- Shinichi Uchida, Deputy Governor of BOJ, says the bank won’t hike rates when markets are unstable

- USD/JPY surges higher on the remark

BOJ capitulates spectacularly

Shinichi Uchida, Deputy Governor of the Bank of Japan (BOJ), says the bank won’t hike interest rates when markets are unstable, delivering a clear message on what traders need to do to prevent them doing so again: create volatility.

It’s an amazing statement, signalling the BOJ can and will be bullied by markets to avoid doing what is right for the Japanese economy. It’s an incredibly dovish admission, giving traders the green light to re-establish carry trades until the BOJ starts making noise about hiking rates again, or we see a major global economic downturn.

The Yen is tumbling understandably.

Adding to the dovish surprise, Uchida said the BOJ must maintain the degree of monetary easing for now and suggested the BOJ would not be behind the curve if it didn’t usher through rate hikes “at pace”.

It’s a capitulation of the grandest scale, undoubtedly orchestrated to restore calm to financial markets. It was only just over a week ago the BPOJ hiked more than expected and provided a hawkish outlook on the monetary policy outlook.

USD/JPY surges as carry trades established

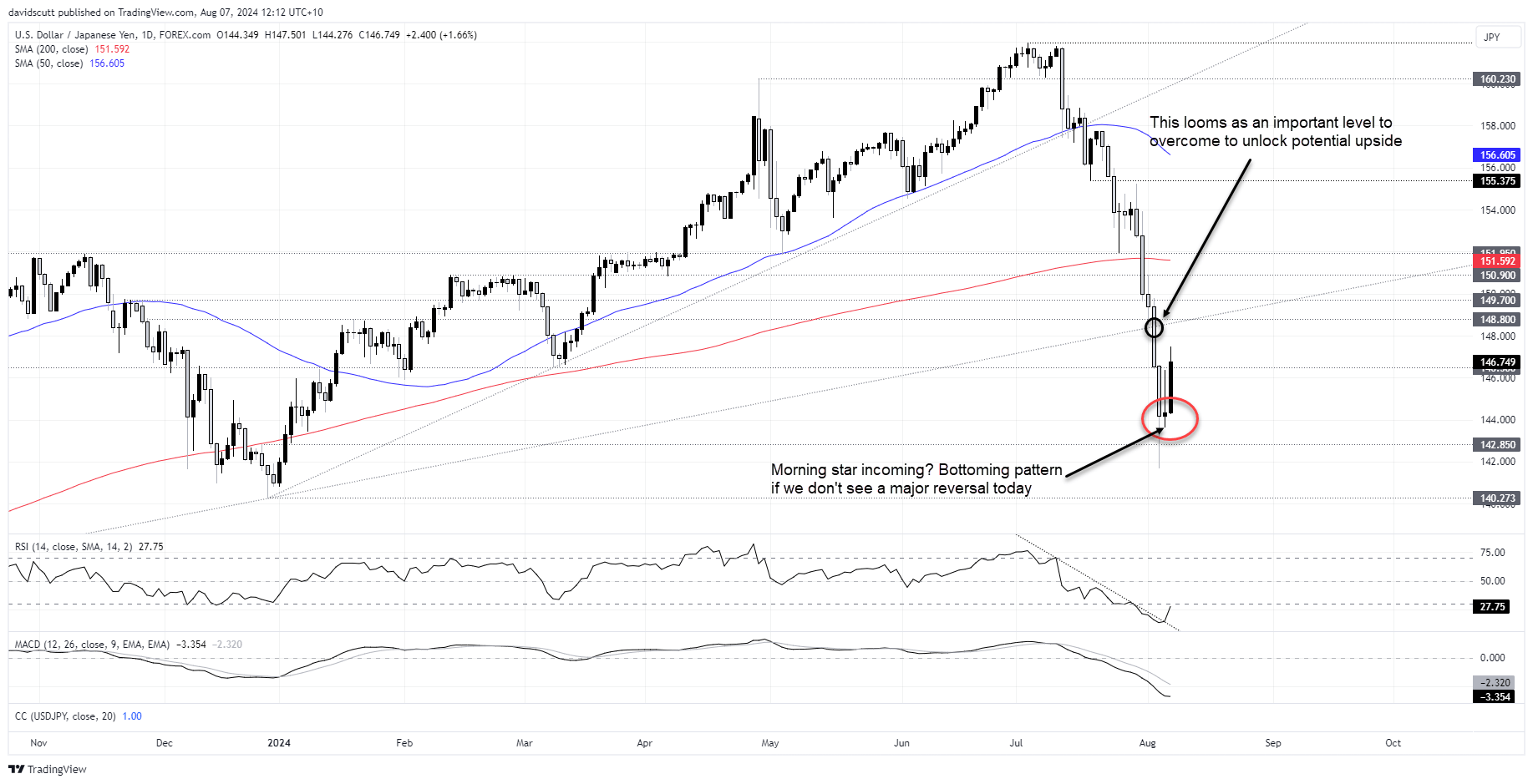

USD/JPY has surged back above resistance at 146.50on Uchida’s remarks, putting a potential retest of the January 2023 uptrend in play. The formation is also yet to be completed, but the three-candle pattern looks like a morning star, adding to confidence that we may have seen the cyclical bottom.

Should the price manage to remain above 146.50, consider buying with a stop below the level for protection. The intersection of the former uptrend and horizontal resistance at 148.80 is one potential trade target. Should that go, 149.70, 150.90 and 151.95 are the next upside levels of note.

The downtrend in RSI (14) has been broken, signalling downside momentum may be ebbing. It has yet to be confirmed by MACD but looks trustworthy given the speed of the rebound.

It’s not just bottoming patterns being seen in USD/JPY but also other pairs such as EUR/JPY and GBP/JPY.

-- Written by David Scutt

Follow David on Twitter @scutty