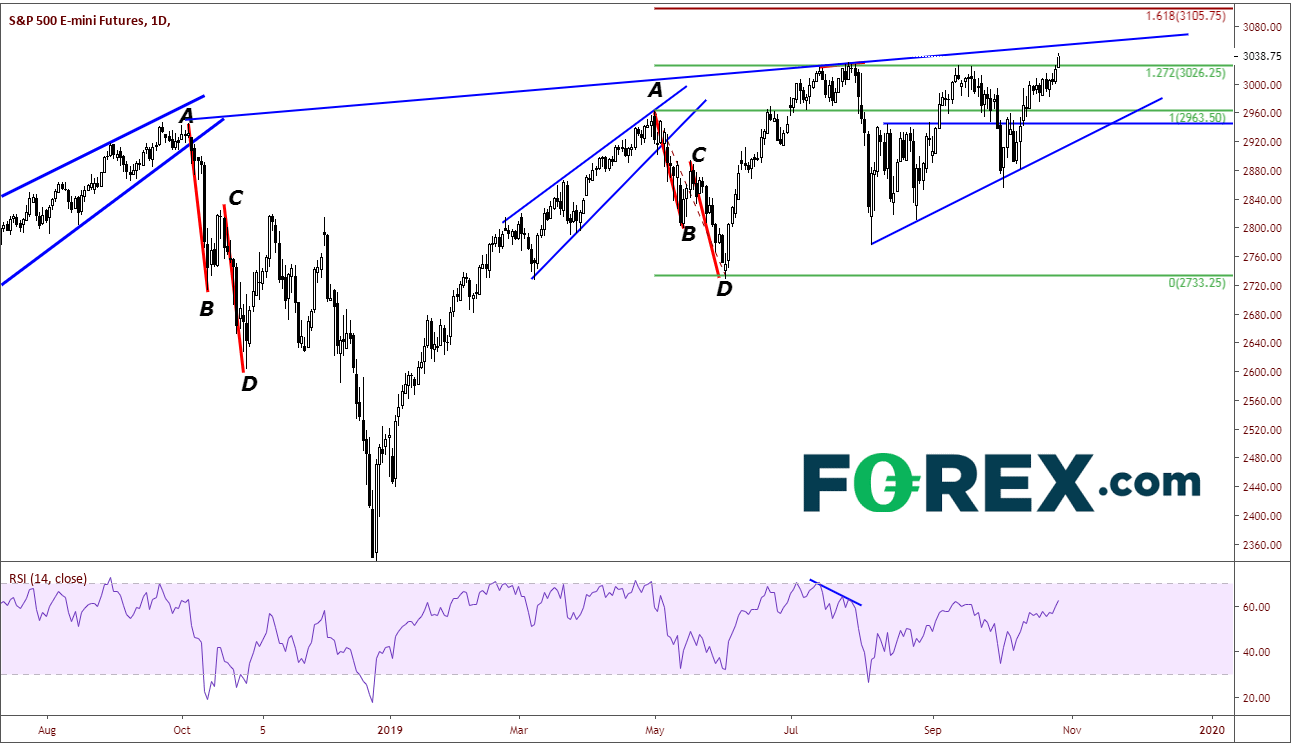

As US stock markets were teetering near all-time highs this morning, President Trump said that “We are looking to be ahead of schedule to sign Phase One of the US-China trade deal” and that he expects to sign the China Trade Pact as APEC in meeting in Chile, according to Reuters. And with that, stocks catapulted to new highs! S&P 500 futures currently trading near their highs at 3042.75. First target on the upside for the index is the upsloping trendline connecting tops from October 2018 near 3050. Next target is the 161.8% extension from the April 30th highs to the June 3rd lows, with is 3105.75.

Source: Tradingview, CME, FOREX.com

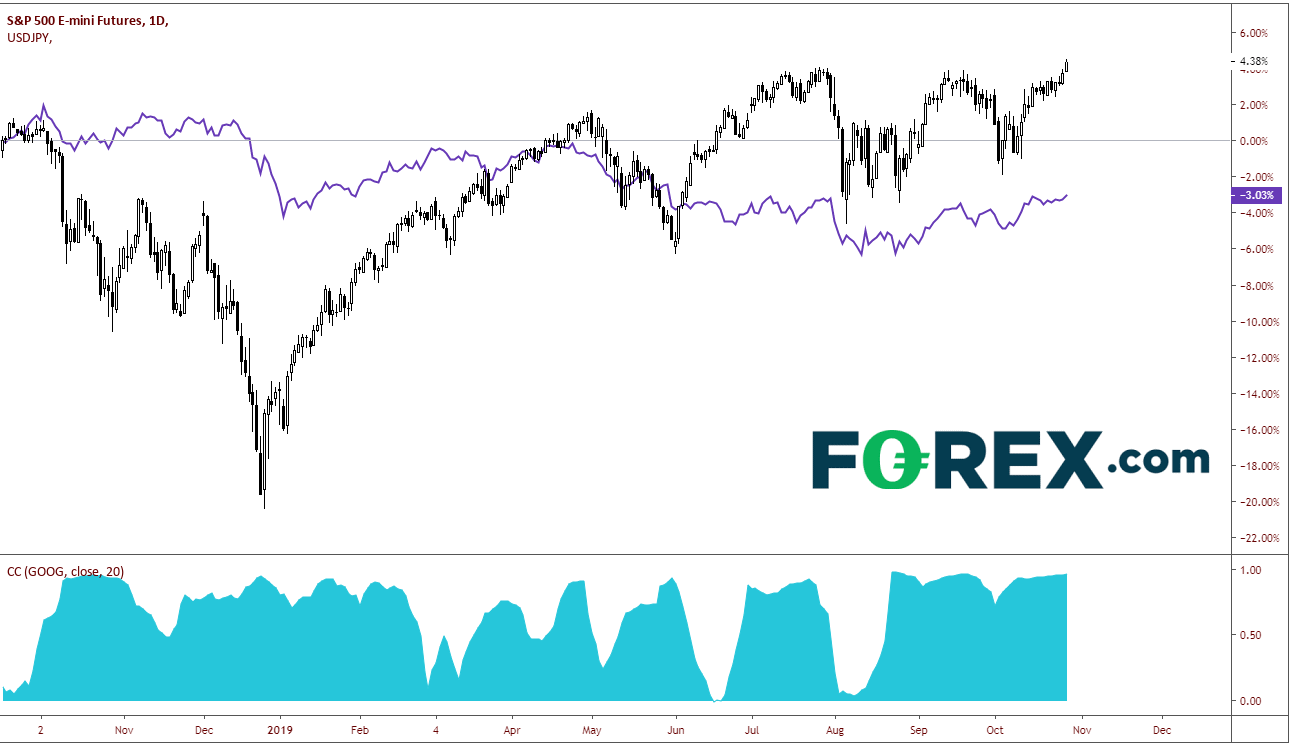

As stocks are making new highs, the USD/JPY is making a move higher with risk on. USD/JPY is highly correlated with S&P 500 at the moment, with a correlation coefficient of +.96! This means that if stocks move higher, USD/JPY tends to move higher. If stocks move lower, USD/JPY tends to move lower.

Source: Tradingview, CME, FOREX.com

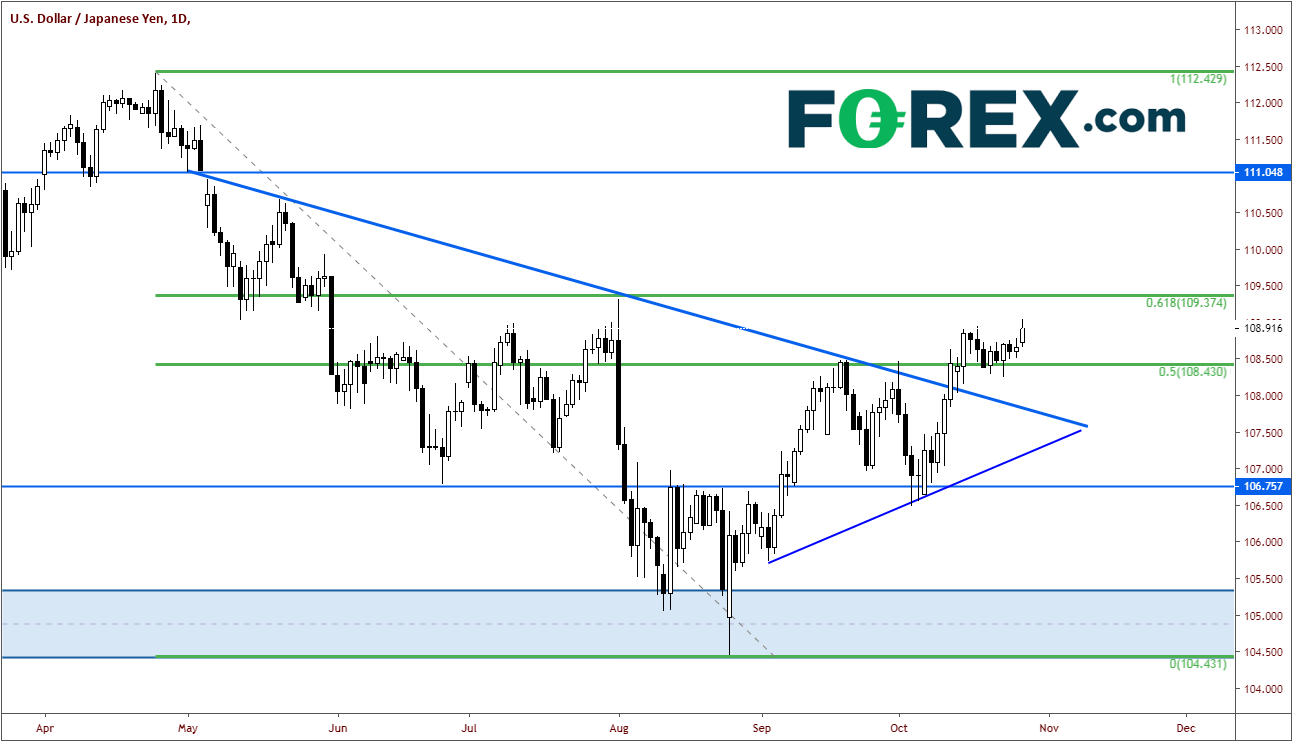

The Bank of Japan is having their rate decision on Friday, and it is expected that the Bank with provide more accommodation due to the recent fall in exports, as my colleague Fawad pointed out the Week Ahead (however some are suggesting that they may hold off until next month). With stocks on the rise, and the possibility of more easing from the BOJ, it’s no surprise that USD/JPY is moving higher. In addition, the pair recently broke through the downward sloping trendline from May 2nd, and through 109.00 for the first time since August 1st. There is resistance at 109.37, which is the 61.8% retracement from the highs on April 24th to the lows on August 26th. There is also horizonal resistance near this level. However, if it breaks through, USD/JPY could run up to the gap fill near 111.00 quickly.

Source: Tradingview, FOREX.com

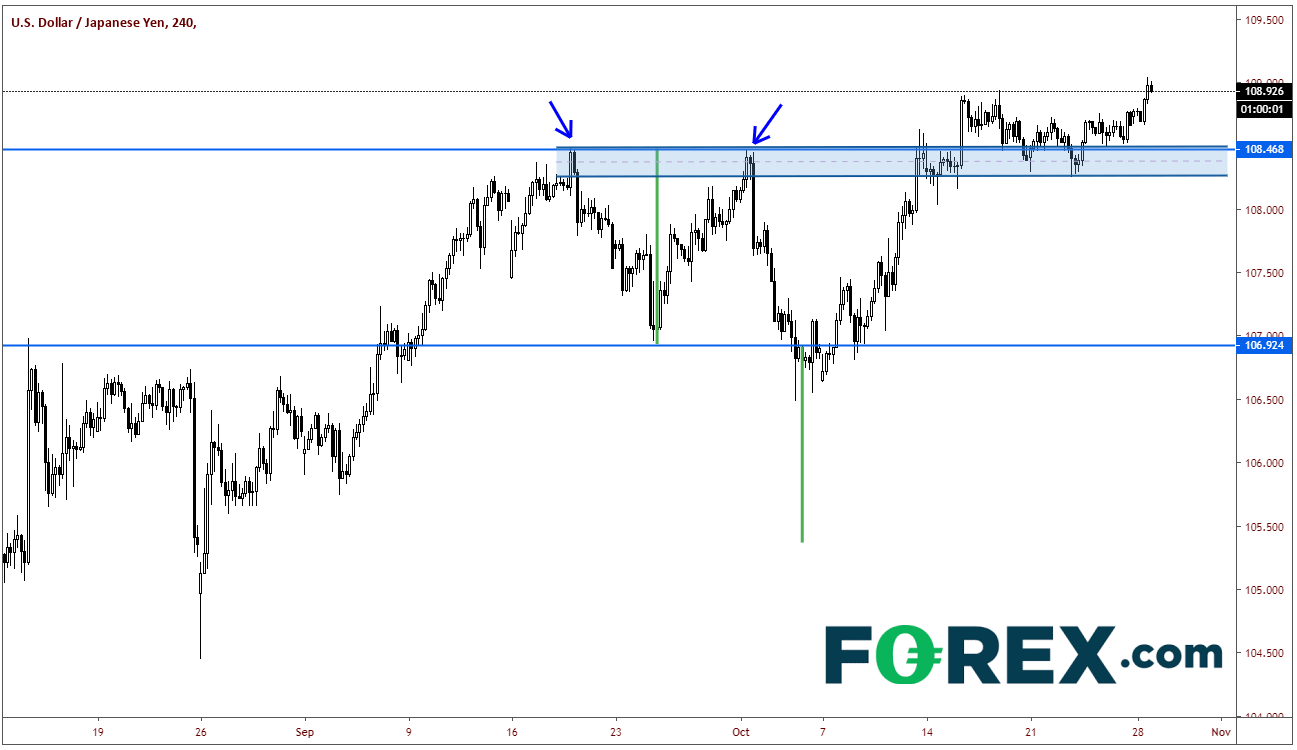

On a 240-minute chart, the USD/JPY shook out weak shorts in the market with the failure to continue lower after breaking thought the bottom of the double top pattern. The pair then went back up to the highs near 108.50 and took out shorts there as well. Currently, there is a strong support zone between 108.25 and 108.50. Below that, support comes in back at the prior lows of the double top near 107.00.

Source: Tradingview, FOREX.com

If you are trading USD/JPY, make sure to pay attention to stocks. If stocks have a sudden move, you can be sure USD/JPY will follow given the current correlation!