US Dollar Outlook: USD/CHF

USD/CHF may stage further attempts to test the 2024 high (0.9225) as it snaps the series of lower highs and lows from the start of the week.

USD/CHF Snaps Bearish Price Series to Hold Above Weekly Low

USD/CHF seems to be unfazed by the weaker-than-expected US Retail Sales report as it holds above the weekly low (0.9079), with the update from the Census Bureau showing a 0.4% rise in December versus forecasts for a 0.6% print.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, USD/CHF may continue to track the positive slope in the 50-Day SMA (0.8934) as it still holds above the moving average, but the Relative Strength Index (RSI) may show the bullish momentum abating as the recent rally in the exchange rate failed to push the oscillator into overbought territory.

With that said, USD/CHF may struggle to retain the advance from the December low (0.8736) if it fails to defend the weekly low (0.9079), but the pullback in the exchange rate may turn out to be temporary as it snaps the bearish price series from the start of the week.

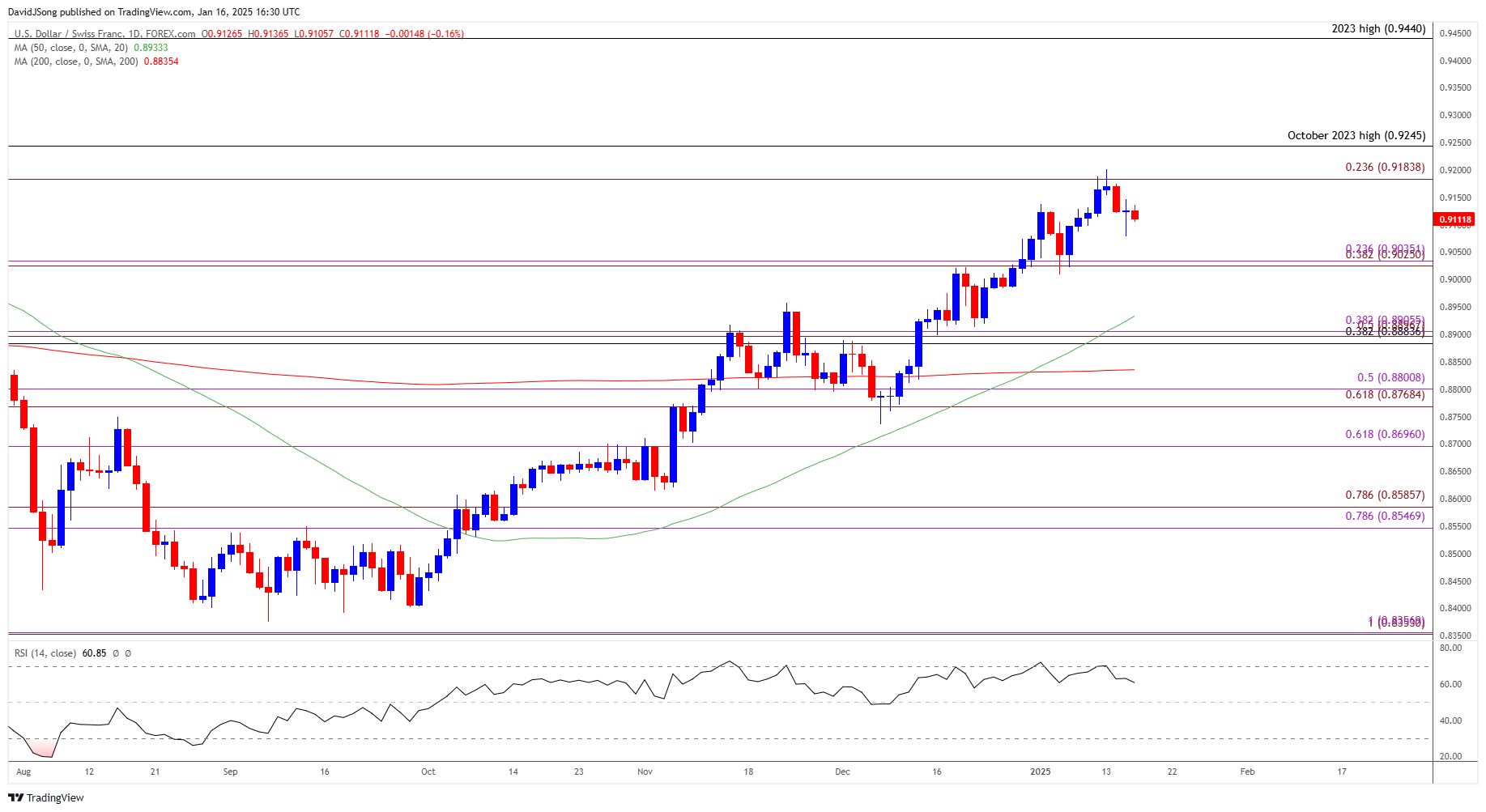

USD/CHF Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; USD/CHF Price on TradingView

- The pullback in USD/CHF seems to be stalling ahead of the monthly low (0.9009) as it holds above the weekly low (0.9079), with a move back above 0.9180 (23.6% Fibonacci extension) bringing the 2024 high (0.9225) on the radar.

- Next area of interest comes in around the October 2023 high (0.9245), but failure to defend the weekly low (0.9079) may push USD/CHF towards the 0.9030 (38.2% Fibonacci extension) to 0.9040 (23.6% Fibonacci extension) region.

- A breach below the monthly low (0.9009) opens up the 0.8880 (38.2% Fibonacci retracement) to 0.8910 (38.2% Fibonacci extension) zone, with the next area of interest coming in around 0.8770 (61.8% Fibonacci extension) to 0.8800 (50% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Susceptible to Test of Monthly Low

Gold Price Recovery Stalls Ahead of December High

EUR/USD Vulnerable Amid Push Below January Opening Range

Australian Dollar Forecast: AUD/USD Halts Four-Day Selloff

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong