US Dollar Talking Points:

- The US Dollar showed strength in the first half of the week and pulled back on Thursday and Friday, with a sizable move showing after the release of Non-farm Payrolls on Friday morning.

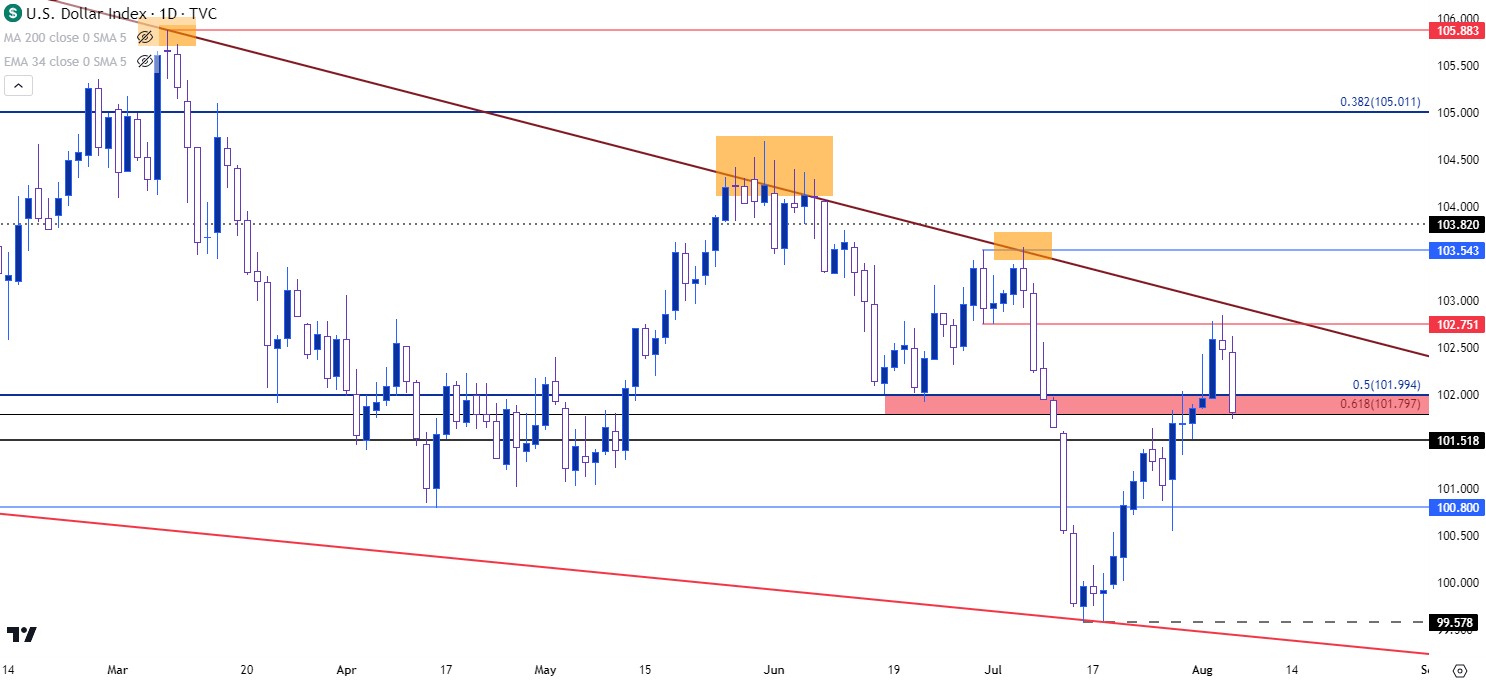

- The USD is currently at the bottom of a support zone that runs from 101.80-102.00, which remains a key spot on the chart. The longer-term consolidation in the form of a falling wedge is still in-place and the short-term bullish trend remains of interest after the pullback from a higher-high. For next week, the key driver will likely come from the US CPI print to be released on Thursday. The expectation is for headline CPI to increase to 3.3% from last month’s 3.0% print, with core inflation remaining flat at 4.8%.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

It was a feast and then famine week for USD bulls, as the week started with the same bullish trend that’s been coursing for the past two weeks. Perhaps more interesting was the spot on the chart where this was taking place. I’ve been discussing the 102 level in DXY for some time now, as this is a key Fibonacci level that helped to set the June low. And when the pullback from the failed breakdown began, this became a key spot to monitor for bearish reaction, as sellers could’ve continued the downside trend with a hold at that level.

But Monday and Tuesday saw bulls drive DXY above that level and Wednesday led into a strong topside push, with the USD running up to a fresh three-week-high. After a hold at resistance on Thursday, sellers came back into the matter to drive price back-down to that 101.80-102.00 level, and as I had shared in the Tuesday webinar, a hold of support in that area could keep the door open for bullish trend continuation scenarios.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

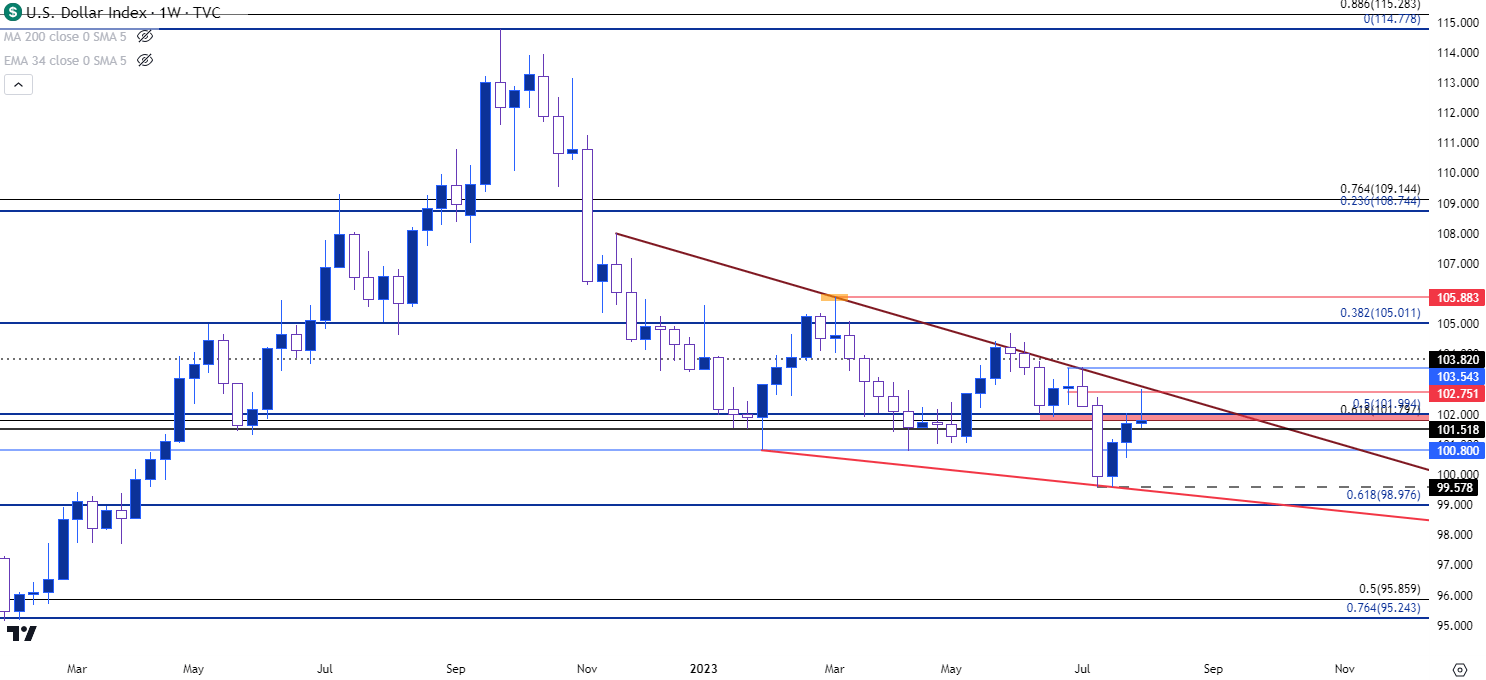

USD Longer-Term

Taking a step back to the weekly chart and the case doesn’t look as strong for bulls, as the weekly bar is currently showing as a gravestone doji. This indicates intra-period failure from bulls as the bulk of the bullish move from the early portion of the week was priced-out in with that Friday pullback. But, nonetheless, this chart is still highlighting consolidation in the form of the falling wedge, so we have to keep an open slate of scenarios here as there’s potential for chop in these types of consolidation situations.

US Dollar - DXY Weekly Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

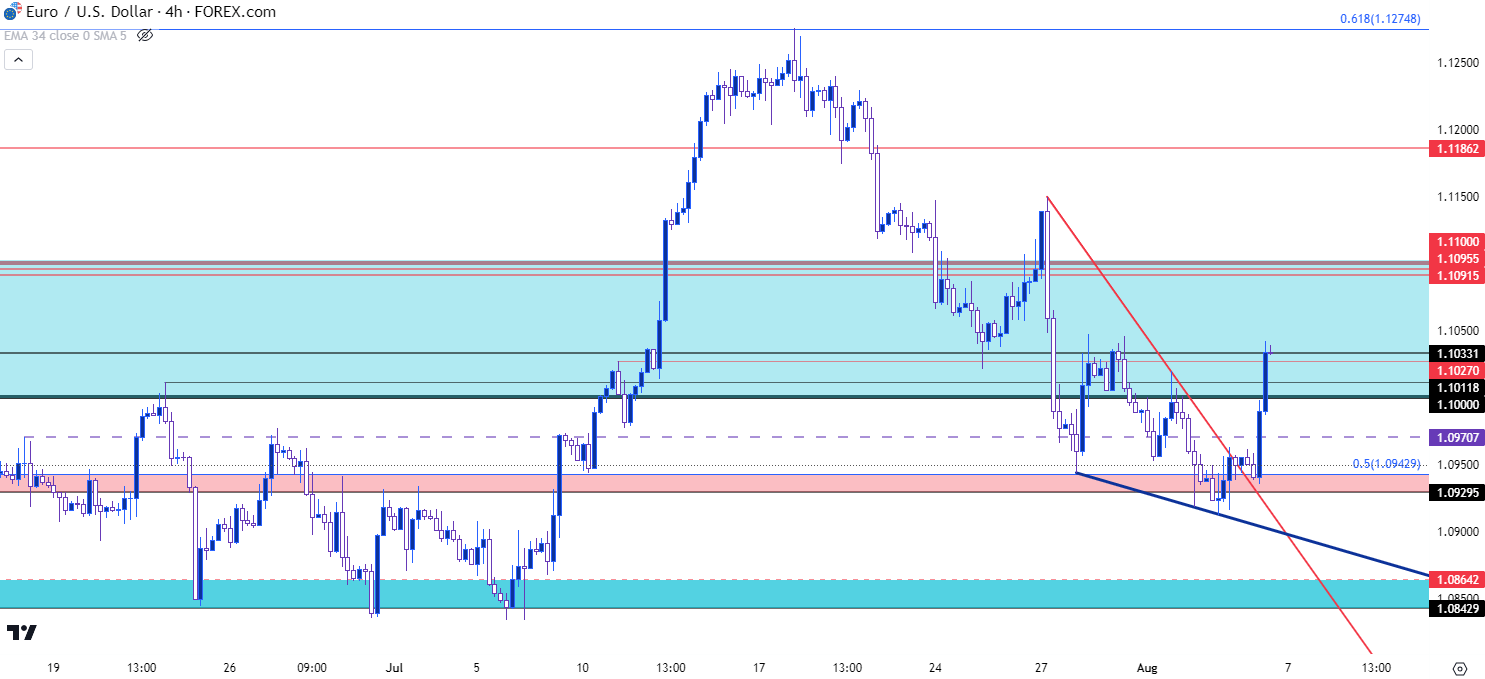

EUR/USD

As a part of that above scenario, we have a strong reaction from bulls at a key spot of support in EUR/USD and this played a role in that Friday pullback in the USD.

The level of interest here is the same 1.0943 level that I was harping on in the Tuesday webinar. This is the 50% mark of the same Fibonacci retracement that’s so far caught the high in the pair at 1.1275. That level initially came back into the picture last Friday, and then repeatedly in the early part of this week as sellers struggled to sink price below it, which allowed for a falling wedge to form.

The wedge gave way before NFP, but it was the reaction to that data that really helped to bring bulls back into the matter, and this led to a fast push back above the 1.1000 psychological level. As of this writing, price is re-testing resistance at 1.1033 so we have a short-term bullish reversal, but the big question is whether this can bring impact to the longer-term mean-reversion that remains in-place, particularly after the message that was delivered after the false breakout in July.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

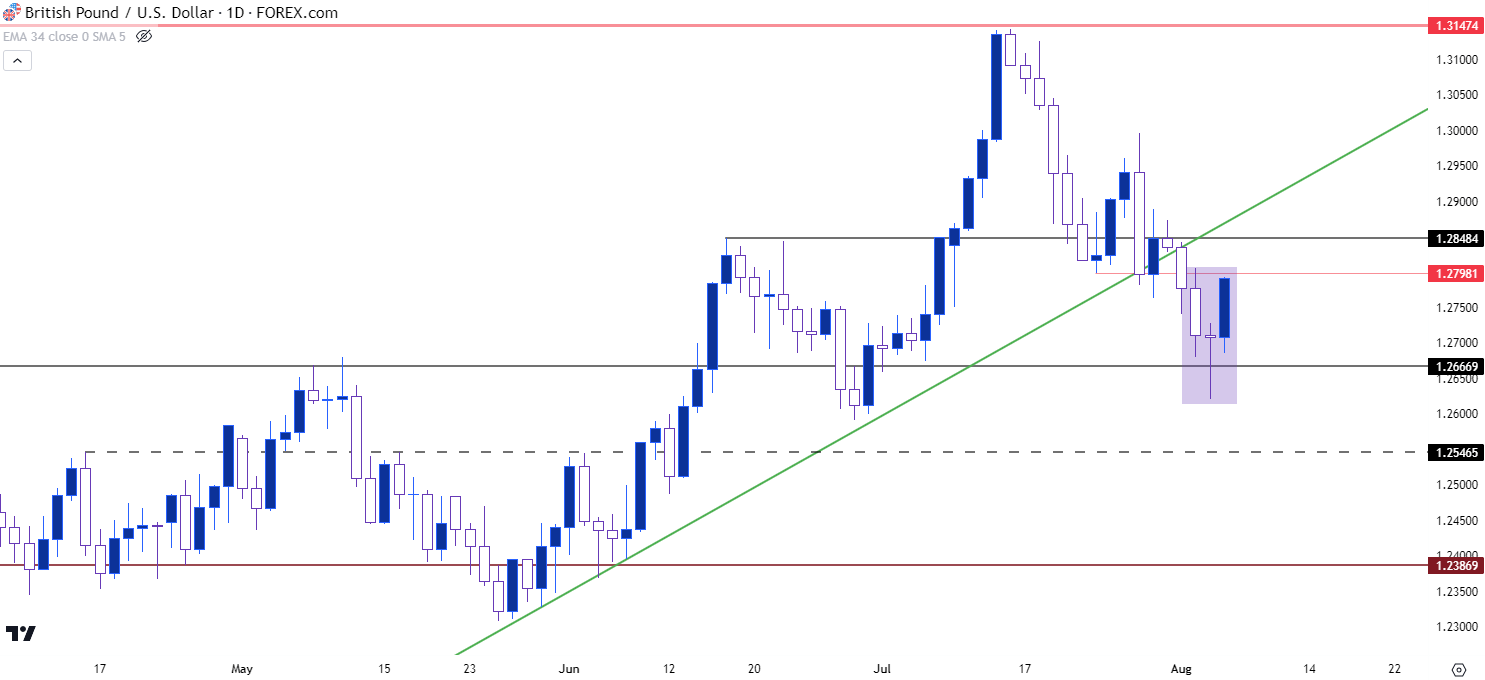

GBP/USD

The rate hike sell-off showed on Thursday, with the pair re-testing a massive level of importance at 1.2677. I discussed that in-depth in the Tuesday webinar and on Thursday morning it was in-play. Sellers even created a temporary break below that level, but they couldn’t show much for continuation.

On the daily chart, this led to a dragonfly doji and with a strong showing on Friday, we can see a morning star formation at work. Such formations are often approached with aim of bullish reversals and given the context, where inflation remains brisk in the UK and the Bank of England may have to continue hiking rates to address that, this could make the pair as one of the more attractive backdrops for scenarios of USD-weakness, if we do see bears continuing to push in DXY.

The next key resistance here is around the 1.2800 handle, followed by 1.2848.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

USD/CAD

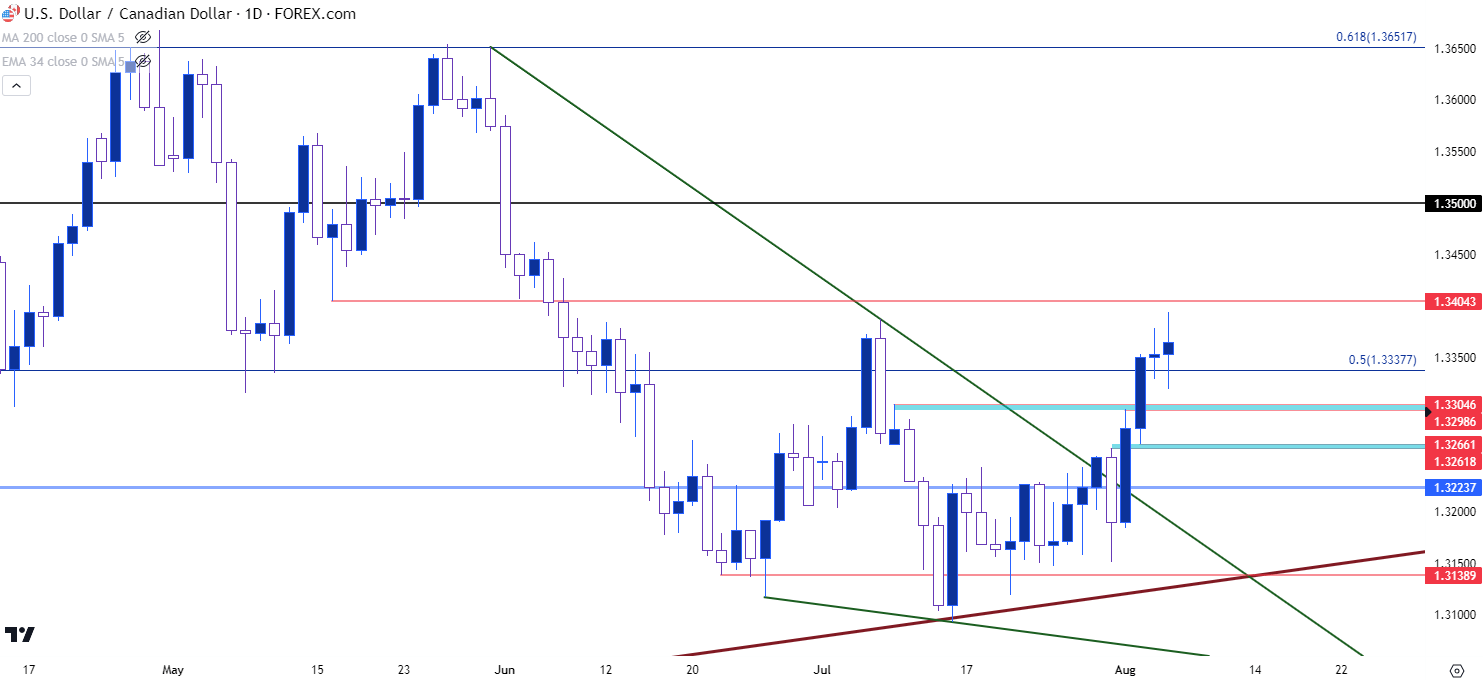

I had written about USD/CAD on Thursday after the pair put in continuation from a recent breakout, and I had also looked into the matter on Tuesday when price was putting in a fresh high after that wedge breakout.

The longer-term look is of interest here, as well, as the pair broke a range in June on the back of the BoC’s unexpected rate hike. That sent the pair spiraling lower, but price eventually caught at a longer-term trendline and that helped to hold the lows enough to stall the move. That stall soon led into the formation of falling wedge, which I had looked at in the webinar two weeks ago, and this week brought a bit of resolution to the matter as price posed a topside breakout.

Of note here is the current daily bar. The USD is weak in a number of areas but as of this writing, the daily bar in USD/CAD is green, which highlights greater CAD-weakness than what we’ve seen in the USD after the NFP report this morning.

This could keep the pair as one of the more attractive venues for USD-strength, should bulls hold that support looked at earlier in the DXY. And collectively, this could create some interest in bullish GBP/CAD scenarios for next week.

In USD/CAD, there’s higher-low support potential around the 1.3300 handle and then again around the 1.3261 level.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

--- written by James Stanley, Senior Strategist