Key Inflation Reports:

- BOJ Core CPI y/y (Tuesday)

- Tokyo Core CPI y/y (Friday)

- Eurozone CPI and Core CPI Flash Estimates y/y (Friday)

- US Core PCE (Friday)

With the leading inflation reports centered on Friday’s monthly close, the markets are expected to shape their insights into September’s trends and monetary policy decisions.

USDJPY

BOJ Governor Ueda recently reiterated the possibility of further rate hikes if inflation continues to rise, even though the markets may be on shaky ground. This week’s inflation data will be closely monitored for any emerging risks that could prompt another rate hike from the BOJ.

While a significant global carry trade effect is not widely anticipated—given that major speculations have likely already been liquidated—there is still a possibility that a smaller segment of speculators could be affected by further rate hikes. This policy risk remains a key factor to watch from both a USDJPY and broader market perspective.

EURUSD

The EURUSD is currently trading near its July 2023 highs, with the potential to retest the 2023 highs. However, a bearish reversal could be on the horizon if upcoming inflation reports align with the ECB’s target, increasing the probability of a rate cut during the September monetary policy meeting.

US Dollar Index

The magnitude of Fed Chairman Powell’s dovish statement is yet to be confirmed with upcoming economic data ahead of the September meeting. The Fed’s preferred inflation gauge is set for release on Friday, followed by next week’s non-farm payroll reports.

The US Dollar, currently stretched to the downside and aligned with December 2023 lows, is awaiting another confirming push towards the July 2023 lows before a potential bullish reversal.

Technical Outlook

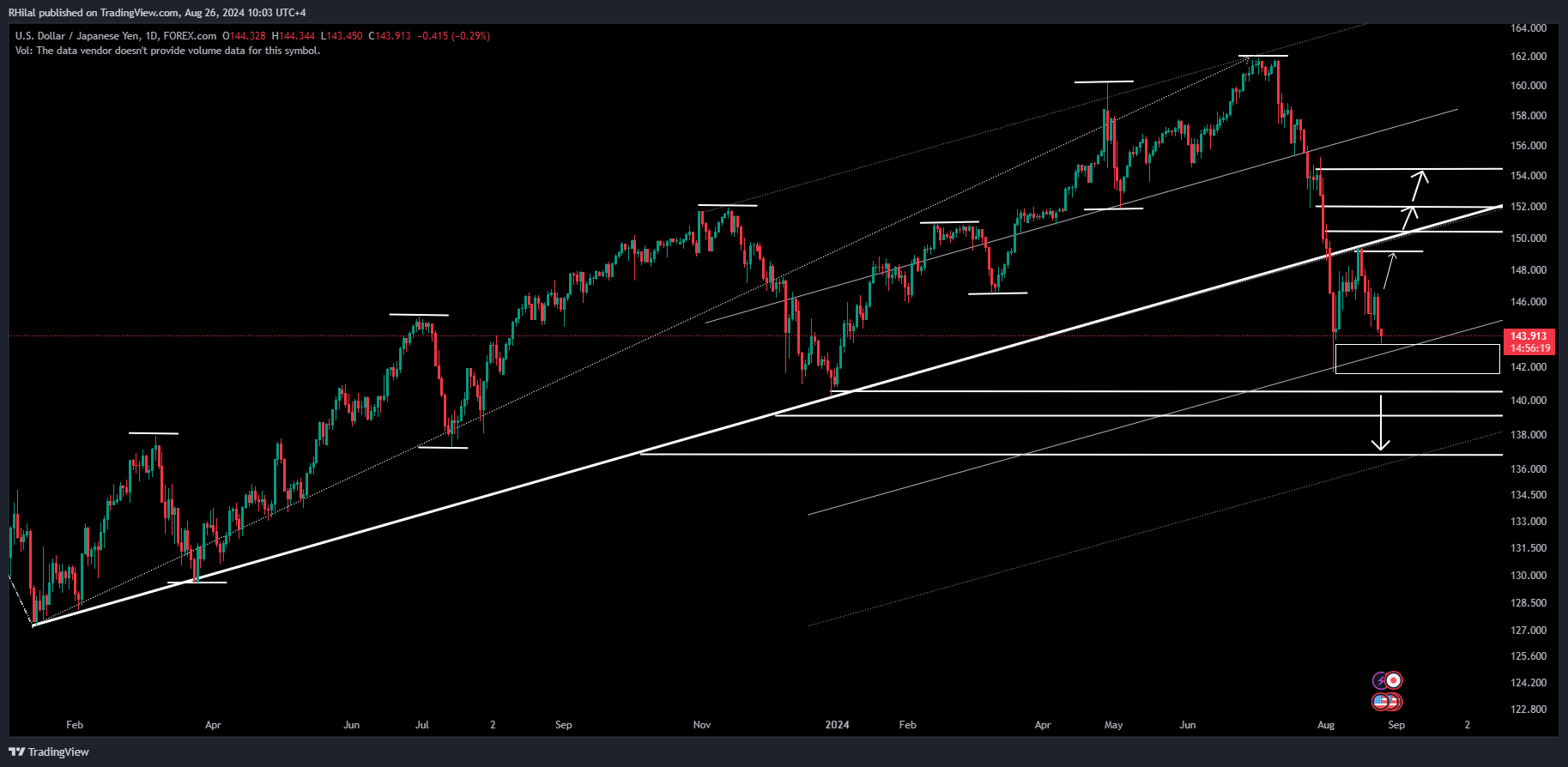

USDJPY Outlook: USDJPY – Daily Time Frame – Log Scale

Source: Tradingview

Following the Bank of Japan's (BOJ) hawkish tone and a slight 0.1% increase in the national core CPI, combined with Fed Chairman Powell’s dovish remarks at the Jackson Hole Symposium signaling the start of an easing monetary policy cycle, the USDJPY is under bearish pressure.

The pair is trading near critical support levels at 143.30 and 141.70, with risks of further decline potentially extending toward July 2023 lows at the 137 level. The 140-139 zone may act as a psychological barrier before deeper moves into the 130s.

From the upside, an unexpected bullish catalyst or overstretched momentum is still expected to drive the trend back towards the trendline connecting the consecutive lows of 2023, near the 149-150.50 zone.

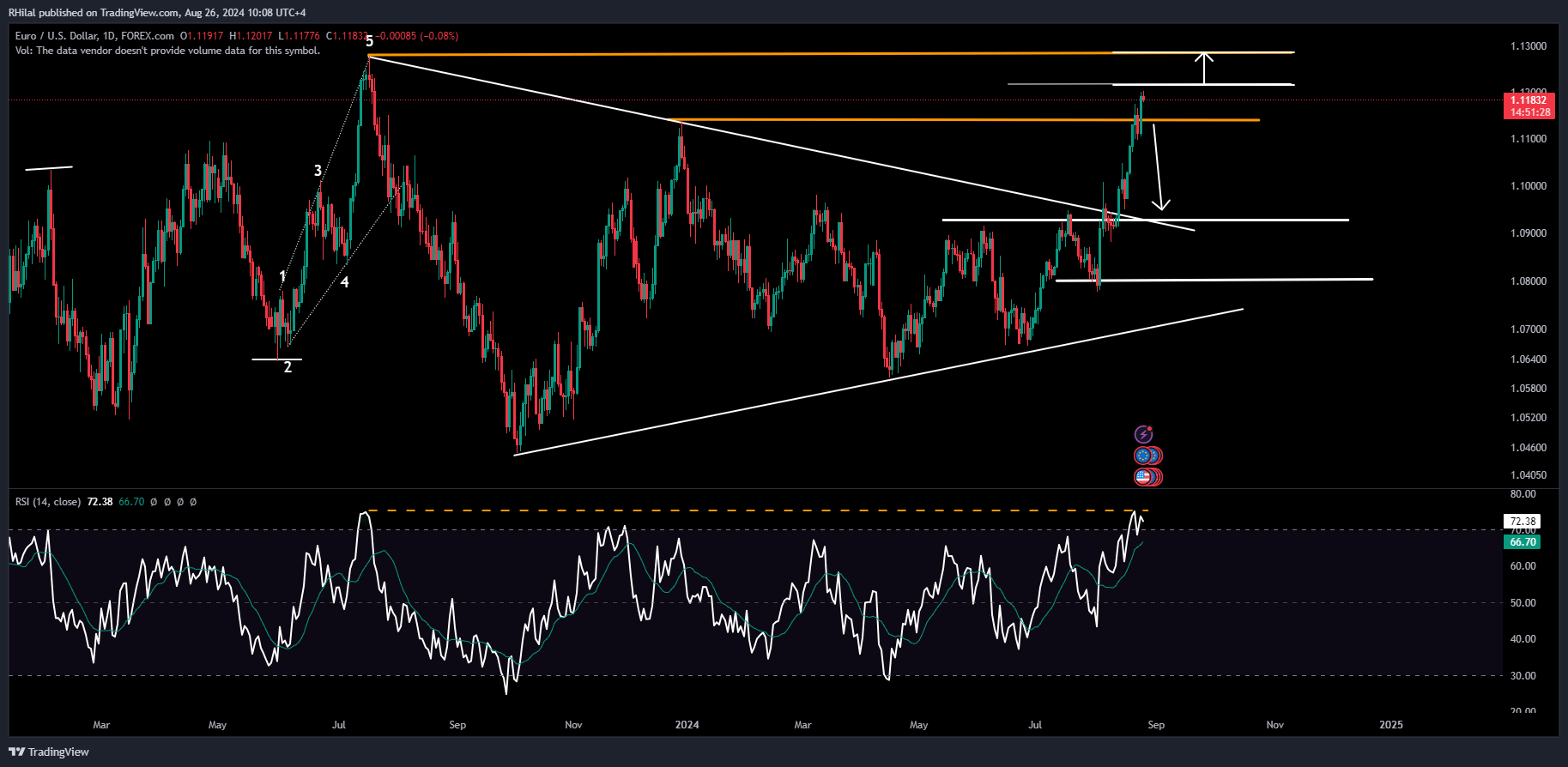

EURUSD Outlook: EURUSD – Daily Time Frame – Log Scale

Source: Tradingview

The EURUSD is trading slightly below the 1.12 psychological barrier, with the Relative Strength Index (RSI) overheated and retesting overbought levels from July 2023. While a reversal could be expected based on market dynamics, a push towards the 2023 highs near the 1.13 barrier is still possible.

The lower end of the 1.10 range, aligned with the upper border of the trendline connecting the consecutive highs of 2023, is expected to provide support if the EURUSD retreats after retesting 2023 highs

. --- Written by Razan Hilal, CMT on X: @Rh_waves