The US dollar extended its gains for a third day, although bullish volatility is clearly receding. So whilst EUR/USD edged closer to 1.07 its next directional move is in the hands of US CPI and the Fed over the next 24 hours.

This is only the 15th time since 2014 that the two events have landed on the same day, and the inflation report could easily sway the tone of the meeting less than six hours later. Whilst the Fed are fully expected to keep policy unchanged, we’re all looking for how they shape expectation from September through to 2025. Given strong employment figures, I suspect the Fed’s hands are tied and they may not feel the urge to provide a dovish tone – especially if CPI comes in hot.

Gold posted a marginal gain in line with yesterday’s bias, although I had hoped for a little more follow through. Still, if inflation behaves and the Fed shape expectations for easing laser this year then the USD could tumble and send gold prices surging higher alongside Wall Street indices.

Apple shares (AAPL) surged 7% to a record high after the company announced new AI features on Monday, helping tech shares lead the way higher for Wall Street. The S&P 500 and Nasdaq closed at a record high ahead of the highly anticipated US CPI and FOMC report.

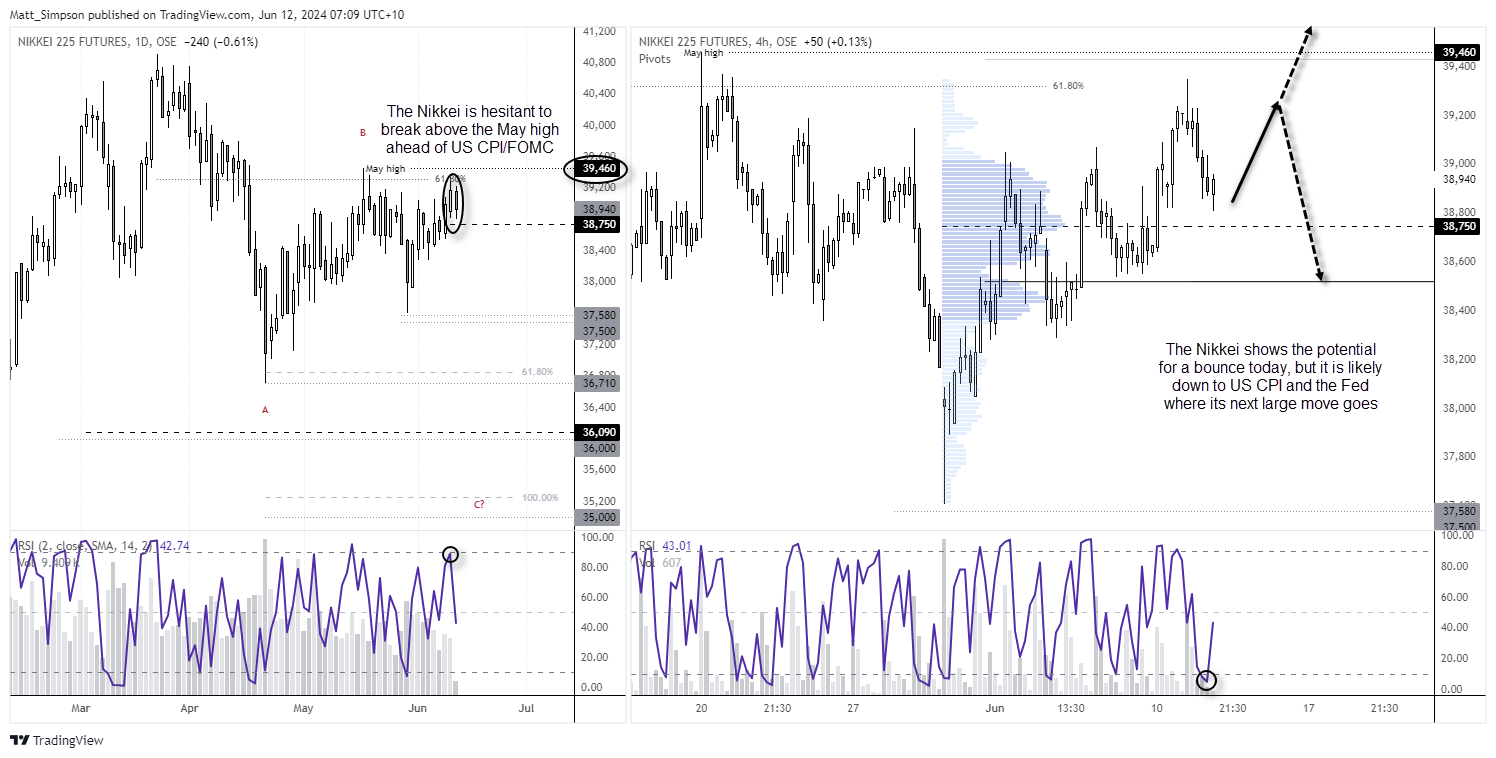

Hang Seng futures were lower for a third day yet continue to hold above the 50% retracement level and 18k handle – making it a pivotal area over the near-term. Nikkei 225 futures were closed back below 39k on Tuesday and formed a bearish inside day. The market needs to push above the May high of 39,460 to invalidate the bearish bias outlined recently.

Economic events (times in AEST)

- 08:45 – New Zealand migration and visitors

- 09:50 – Japan’s PPI

- 11:30 – China CPI, PPI

- 16:00 – UK monthly GDP, industrial/manufacturing/construction output, trade balance

- 16:00 – Germany CPI

- 19:30 – ECB Schnabel Speaks, Supervisory Board Member Tuominen Speaks

- 22:30 – US CPI

- 04:00 – Fed interest rate decision, staff forecasts, dot plot and statement

- 04:30 – FOMC press conference

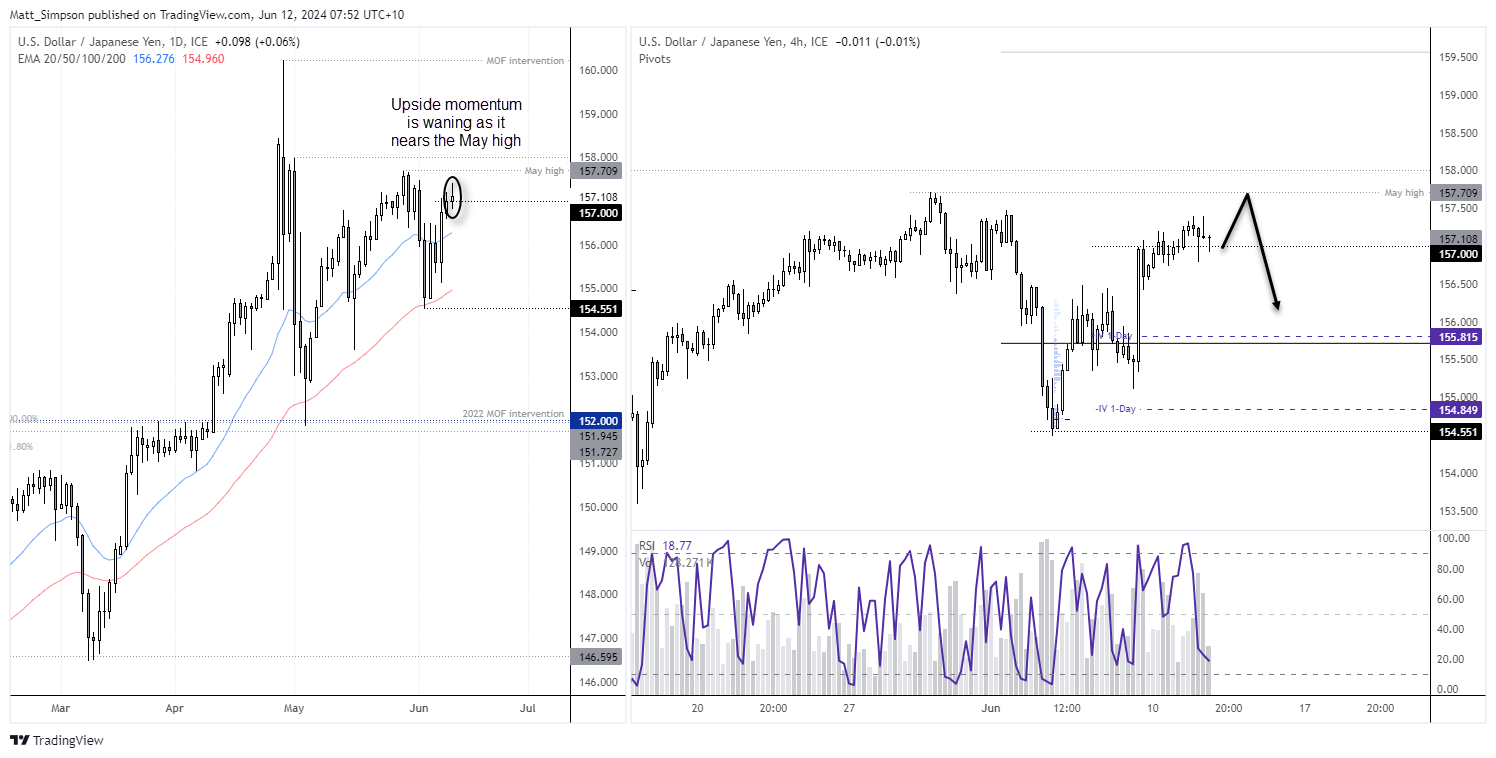

USD/JPY technical analysis:

Like the US dollar index, upside volatility for USD/JPY is waning as it nears the May high. Prices are meandering around the 157 handle, a level which could spur a few cheeky long bets in today’s session. But with the 4-hour RSI (2) approaching oversold, I suspect dips might be bought and USD/JPY ha another crack at the May high – even if it might not reach it. Should prices rise, I suspect a reasonable chance that bears could seek to fade into moves towards the May high with a stop above 158 ahead of US CPI.

Nikkei 225 futures technical analysis:

My bearish bias for the Nikkei 225 to fall to 37k or 35k was close to becoming invalidated with a break above the May high (39,460). However, a bearish inside day formed on Tuesday to keep it alive ahead of a huge risk event, even if only just. And it really is down to whether CPI is soft and the Fed deliver a dovish tone as to whether the Nikkei surges higher alongside global stocks, or roll over if the Fed disappoints and stops short of any dovish tone.

For now, I see the potential for at least a minor leg higher today. The 1-hour chart shows a bullish (even if choppy) trend, and a small bullish candle just snaped a 3-bar bearish streak after RSI (2) reached oversold. Prices are also holding above a high-volume node at 38,750.

I’m not looking for any home runs today, but the Nikkei might get a boost from the Nasdaq reaching a record high, so perhaps a move to 39,200 is achievable. Beyond that, it all comes down to how risk events play out over the next 24 hours as to where the Nikkei goes next.

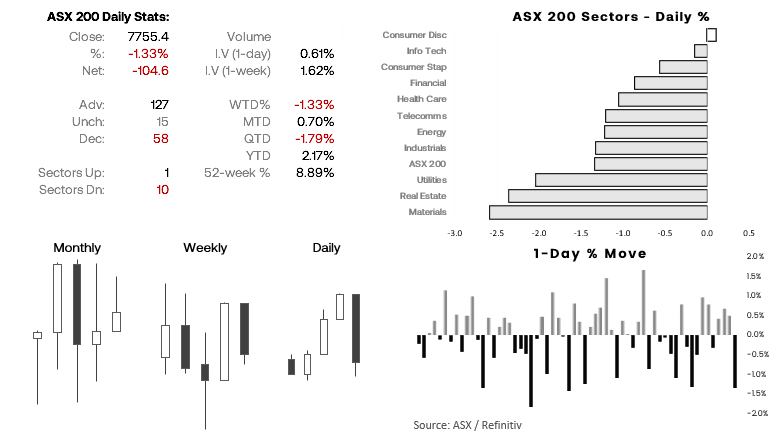

ASX 200 at a glance:

- The ASX cash market snapped a 3-day wining streak during its worst day in six months

- 10 of the 11 ASX 200 sectors declined, led by materials and real estate

- 1-day implied volatility rose to its highest level since late May of +/- 0.67%

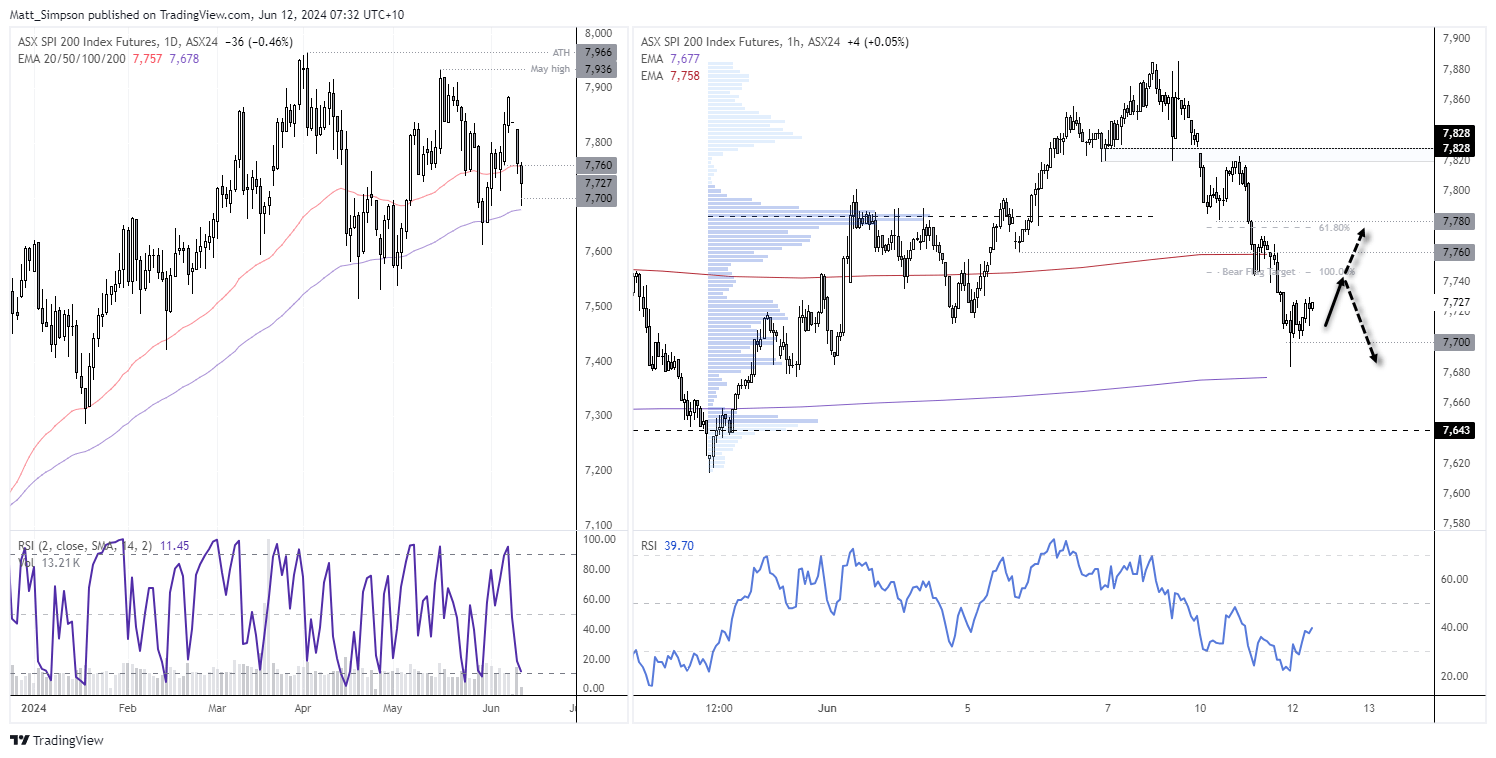

- SPI 200 futures reached the downside bear flag target outlined in yesterday’s report, and continued lower overnight

- Support was found just above the 100-day EMA and prices recovered back above 7700

- A bullish hammer on H4 marked to move above 700 with RSI oversold

- Today’s bias is for cautious gains while 7700 supports

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge