The Bank of Japan, as expected, kept its benchmark interest rate at Negative -0.1% unchanged.

At the same time, the central bank announced plans to purchase unlimited amount of Japanese government bonds in case it is necessary.

Meanwhile, official data showed that Japan's jobless rate ticked up to 2.5% in March (as expected) from 2.4% in February.

However, the Japanese yen seems not to be weakened markedly by such economic reports.

On a Daily Chart (Short-Term view), USD/JPY is testing the key support at 107.00. A break below this level on a daily basis should bring about a bearish reversal.

At the same time, the central bank announced plans to purchase unlimited amount of Japanese government bonds in case it is necessary.

Meanwhile, official data showed that Japan's jobless rate ticked up to 2.5% in March (as expected) from 2.4% in February.

However, the Japanese yen seems not to be weakened markedly by such economic reports.

On a Daily Chart (Short-Term view), USD/JPY is testing the key support at 107.00. A break below this level on a daily basis should bring about a bearish reversal.

Source: GAIN Capital, TradingView

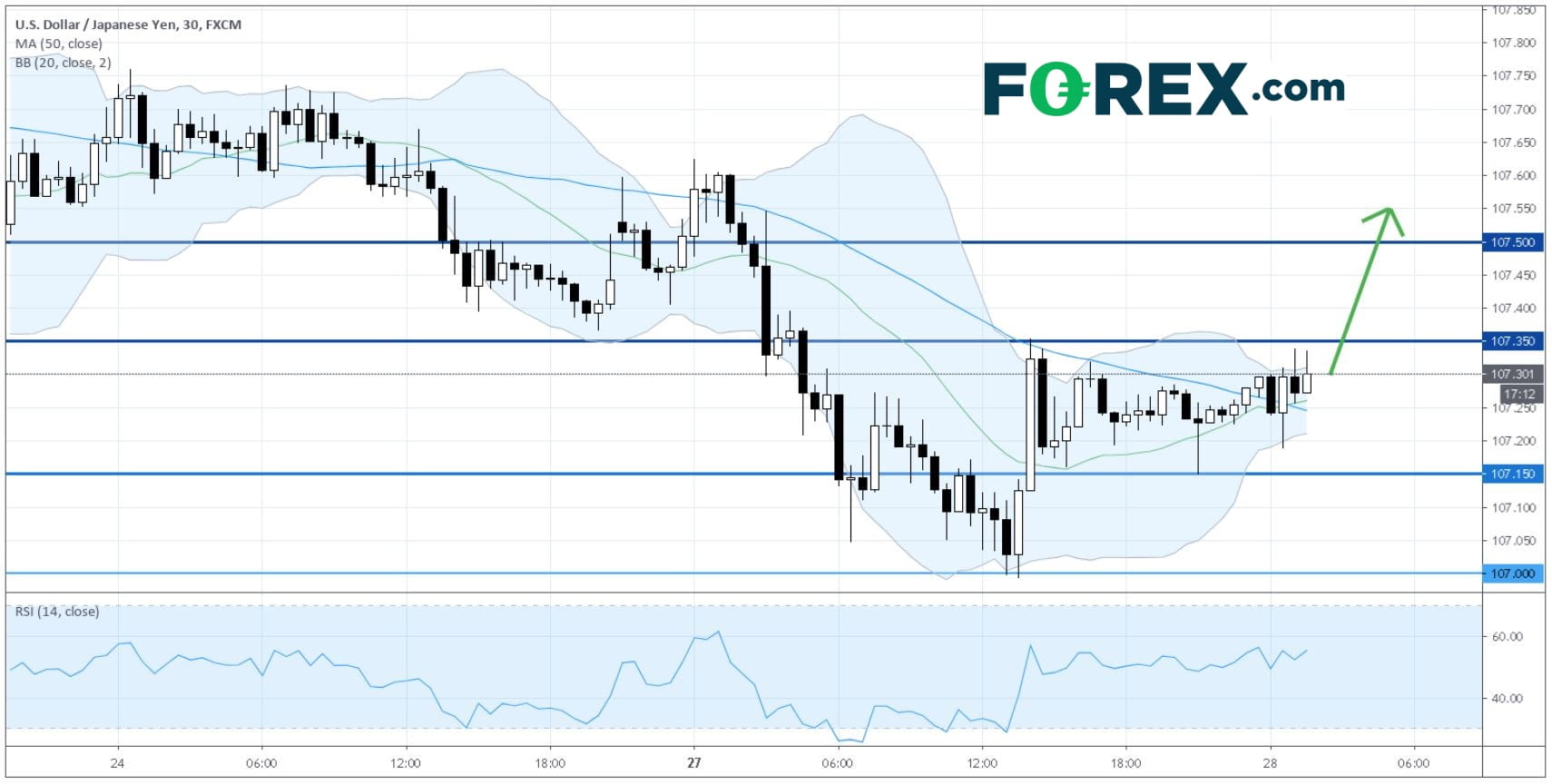

On an Intraday 30-minute Chart, USD/JPY continues a rebound from a low of 106.97 seen overnight. It has located a key support at 107.15. Overhead resistance is 107.35. Above this level, further resistance would be encountered at 107.50.

Source: GAIN Capital, TradingView

Latest market news

December 20, 2024 04:14 PM

December 20, 2024 02:45 PM

December 19, 2024 10:26 PM

December 19, 2024 05:22 PM

December 19, 2024 02:23 PM

December 19, 2024 01:56 PM