Key Events for the Week Ahead

- FOMC Member Waller Speech (Monday)

- Japanese Flash Manufacturing PMI (Thursday)

- US Flash Manufacturing and Services PMI (Thursday)

- Japanese National Core CPI (Friday)

- Jackson Hole Symposium: Fed Powell Speech (Friday)

Latest FOMC Member Note

On Friday, Fed’s Goolsbee highlighted the risks posed by tight credit conditions due to elevated interest rates, suggesting that current monetary policy may not be as contractionary as needed given the non-overheated state of the economy. The next in line to speak is Fed Waller, followed by the much-anticipated outlook from Fed Chair Powell at the Jackson Hole Symposium.

Japanese Inflation State

Japan’s latest Producer Price Index (PPI) figures have shown an uptick toward 3%, coupled with an increasing import price index and a stable export price index, setting positive expectations for this week’s national CPI figures. Anticipation of further hawkish monetary policies from Japan remains a significant market factor.

Flash PMIs

Manufacturing PMI data for both Japan and the U.S. are scheduled for Thursday, which could introduce significant volatility to the USDJPY pair. Besides the outlook on Japan’s economy, the U.S. services PMI will be watched closely as it continues to challenge the global trend toward easing inflation.

Jackson Hole Symposium and Fed Powell Statement

With recent dovish remarks from FOMC members, the market is anticipating further dovish signals and increased volatility on Friday, when Fed Chair Powell is expected to speak at the Jackson Hole Symposium. His comments will address the overall health of the latest economic data. This, combined with global insights from other central bankers on their respective monetary policies, is likely to shape monetary policy projections towards the year end.

Technical Outlook

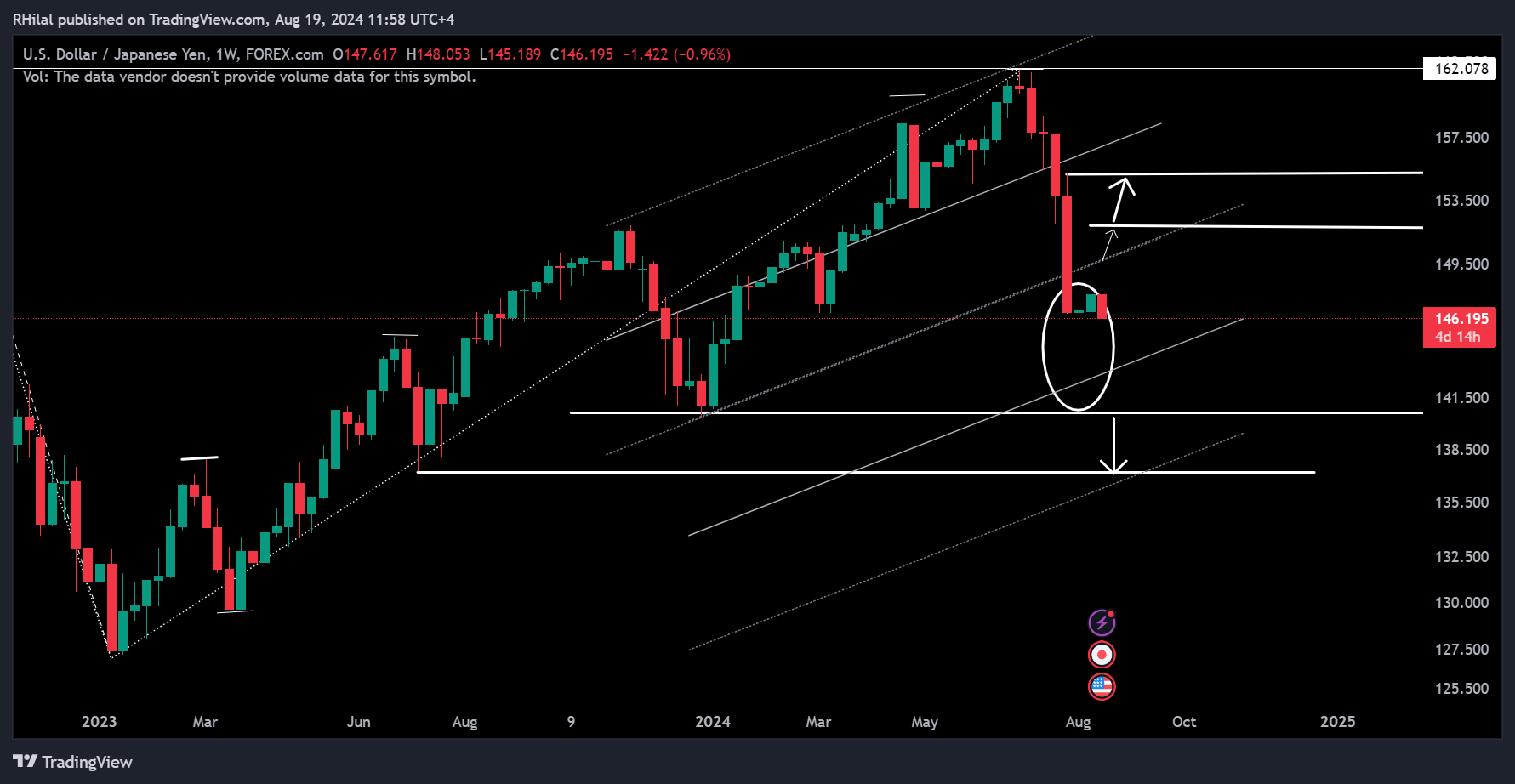

USDJPY Forecast: USDJPY – Weekly Time Frame – Log Scale

Source: Trading view

From a weekly time-frame perspective, the yen recently touched down at a strong support level around 141.69, forming a significant bullish reversal candlestick pattern known as a dragonfly doji. This pattern, characterized by a long lower wick and the same open and close price, indicates strong bullish momentum.

If the price closes below the 140 mark and this pattern, the chart could move toward potential support around 137.

On the upside, if the bullish reversal holds, the yen is likely to realign with higher levels, targeting 151 and 155 respectively.

--- Written by Razan Hilal CMT - on X: @Rh_waves