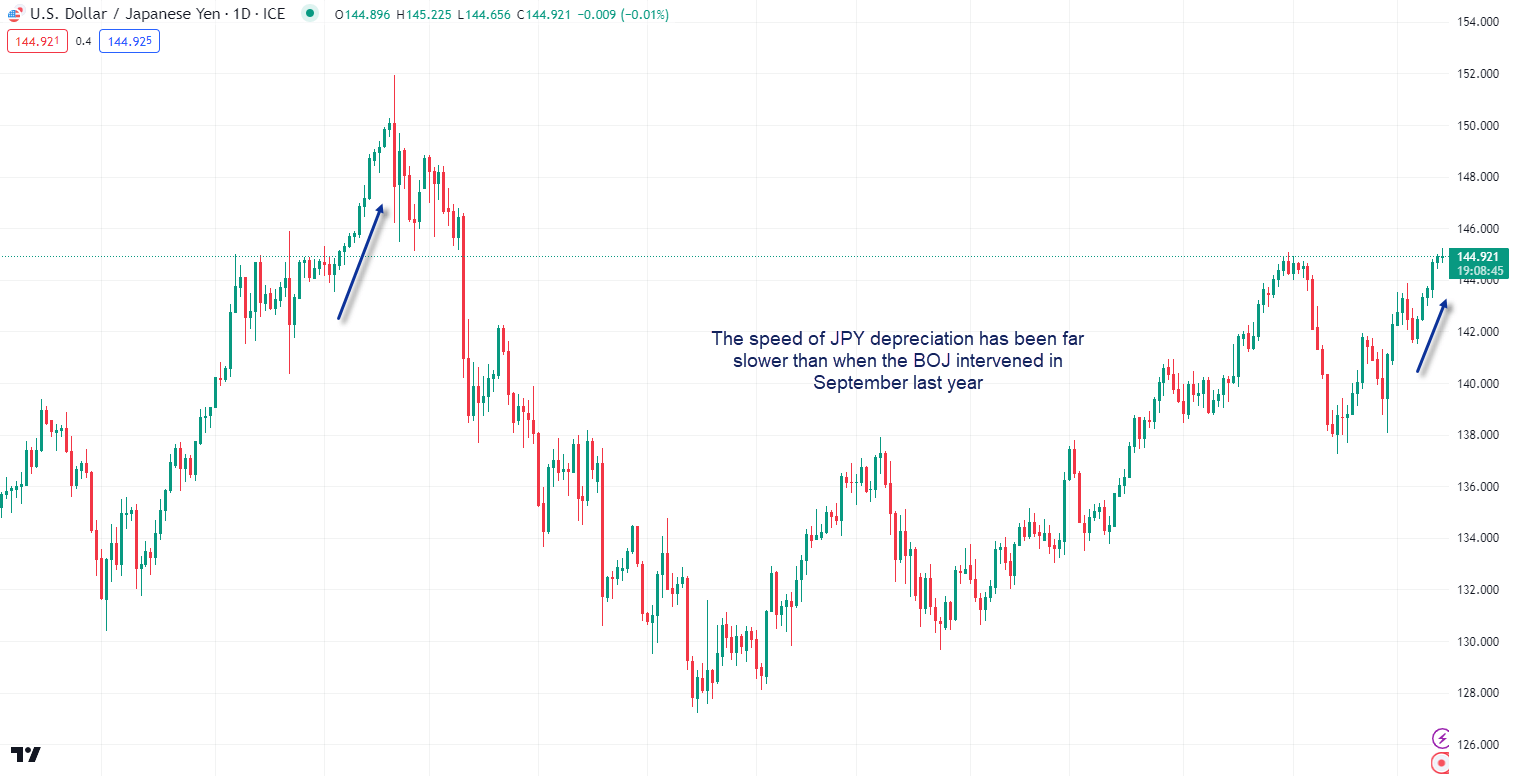

Widening interest rates differentials between the United States and Japan continue to support the USD/JPY, seeing the pair pop to a fresh multi-month high above 145.00 today. While the move was unable to be sustained, the probe above the level will undoubtedly raise questions among traders about the threat of renewed currency market intervention given it was where the Bank of Japan first intervened back in September last year to curb relentless yen weakness.

The widening in rate differentials corresponds with another push higher in US bond yields after producer prices rose more than expected in July, including for services which reinforced concerns about strong wage inflation contributing to stickiness in services inflation.

How likely is that we see renewed intervention?

While the level is the same, the market dynamics are not. For starters, the yen has lost a little more than 5% against the US dollar over the past month, around half the amount seen over a similar timeframe prior to when the BOJ decided to intervene. As many seasoned central bank watchers know, it’s not levels that concern policymakers but how markets are functioning at the time. This move, so far at least, has been relatively measured, likely explaining why we’ve not seen a deluge of commentary from Japan’s Ministry of Finance (MOF) expressing displeasure at where the yen is trading. As a reminder, the MOF instructs the BOJ to intervene on its behalf.

Adding to the case against intervention, the latest yen depreciation mirrors a widening in yield differentials with the US dollar, suggesting the move is warranted, especially when the BOJ continue to actively intervene in the Japanese government bond (JGB) market to keep benchmark 10-year yields anchored around 0%.

Watch for verbal intervention from the MOF

If the BOJ is instructed to intervene again, keep a look out for remarks from Japan’s Ministry of Finance expressing concern about market movements. As yet, we’ve not seen anything similar to what was seen before prior interventions, including after today’s move.

The USD/JPY trades at 144.90, well off the intraday high of 145.22 as a distinct risk-off tone spreads across Asia.

-- Written by David Scutt

Follow David on Twitter @scutty