For the second day in a row, the heavily-battered US dollar index showed signs of rebounding and rallying from extreme lows early in the day, only to pare those gains and dip into negative territory further into the trading day. In the case of USD/JPY, the currency pair also pared a bit of its earlier gains, but did not fall back as far as the dollar index only because the Japanese yen was also showing substantial weakness itself against other major currencies. This yen weakness was due in part to sharply rallying US equity markets that rose more than 1% on a strong start to earnings season, which weighed on both market volatility and safe-haven demand for the yen.

Looking ahead to early next week, a key event that is likely to have a significant impact on the yen will be Tuesday’s monetary policy and interest rate decision from the Bank of Japan. Though there are no expectations of any changes to the longstanding negative interest rates, markets will be watching closely for any signs that the central bank may be looking to wind down its massive stimulus program at some point in the foreseeable future. Last week, the BoJ unexpectedly reduced its purchases of Japanese government bonds, which provided a sharp boost for the yen on speculation that the central bank may be leaning towards tighter monetary policy.

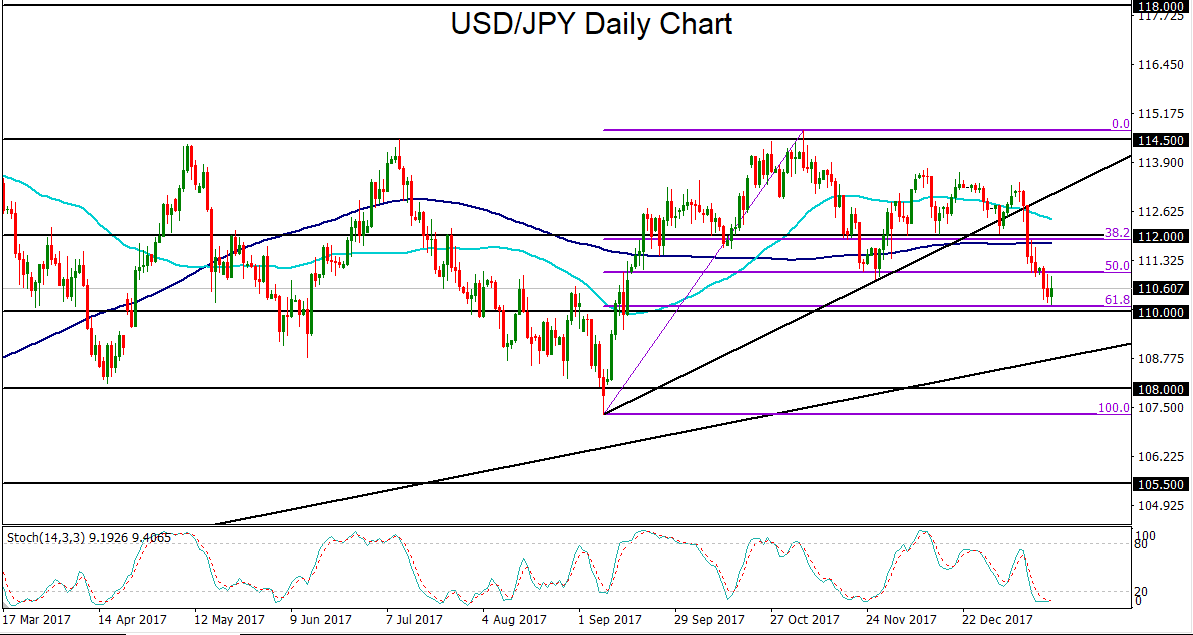

In the event that the yen does indeed receive a boost from a more hawkish Bank of Japan, and the US dollar remains weighed down for the time being by continued bearish sentiment, USD/JPY could be poised to continue its sharp breakdown. Currently, the dive from last week has reached a low and hesitated just above the key 110.00 support level, which is also in the vicinity of the 62% Fibonacci retracement of the last major up-move (between early September and early November). Amid continuing bearish sentiment towards the US dollar and ahead of the potentially market-moving Bank of Japan decision early next week, the key level to watch continues to be the noted 110.00 support area. With any sustained breakdown below 110.00, extending the recent dive, the next major downside target is around the important 108.00 support level.