- USDJPY records new monthly lows

- Japan’s Tertiary Industrial Activity Drops to -0.4%

- US Treasury Yields vs JGB Yields

USDJPY Forecast: JP10Y – Daily Time Frame – Log Scale

Source: Tradingview

The yields on 10-year Japanese bonds have rebounded positively today, bouncing back from a trendline that connects the lows of January, March, and June 2024, and surging above the 1.04% mark. Recent speculations about a potential rate hike at the end of July, coupled with the 10-year US bond yields hitting a 4-month low, have contributed to positive sentiment for Japanese government bond yields and provided a boost for the Yen against the Dollar.

Economic development updates leading up to the Bank of Japan (BOJ) meeting, particularly concerning Japanese inflation and growth figures, may alter or reinforce the current speculations. The latest Tertiary Industrial Activity report showed a bearish drop to -0.4%. However, the recent uptrend in Japanese inflation levels is bolstering confidence in a potential rate hike.

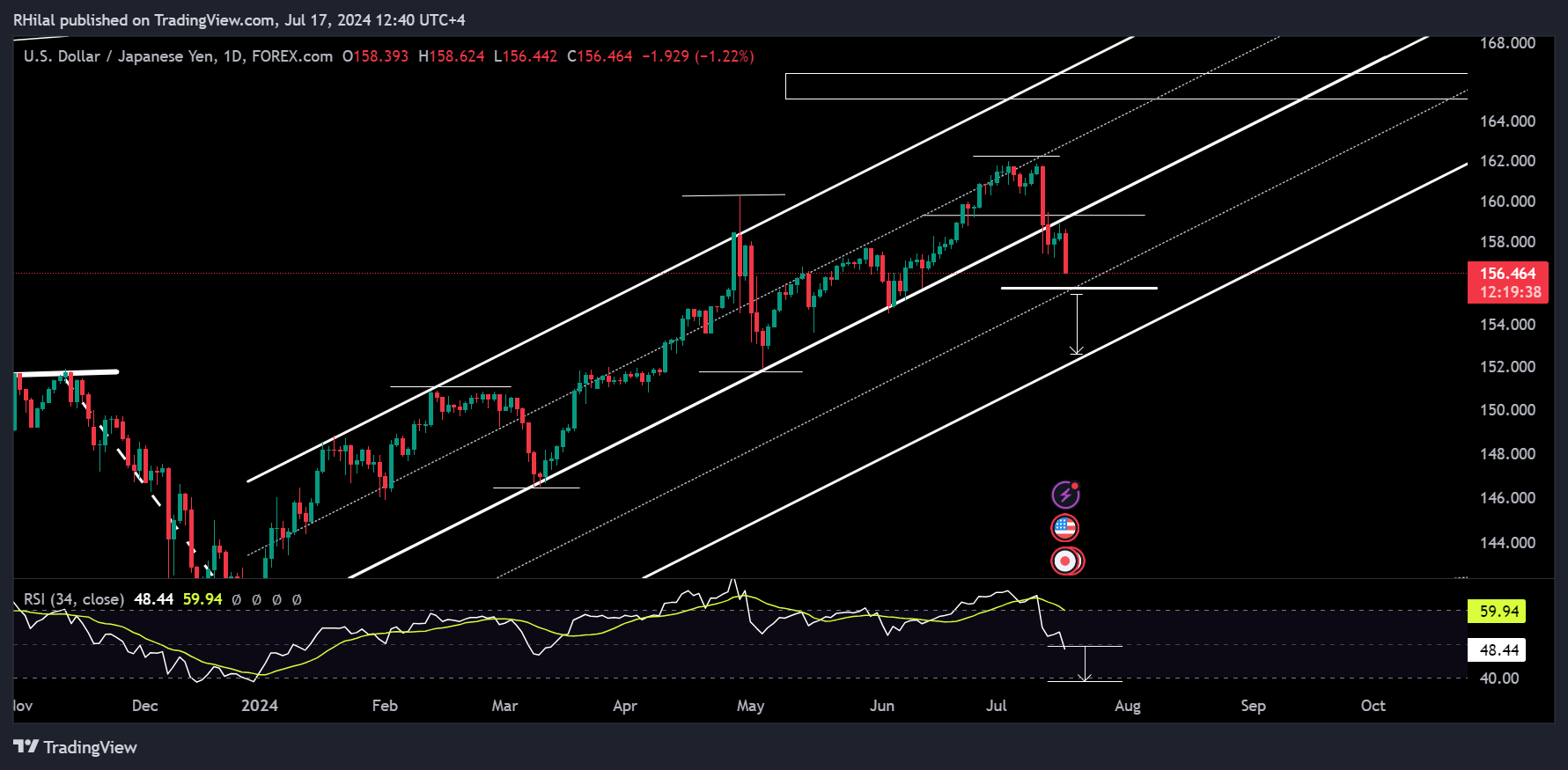

USDJPY Forecast: USDJPY – Daily Time Frame – Log Scale

Source: Tradingview

The weakening of the US Dollar below its 104 support level, coupled with the drop of USD/JPY below its yearly up-trending channel, is paving the way for a projected decline towards a duplicated bearish channel.

Support Levels:

Initial Support: Tracing potential support levels using channel patterns and Fibonacci retracement alignments, the mid-channel of the projected pattern aligns with the 0.618 Fibonacci retracement at the 155.70 level, potentially providing initial support for the downward trend. The Fibonacci retracement is traced between the low of May 2024 and high of July 2024

Further Decline: Should the trend continue to drop, it is projected to reach the bottom of the channel, aligning with the May 2024 low in the 152 – 151.80 zone.

Relative Strength Index (RSI): From an RSI perspective, the break below the neutral 50 zone adds to the bearish sentiment for the USD/JPY trend.

Resistance Levels: On the upside, the lower border of the initial channel near the 158.80 – 159 zone may serve as a resistance barrier if the trend reverses and climbs back up.

The expectations of a Bank of Japan (BOJ) rate hike and a US Federal Reserve rate cut appear to be getting priced into the charts ahead of the actual news releases. This preemptive pricing sets the tone for potential reversals if the market momentum continues in the same direction until then.

--- Written by Razan Hilal, CMT