Key takeaways

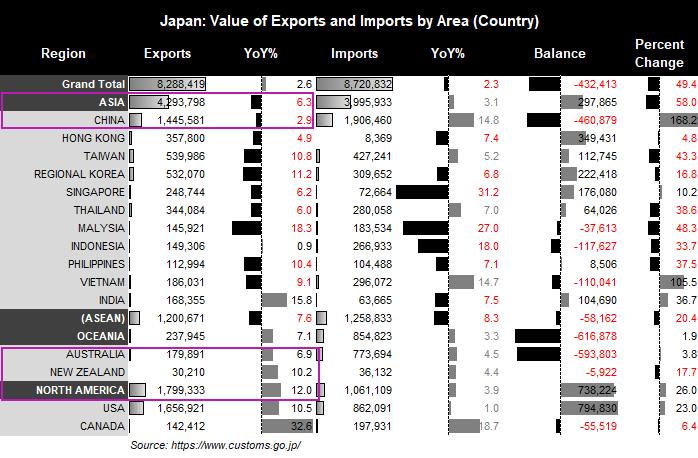

- Japan’s exports fell to a 2-year low of 2.6% y/y

- Imports (domestic demand for international goods) contracted -2.3%

- Exports to Asia contracted -6.3% y/y (-2.9% to China)

- Exports to the US, New Zealand and Australia rose 12%, 10.2% and 6.9% y/y respectively

- USD/JPY’s rally has stalled below the May high, where a pullback is favoured ahead of an eventual breakout

- The Nikkei is within striking distance of its 201 high

Slowing trade is a growing problem across Asia as we make our way through 2023, which in turn is a drag on global growth prospects. Already we have seen Q2 trade data for China take a hit, alongside contracting PMI’s, a slump in loan demand and softer figures for retail sales, industrial production and investment. And today we see that Japan’s exports fell to a 26-month low of 2.6% and imports contracted at their fastest pace since February 2021.

Looking behind the headline numbers reveals a slump in demand for Japan goods across Asia, with exports to the region falling -6.3% y/y. Interestingly, exports to China are also down -2.9% y/y and demand falters with China’s economic recovery. Although with China encouraging domestic-consumption to support growth, we’d expect this trend to continue and weaken Japan’s growth (with China being their largest trade partner).

Nikkei head for 2021 with debt-ceiling hopes

Debt-ceiling talks between US President Biden and Republican House Speaker McCarthy made a positive step, with both announcing that a deal is on the horizon. The fact that it is being announced is almost inevitable, as there really is no other choice. But if there is a pleasant surprise, it is that it didn’t happen at the absolute last minute.

The positive development prompted a risk-on rally on Wall Street, sending the Nasdaq to a 9-month high, WTI up 2.8% and gold down to a low of 1975. This in turn has provided a positive lead for Asian indices to help the ASX rebound back above 7200 and the Nikkei extend yesterday’s breakout above 30,000.

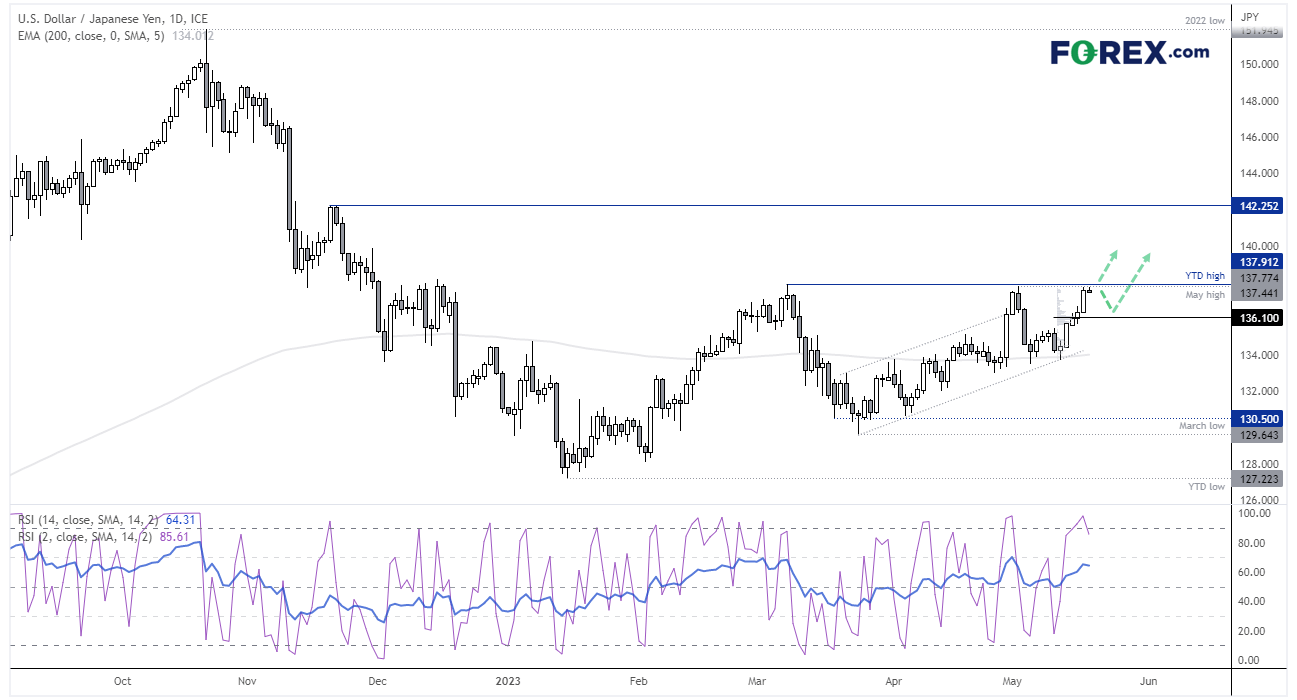

USD/JPY daily chart

The pair has provided a strong rally since its based formed around the 200-day EMA last week, with a Doji. Yet the rally has stalled just beneath the YTD high – a level which prompted a selloff a couple of weeks ago – which leaves the potential for a pullback from current levels. RSI (2) is also oversold to warn of a near-term inflation point and a slight bearish divergence is forming in RSI (14).

Volume analysis of the rally shows heavy trading activity around 136.1, which could provide support should prices retrace before an anticipated breakout. But with a defiantly hawkish message from the Fed, a banking crisis that never and a dovish BOJ, an upside break if favoured sooner than later.

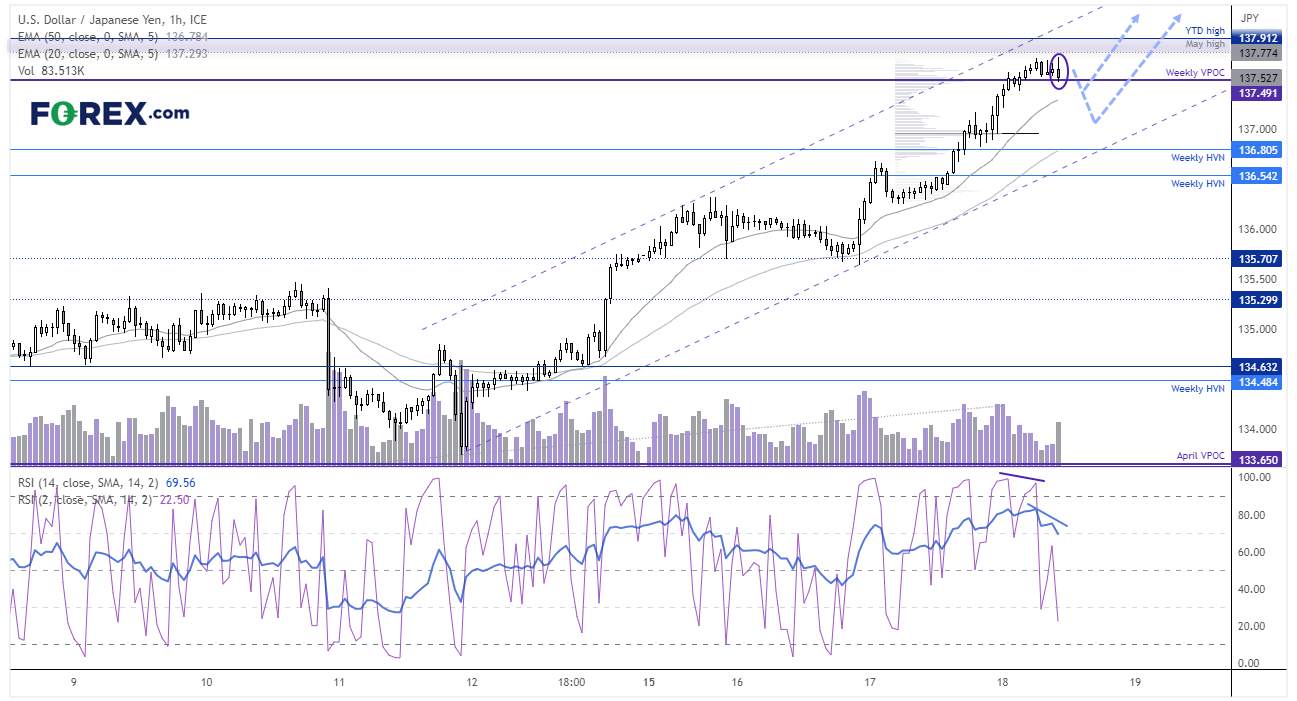

USD/JPY 1-hour chart

Whilst USD/JPY trades within a strong trend and bullish channel, there are early sigs of a potential top. A bearish engulfing candle and bearish pinbar formed on the 1-hour chart and the current candle is currently a bearish outside bar with high volume. Furthermore, none of the candles at the highs were able to test the May high.

A bearish divergence formed on RSI (2) leading into the highs and RSI (14) is now rolling over from the overbought zone. So we’re now seeking a countertrend move within the bullish channel whilst prices remain beneath 138.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge