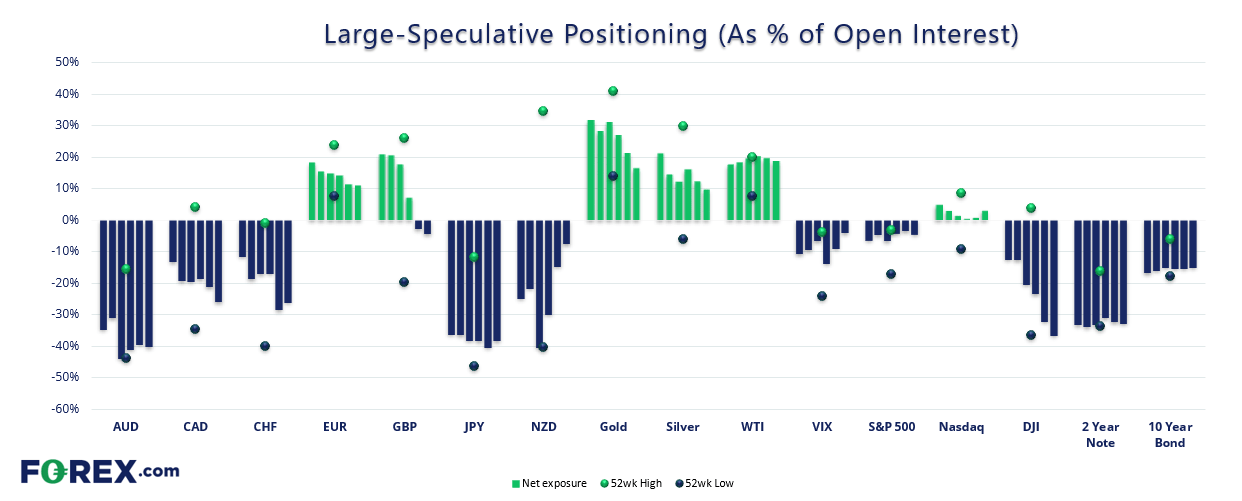

The commitment of traders (COT) report shows how large speculators are positioned across futures markets on the CME exchange.

Net-short exposure to the VIX (volatility index) has fallen to its least bearish level in several years. Yet as we highlight below, the fact the traders are predominantly net-short VIX futures most of the time then that can be seen as a bullish data set for VIX and volatility in general.

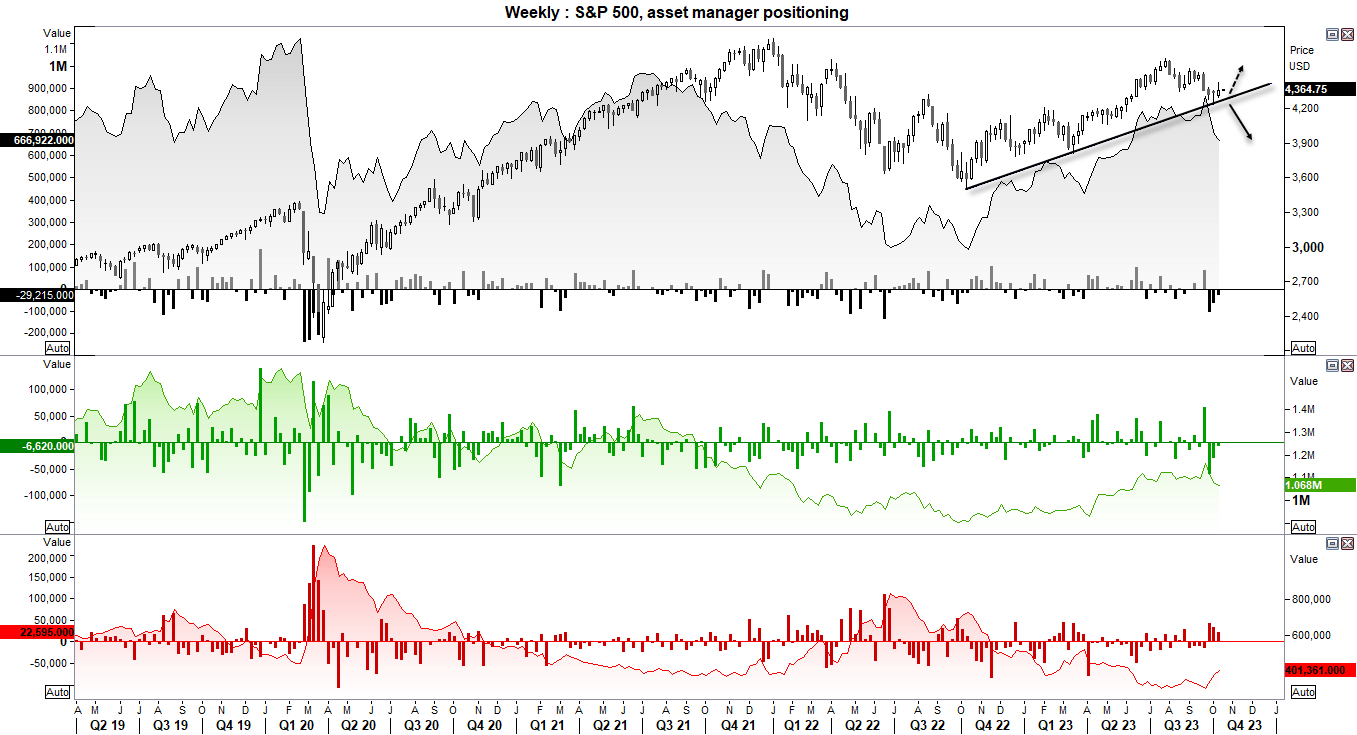

It also means I’m keeping a very close eye on the S&P 500 as it decide which way it wants to travel from a key trendline on the weekly chart. Asset managers has reduced longs and increased shorts for the past three weeks, yet remains relatively bullish considering the headline risk for sentiment in general.

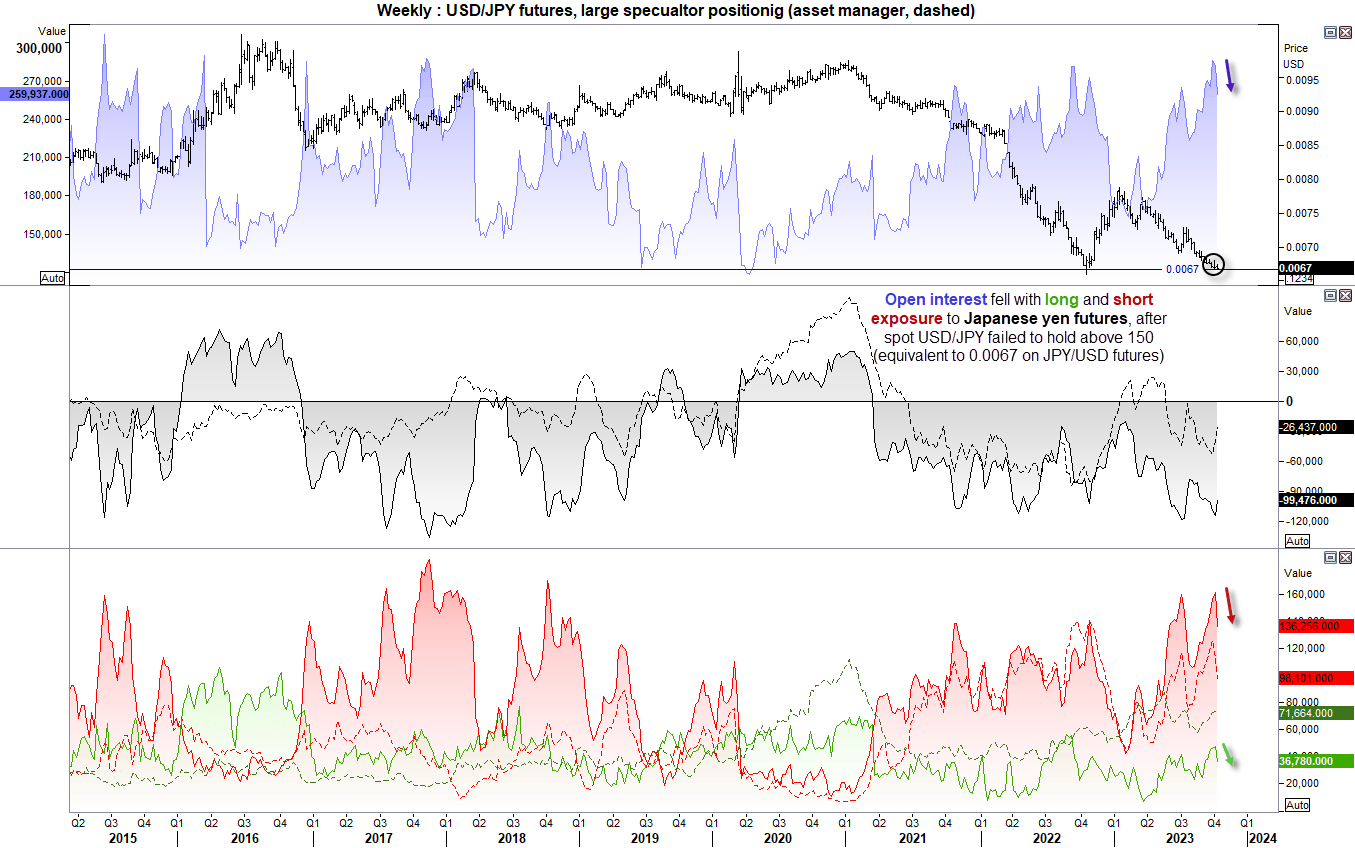

Open interest has fallen notably on USD/JPY since its failed ‘bid’ for spot prices to break and hold above 150. And that further suggests a glass ceiling for prices. Japanese yen futures also saw grow longs increase by 19.6%, although traders remained heavily net-short.

The Swiss franc seemingly attracted safe-have flows at the beginning of last week, with large speculators increasing their gross-long exposure by CHF/USD futures by 35.4%.

Net-long exposure to EUR/USD futures fell for an eight week and to its least bullish level in 50-weeks among large speculators.

Commitment of traders – as of Tuesday 2023:

USD/JPY (Japanese yen futures) – Commitment of traders (COT):

On October 3, spot prices for USD/JPY failed to hold onto gains above 150 and its initial 280-pip declined saw BOJ quickly get blamed for intervening. They have neither confirmed nor denied any such activity, which now leads me to believe they actually did not (and that would they gain now from denying it?). However, 150 has remained a clear line in the sand as prices have remained within the upper two thirds of the daily range from October 3.

Interest rate and central bank differentials make USD/JPY a difficult market to trade to the short side unless we see a decent pullback, yet being long below 150 is also a tricky, and this helps explain the lacklustre price action of late.

But we’ve seen open interest decline for the last couple of weeks as soe traders are seemingly de-risking, with both gross longs and shorts falling among large speculators. And as both the US dollar and Japanese yen are attracting safe-haven flows due to the Middle East conflict, it makes for a less lively pair to trade. Still, knowing this information can be beneficial and help us avoid unnecessary risk. For now, we’d either pressure to wait for a decent pullback and seek dips, and remain wary of any move up to and beyond 150.

S&P 500 futures (ES) - Commitment of traders (COT):

Asset managers are less confident in the S&P 500 than they were four weeks ago, with the subset of futures traders trimming gross longs and adding to shorts for the past three weeks (which has dragged net-long exposure lower for a third week, to an 18-week low).

I prefer to track asset managers over large speculators for indices such as the S&P 500, as net-long exposure generally shares a better relationship with prices. Asset managers still remain heavily net-long, although exposure has clearly pulled back from its 2-year peak. But if we see the S&P 500 break trend support, I would have to assume it could also see asset managers reconsider their long exposure and we could see a bearish follow-through in due course.

Earnings season is about to kick off, although the Middle East conflict is suppressing sentiment ahead of what was expected to be a decent set of earnings. So what if earnings disappoint alongside the current backdrop? Perhaps we may see a break of the trendline after all and short exposure rise from relatively low levels.

NZD/USD (New Zealand dollar futures) – Commitment of traders (COT):

There has been a clear reluctance for NZD to hold materially below 59c in the previous weeks, and we’ve since seen a rapid decline of net-short exposure to NZD/USD futures from large speculators and asset managers. Large specs has trimmed shorts and added to longs whilst asset managers have simply reduced shorts. SO there appears to be a floor of support around 59c heading into this week’s inflation report for New Zealand. And if that comes in hot? We may be looking at further short covering and a move back above 60c.

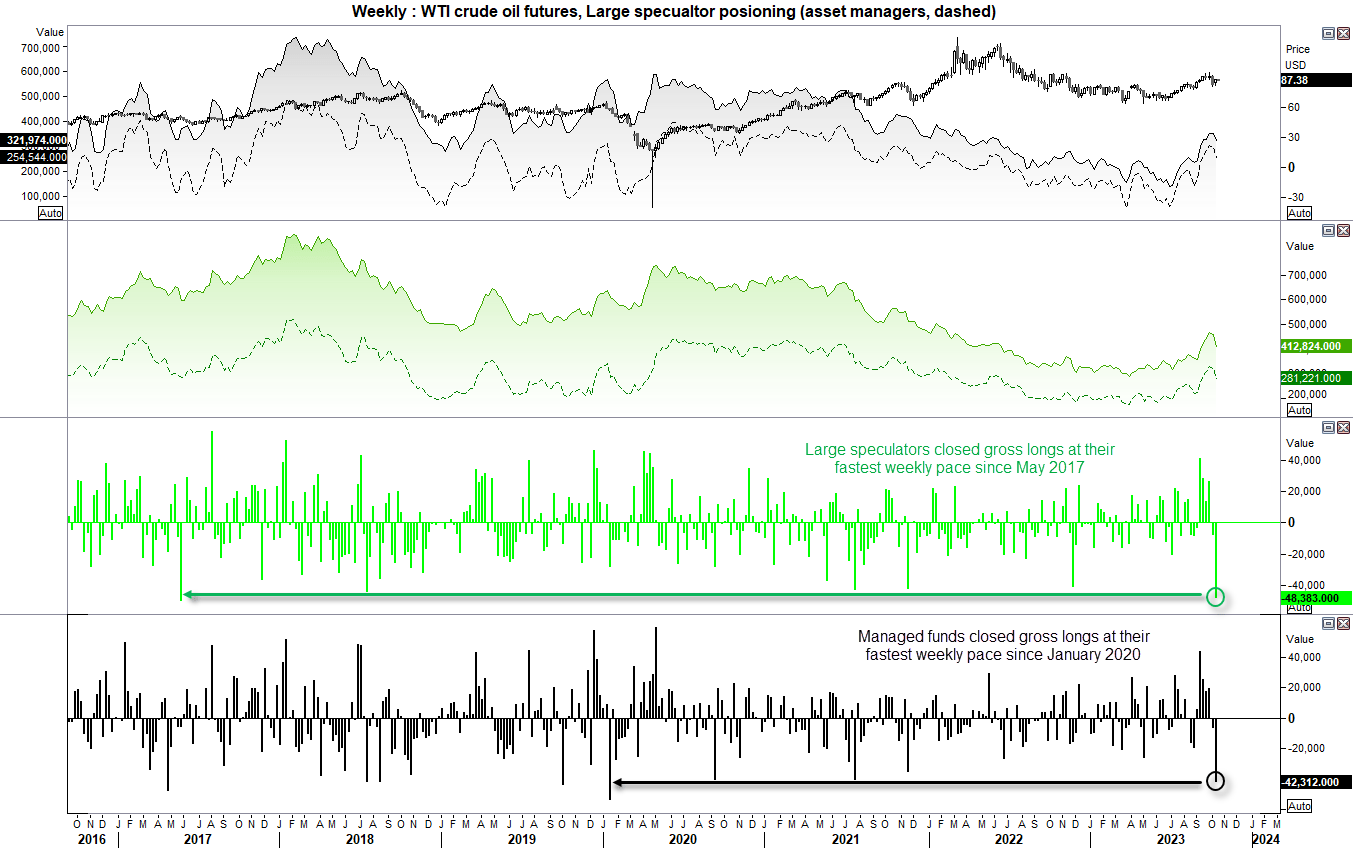

WTI Crude oil future (CL) - Commitment of traders (COT):

Last Monday we saw oil prices gap higher due to the weekend news that Israel had declared war on Hamas. So it is interesting to see that large speculators and managed funds had actually culled their long bets at their fastest weekly pace since May 2017 by the following day. Manage funds had also reduced gross longs by their fastest weekly pace since January 2020.

At this stage I am inclined to run with the assumption that oil futures traders felt the need to de risk, given that neither set of traders materially increased their short exposure. But the fact that prices rallied over 5% on Friday suggests some of these bulls may have stepped back to the table, and perhaps squeezed some shorts. Either way, oil prices remain volatile and highly sensitive to developments in the Middle East.

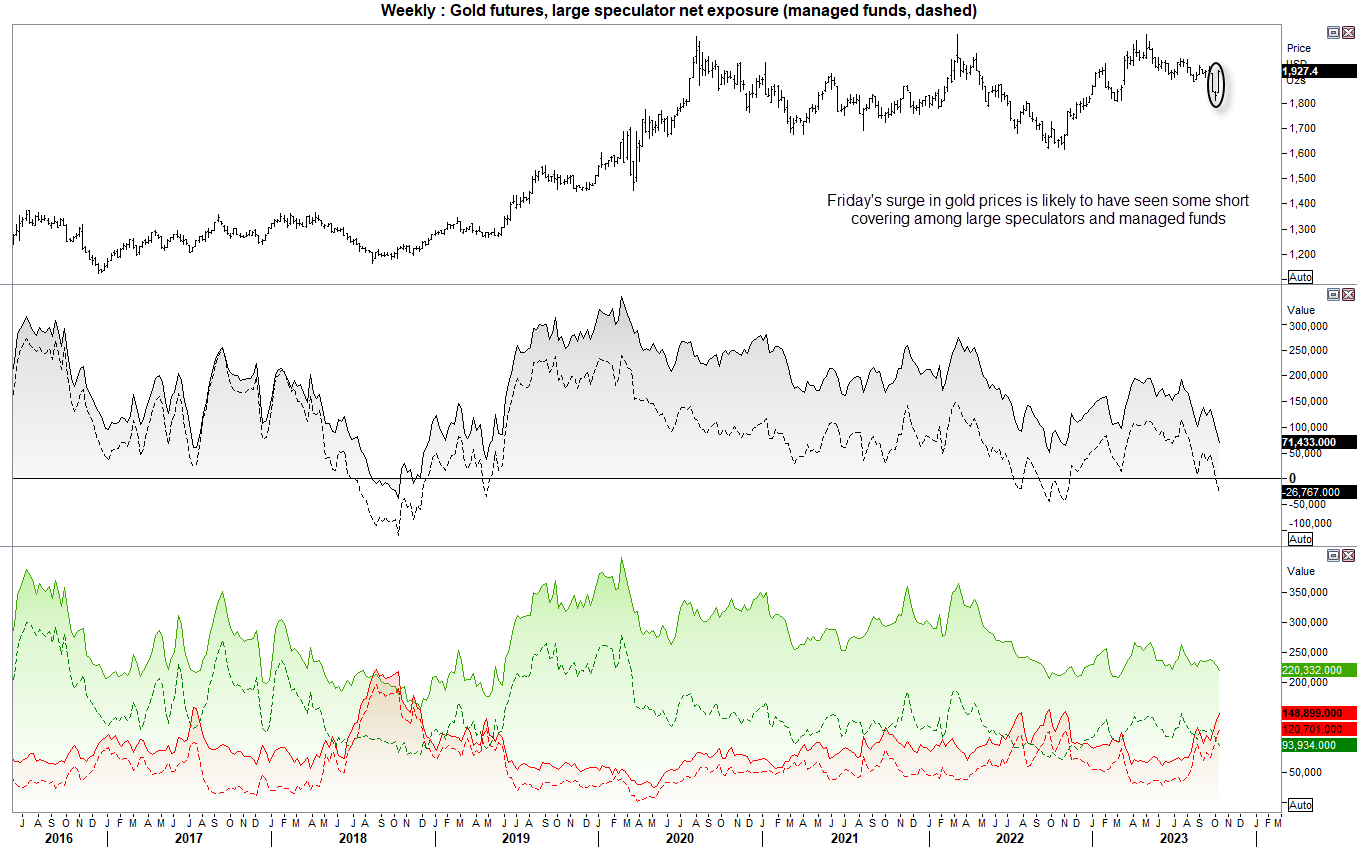

Gold futures (GC) - Commitment of traders (COT):

Gold is another interesting one regarding market positioning, as manage funds were net-short gold for a second week ahead of Friday’s surge higher in prices. I can only assume that a short squeeze at least partially explained the volatility of gold on Friday, which was its most bullish day in percentage terms in seven months. And if bulls return to the table, it may mark the 1809.4 as the corrective low.