend the monthly low (156.24).

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Nevertheless, data prints coming out of the US may sway USD/JPY as the Consumer Price Index (CPI) is seen widening to 2.8% in December from 2.7% per annum the month prior, while the core rate is expected to hold steady at 3.3% during the same period.

Indications of persistent inflation may generate a bullish reaction in the US Dollar as it puts pressure on the Federal Reserve to pause its rate-cutting cycle, but a softer-than-expected CPI print may keep USD/JPY under pressure as it fuels speculation for lower US interest rates.

With that said, USD/JPY may threaten the monthly low (156.24) should the bearish price series persist, but the exchange rate may attempt to further retrace the decline from the 2024 high (161.95) should it track the positive slope in the 50-Day SMA (154.40).

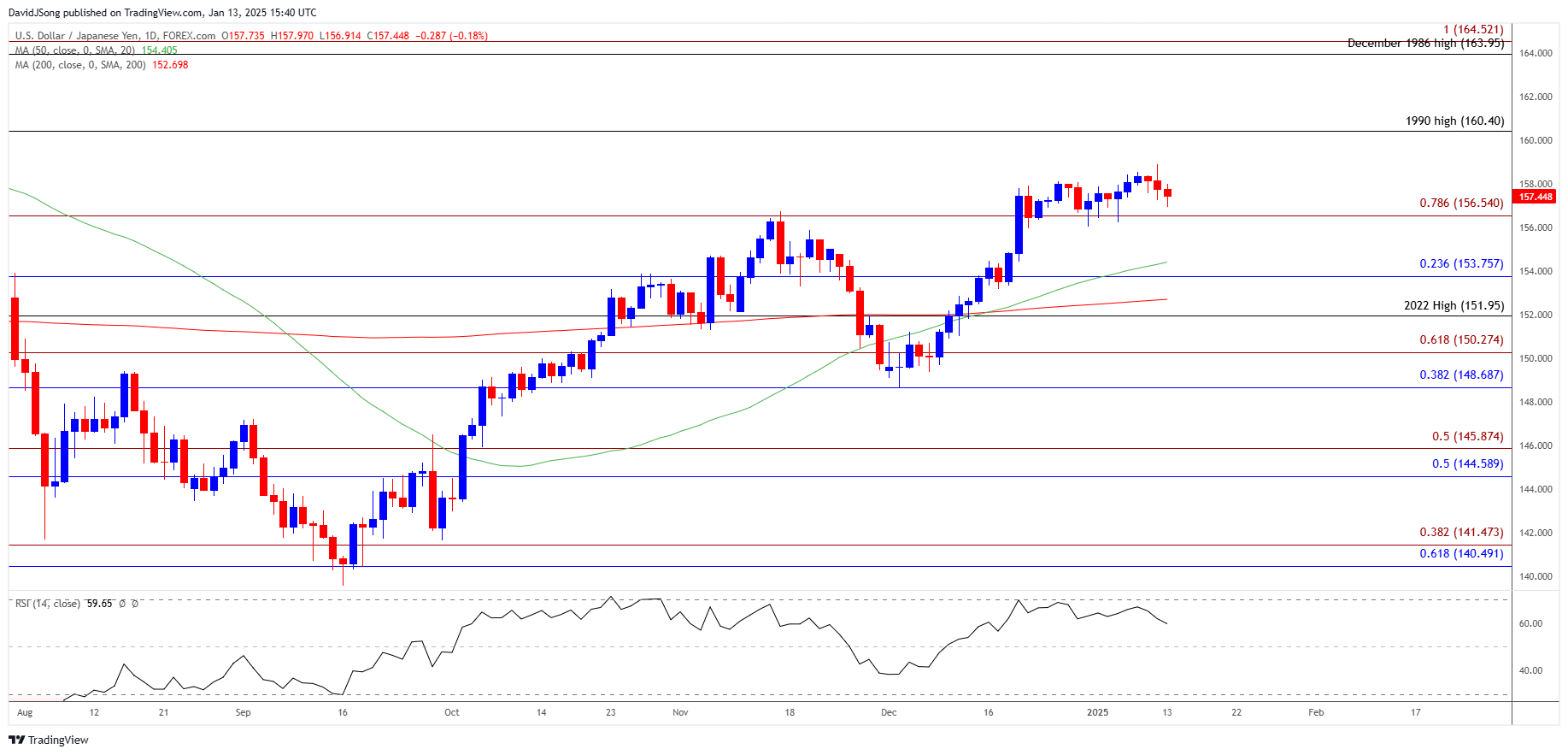

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/JPY on TradingView

- USD/JPY marks a three-day decline for the first time since November, and failure to hold above the monthly low (156.24) may push the exchange rate towards 153.80 (23.6% Fibonacci retracement).

- Next area of interest comes in around 151.95 (2022 high), but lack of momentum to close below 156.50 (78.6% Fibonacci extension) may keep USD/JPY above the 50-Day SMA (154.40).

- Need a breach above the monthly high (158.88) to bring 160.40 (1990 high) on the radar, with the next region of interest coming in around the 2024 high (161.95).

Additional Market Outlooks

US Dollar Forecast: USD/CHF Climbs Towards 2024 High

GBP/USD Approaches November 2023 Low

Gold Price Recovery Eyes December High

US Dollar Forecast: USD/CAD Stages Three-Day Rally

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong