- USD/JPY is closing on 150 where the BOJ may be lurking

- The last time the pair ventured above this figure, it fell over 200 pips within seconds

- Inflationary pressure in Japan are moderating, creating a headache for the BOJ as yield differentials with the US surge

- Laden with big exporters, whatever happens with USD/JPY will influence the Nikkei 225

Japanese inflationary pressures may already be easing, providing a headache for policymakers at the Bank of Japan (BOJ) as they consider whether to begin normalising monetary policy settings. For the USD/JPY and Nikkei 225, whichever way the board decides to go, the impact will be felt long beyond when and if the final decision is made.

Japan inflationary pressures are slowly easing

Ahead of the BoJ’s next monetary policy decision on October 31, the Japanese government released inflation data today which revealed that while inflation pressures are easing, they remain well above the BOJ’s 2% annual target for an 18th consecutive month.

Core inflation – excluding fresh food prices – rose 2.8% from a year earlier in September, coming in a tenth above expectations. Despite the marginal overshoot, it was the first time the core reading printed below 3% since August last year. Excluding energy and fresh food, inflation slowed marginally over the same period, coming in at 4.2% compared to 4.3% a month earlier.

BOJ needs wage pressures to begin normalising monetary policy

The data comes a day after the BOJ upgraded its assessment for most of Japan’s regional economies, nothing activity was expected to pick up or recover moderately moving forward. However, while many firms said they expect increases to be agreed in next year's wage negotiations, they were largely undecided as to the magnitude of the increase. That’s important for the BOJ as it has repeatedly said that to have confidence about a sustainable increase in inflation, persistent wage pressures would likely be required.

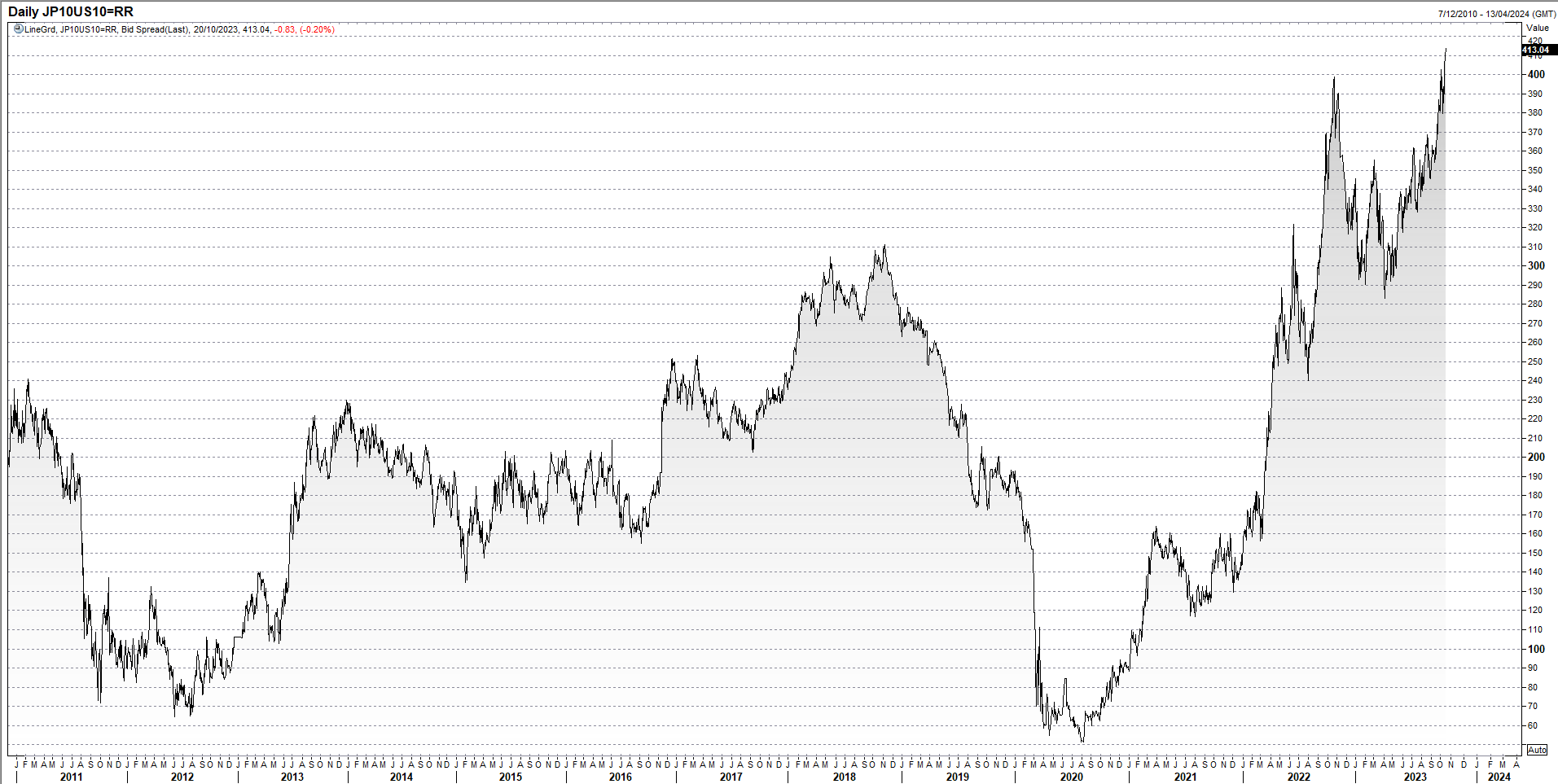

Yield differentials between the US and Japan surge again

Given the role interest rate differentials have played in determining movements in the USD/JPY in recent years, whichever way the BOJ decides to go – be it to do nothing, lift policy rates out of negative territory and/or abandon yield curve control, the decision will flow immediately through to the Japanese yen against a variety of different FX pairs.

US-Japan 10-year yield spread. Source: Refinitiv

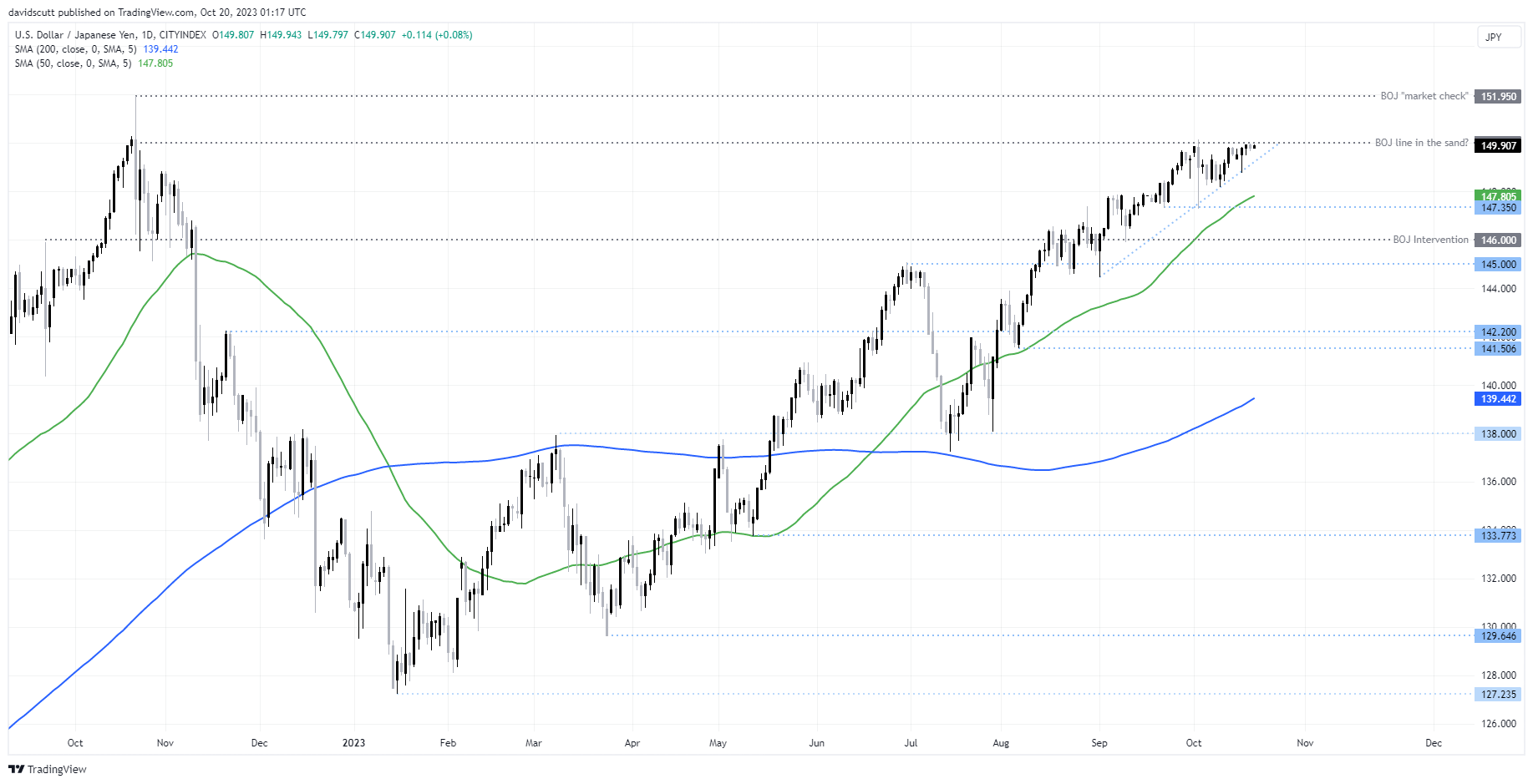

USD/JPY coiling up for a potential big move

Right now, USD/JPY is wedged between a rock and a hard place, wary of venturing towards 150 given the threat of market intervention from the BOJ on behalf of the government but unwilling to reverse too far given yield differentials between the United States and Japan have blown out to unprecedented highs, surpassing levels when the pair traded at multi-decade highs last year.

Just look at how USD/JPY is coiled up in an ascending triangle on the daily chart, bumping up against uptrend support while hemmed in below 150. Convention suggests the pair is likely to exit the formation in the direction in which it entered, but as well saw a few weeks ago, the last venture above 150 ended with a precipitous 200-plus pip plunge within seconds, creating speculation over whether the BOJ had intervened. We still don’t know, but you can understand why traders aren’t willing to venture above the level.

If USD/JPY does successfully break resistance above 150, traders will be looking for a retest of the 2022 highs just below 152. Beyond that, we’re getting back to territory not seen in decades. On the downside, minor support is located around 149.50 and again at 148.50. 147.35 is where USD/JPY stopped dead following its post 150-probe plunge, so that level is important. Ore pronounced support is found at 145.

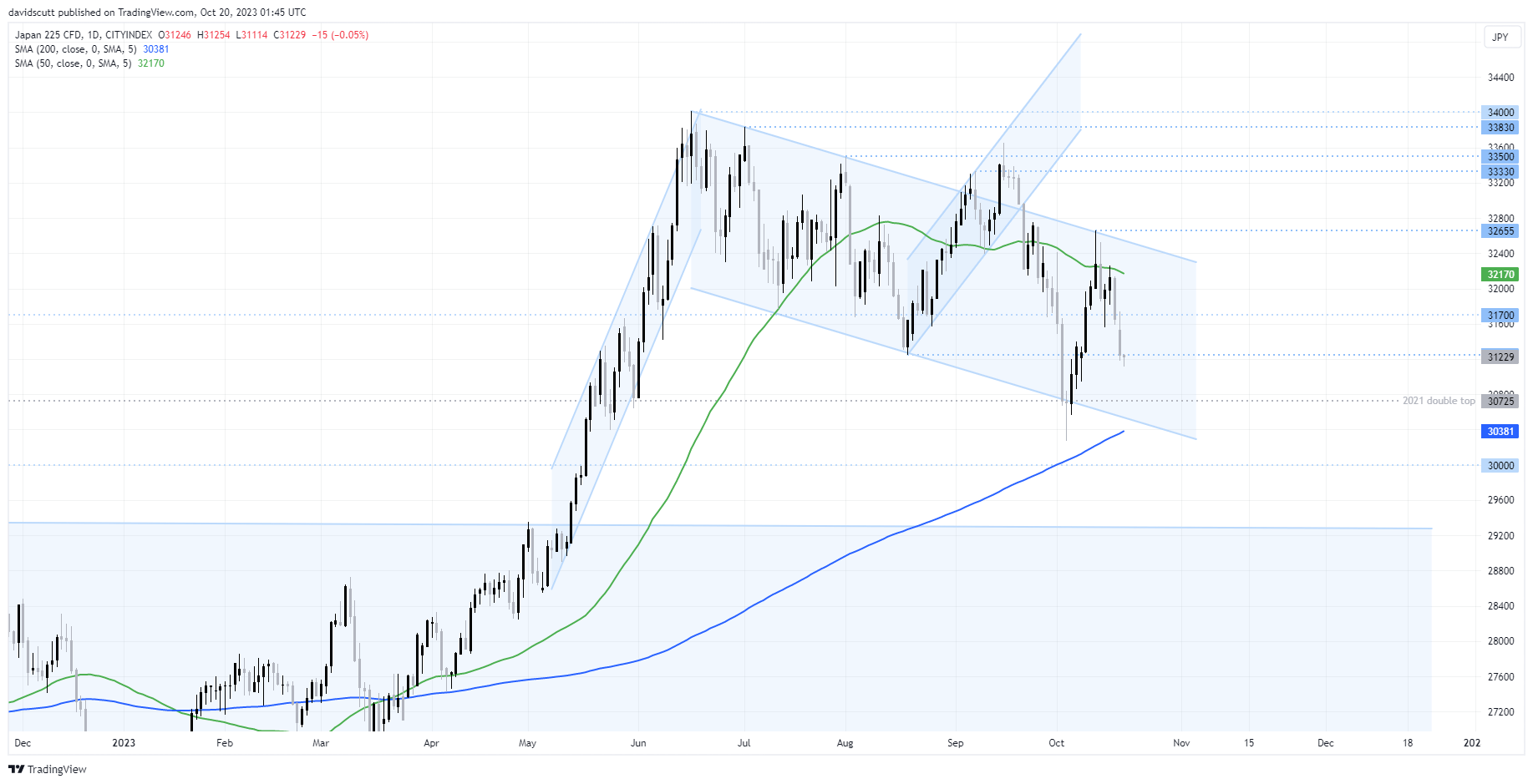

Nikkei 225 to be impacted by FX movements

While it’s a totally different asset class, given the flow-through to earnings and relative valuations, the direction of USD/JPY will also be influential on the export-heavy Nikkei 225 index. It’s currently operating in a modest downtrend, testing support and resistance on multiple occasions since June. Having broken minor support today, traders will be eyeing off a potential move back towards 30725, where the index found strong buying support earlier this month. On the topside, 31700 and 32500 are the levels to watch.

-- Written by David Scutt

Follow David on Twitter @scutty