The Fed appear to have finally accepted that data is too hot to cut multiple times this year, scaling back expectations of three cuts in 2024 to just one. Even back in March, three cuts seemed like a stretch with data on hand. And aggregate data since has not allowed them to sustain such dovish optimism.

Still, Jerome Powell acknowledged that the softer inflation report gifted to them just hours ahead of the meeting was a “step in the right direction” but also pointed out that “one reading is just one reading” and that the Fed are not in a position to discuss dates for cuts.

We expected a particularly volatile session on Wednesday, and it did not disappoint. The US dollar index plunged 1% after core CPI softened to 0.2% m/m (0.3% prior, expected) and 3.4% y/y (3.5% expected, 3.6% prior. CPI was flat at 0%, or 3.3% y/y. Yet the dollar only managed to recoup around half of the day’s losses following the relatively hawkish meeting. Although it was hawkish relative to market expectations and not mine.

Summary of FOMC meeting: June 13, 2024

- Maintained their interest rate target at 5.25-5.5% (as expected)

- The dot plot suggests one 25bp cut by year end (down from three prior)

- Four cuts now anticipated in 2025, which could take rate to 3.75–4%

- Four members now see no cuts this year

- Core PCE estimate for 2024 raised to 2.8% y/y (2.6% prior)

- 2025 core PCE estimate raised to 2.3% (2.2% prior)

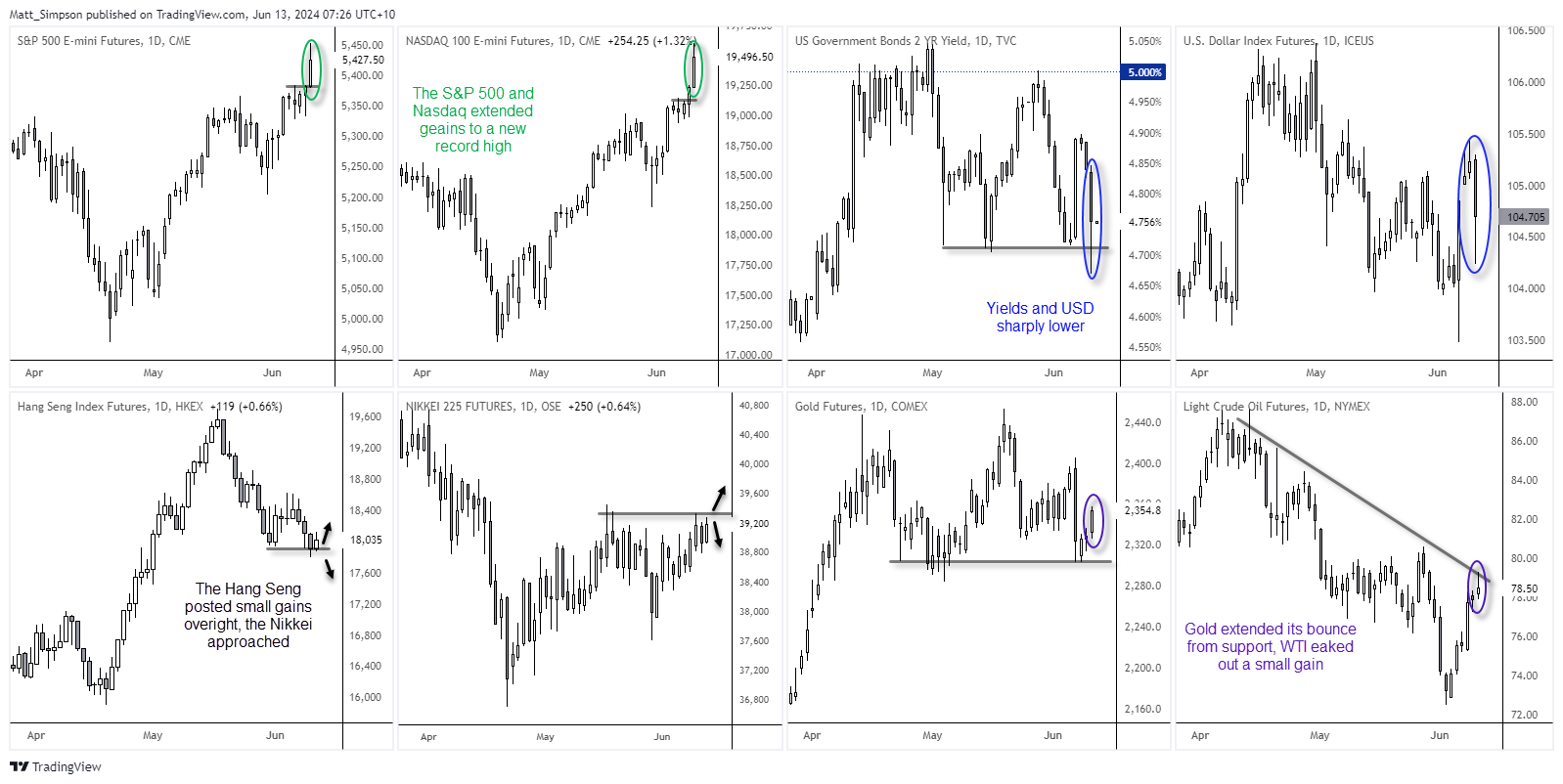

- Wall Street did what it does best and sent the S&P 500 and Nasdaq 100 to fresh record high, and mostly held onto gains despite the relatively hawkish FOMC meeting

- The 2-year yield fell to a 2-month low and dragged the USD index below 104.5 before both parred around half the day’s losses

- Gold extended its gains thanks to lower CPI, USD and yields although gains were modest

- WTI crude oil held above $78 but formed a small bearish hammer below trend resistance

- Hang Seng futures posted minor gains overnight and held above 18k support, yet the move lacks enthusiasm

- The Nikkei recouped Tuesday’s losses yet resistance around the May high looms, which clouds the bullish outlook for today

Economic events (times in AEST)

- 08:45 – New Zealand retail sales

- 09:50 – Japan foreigner stock/bond purchases

- 10:30 – Australian consumer sentiment (Westpac)

- 11:30 – Australian employment report

- 22:30 – US producer prices

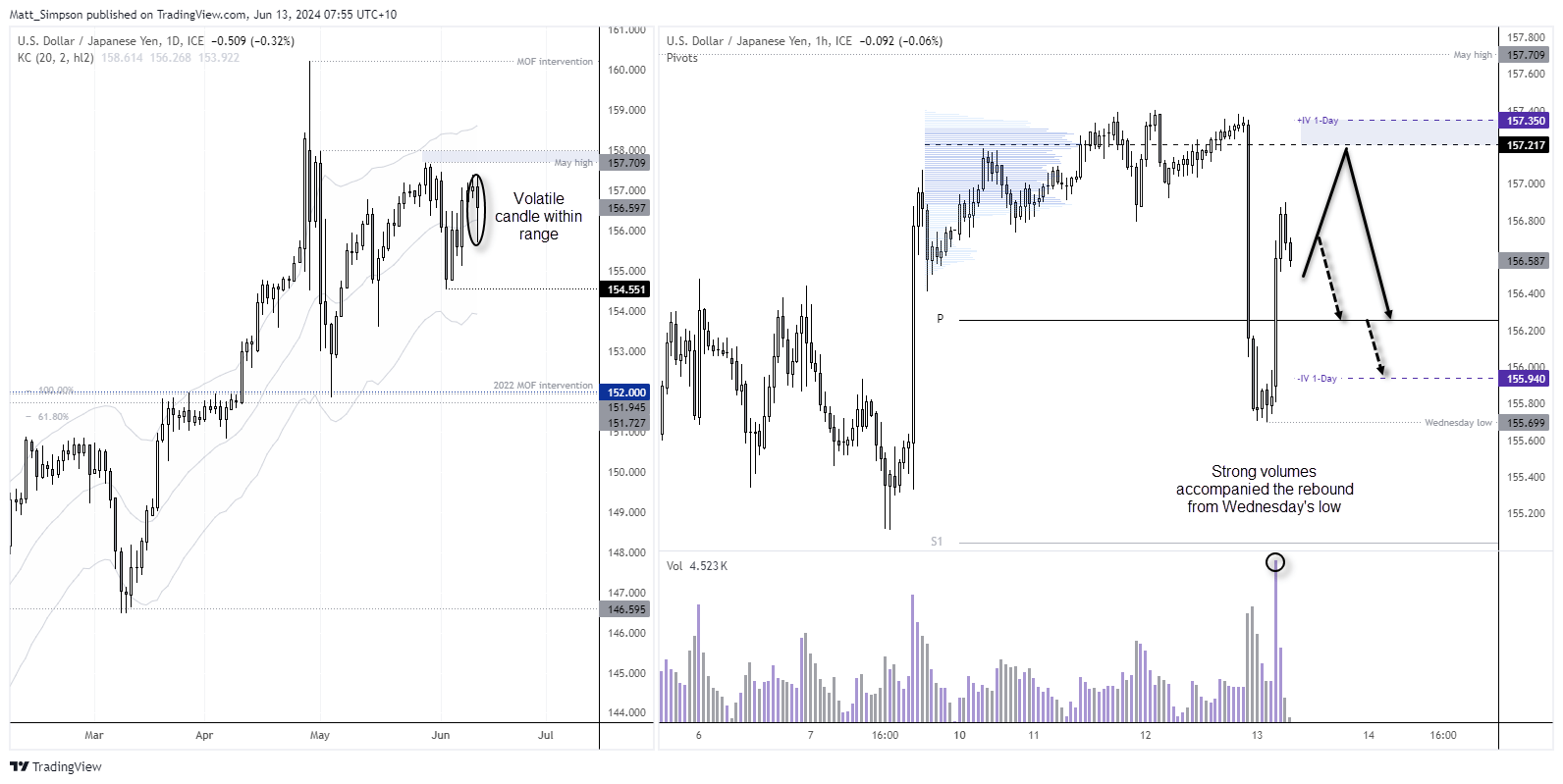

USD/JPY technical analysis:

Bulls had enjoyed three days of gains heading into Wednesday’s events, although as I noted yesterday bullish momentum was waning below resistance. The volatile shakeout from the highs saw prices roll over before parring losses, to close the day with an large hanging man candle. In context if USD/JPY essentially being trapped in a range, it may be a pair that remains favourable for bears to fade into the highs and exit at the lows (and visa verse).

The market does not yet seem ready to test 158, so any moves to the 157.70 high could appeal to bears. In the same token, I’m neither sure it is ready to break below 154.55, which makes the 156 and 155 handles potential bearish targets.

The 1-hour chart shows a solid rebound from Wednesday’s low, even if it didn’t reverse all of its earlier losses. The large bullish candle was accompanied by strong volumes to suggest there could be further upside and another crack at the cycle highs. If so, bears could then seek evidence of a swing high to reconsider shorts.

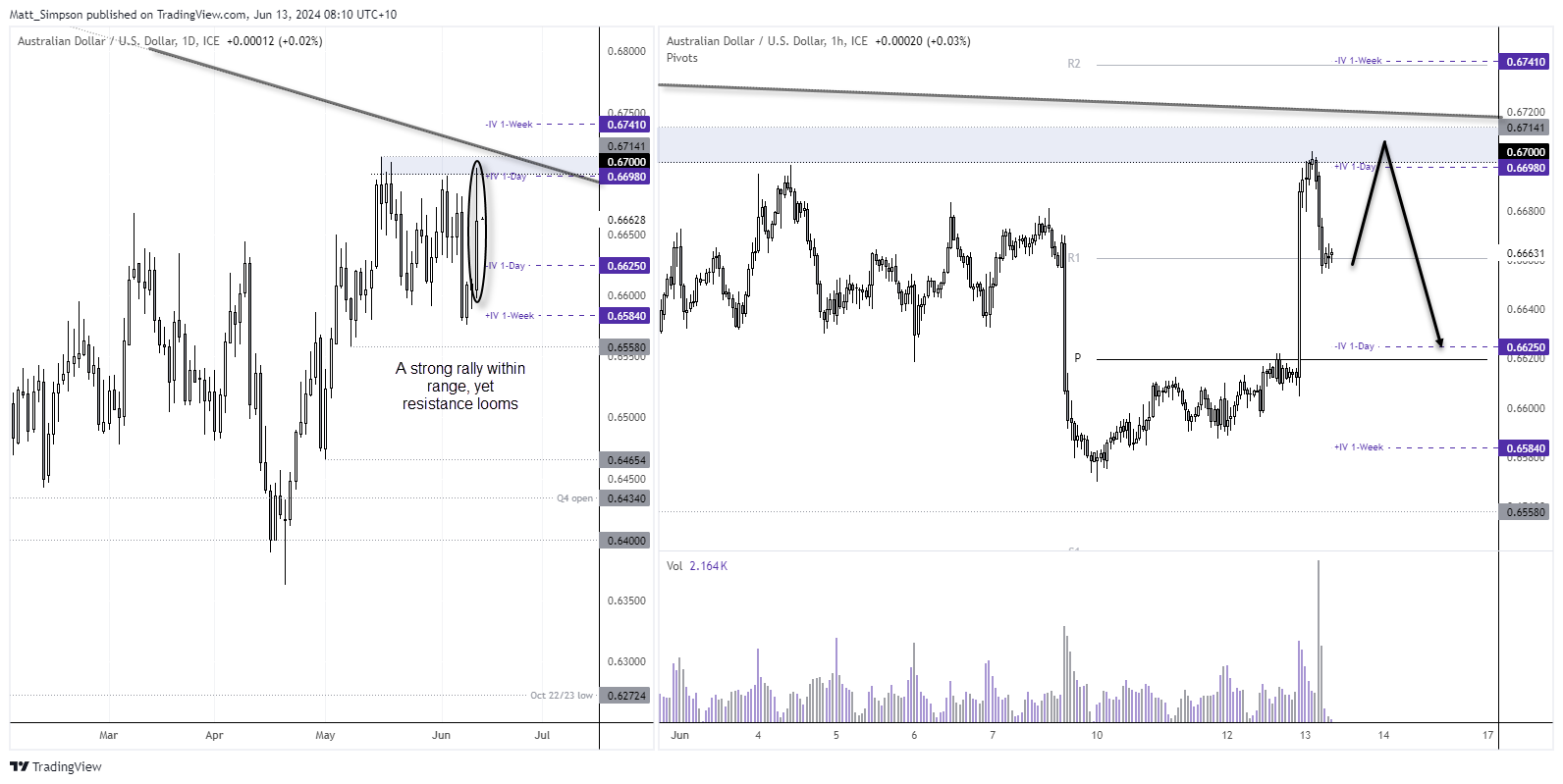

AUD/USD technical analysis:

The Australian dollar finds itself in a similar situation to USD/JPY: trapped in a range with resistance overhead. AUD/USD has spent most of the past month trapped between 66-67c, and for it to stand any chance of breaking above this range it requires Wall Street indices to continue rising and USD falling. I am not convinced we that is yet to materialise, despite its strong bullish candle within range on Wednesday. 0.6700 has proven to be a very tricky level to break and we also have the February 2023 trendline to contend with.

The 1-hour chart shows prices meandering around the weekly R1 pivot, so perhaps it can provide a bounce today – especially if Australian employment data comes in hot. Yet I remain sceptical of a break above 67c for now, making it an area for bears to consider fading into.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge