- A sustained decline in US bond yields may amplify downside risks for USD/JPY and the Nikkei

- USD/JPY has fallen sharply from above 150 to below 149

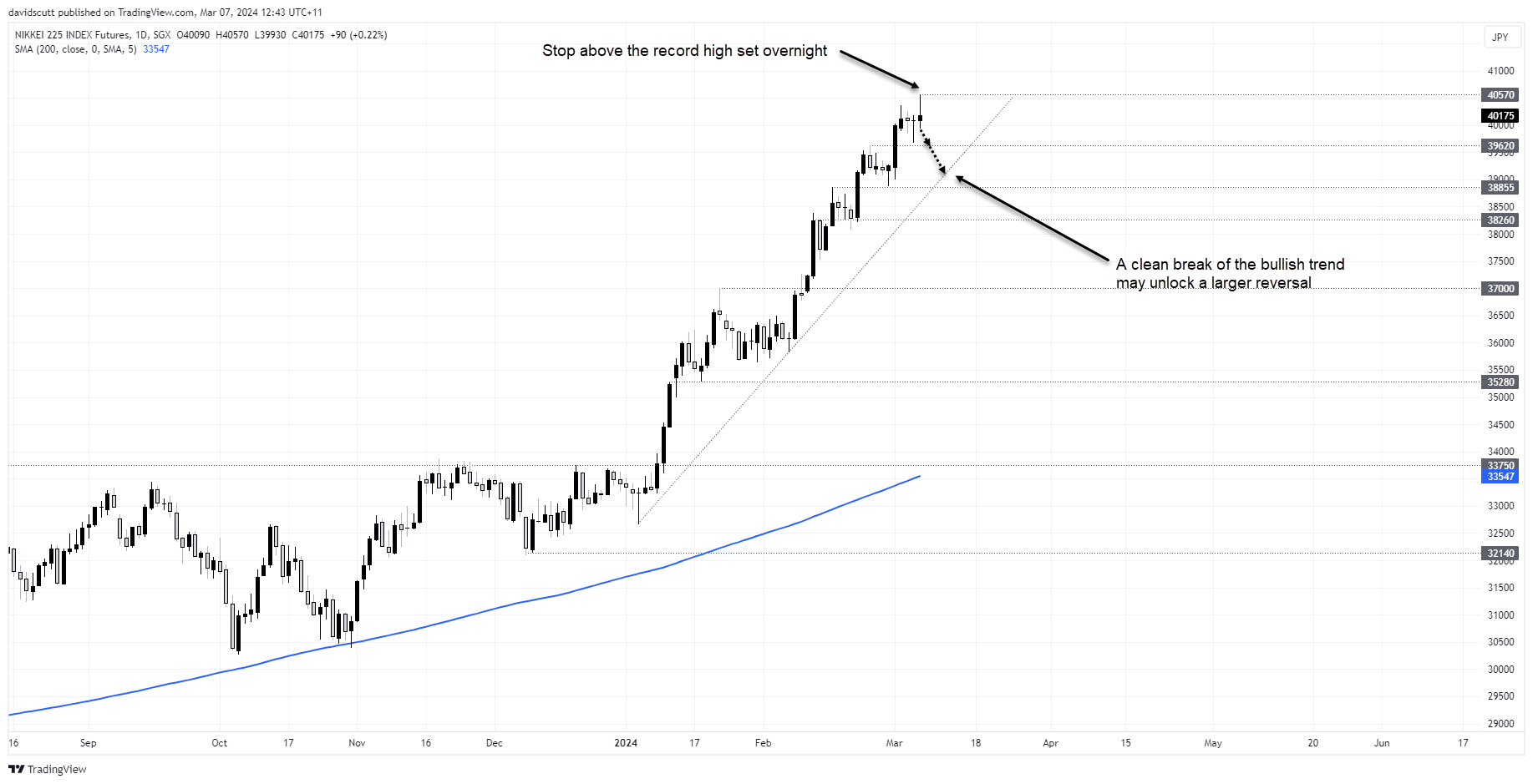

- Nikkei futures hit another record high but have since reversed

For a market that has enjoyed tailwinds strong from a weaker Japanese yen in 2024, Nikkei futures are curiously ignoring the unwind in USD/JPY over the past 24 hours, at least so far. I say curious because over recent months the Nikkei and USD/JPY have basically been moving in lockstep, benefitting from strength in the US dollar and equity markets. But with investors not requiring a second invitation to buy US bonds right now, seeing yield differentials with Japan compress, the fuel that helped propel USD/JPY higher looks to be running out. If downside risks for USD/JPY are finally materialising after a long wait, the high-flying Nikkei could be next.

Nikkei watching USD/JPY closely

The daily chart below shows the rolling 60 period correlation between Nikkei 225 futures and USD/JPY. I’ve used that timeframe to represent the relationship over the past quarter, give or take a few days. Right now, for all the bullish narratives you’ve heard about why Japanese stocks are rallying, a big factor has been the weaker Japanese yen. The correlation over the past quarter has been 0.9 and rising, indicating a strong and strengthening relationship between the two.

When you take a step back, the relationship makes plenty of sense as the Nikkei is laden with big Japanese exporters who are reliant on demand abroad. With the Japanese yen so weak, it helps make Japanese goods and services more competitive internationally, helping to boost earnings and propel valuations higher.

While a continuation of the relationship between the Nikkei and USD/JPY isn’t a given – there have been plenty of episodes where the two have danced to their own tune – it’s obvious that should it remain as strong as it is right now, downside risks for USD/JPY mean downside risk for Japanese stocks.

And USD/JPY has been watching US bond yields closely

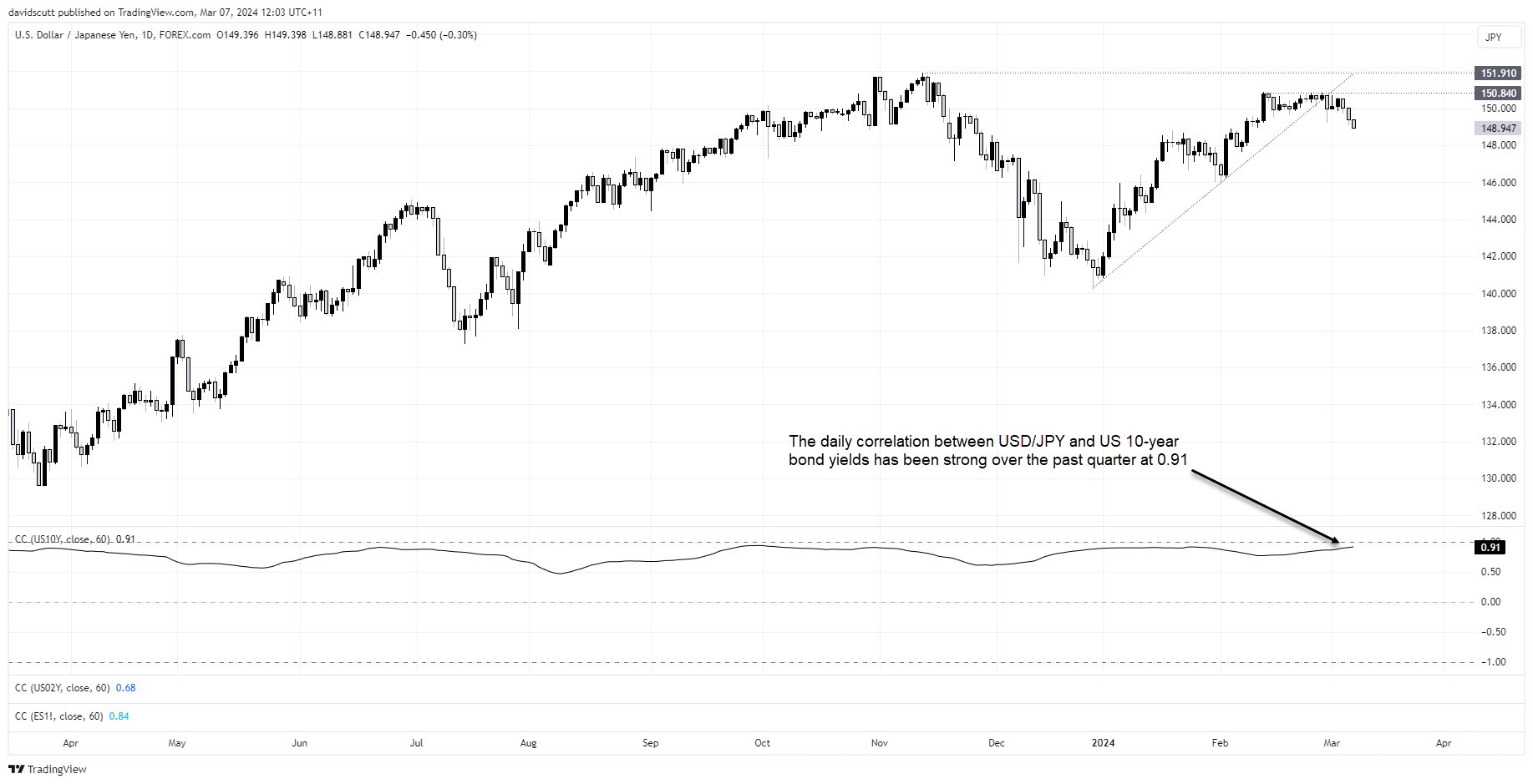

Based on the chart below which shows the rolling daily correlation between USD/JPY and US 10-year bond yields over the past quarter, the key to unlocking that downside will likely come from a sustained decline in longer-dated US yields.

The correlation between USD/JPY and yields sits at 0.91 over the past quarter, even stronger than between the Nikkei and USD/JPY. Like a set of dominos, it suggests that should US long bond yields fall, USD/JPY and the Nikkei will be next, assuming the relationships don’t suddenly change. That is a risk.

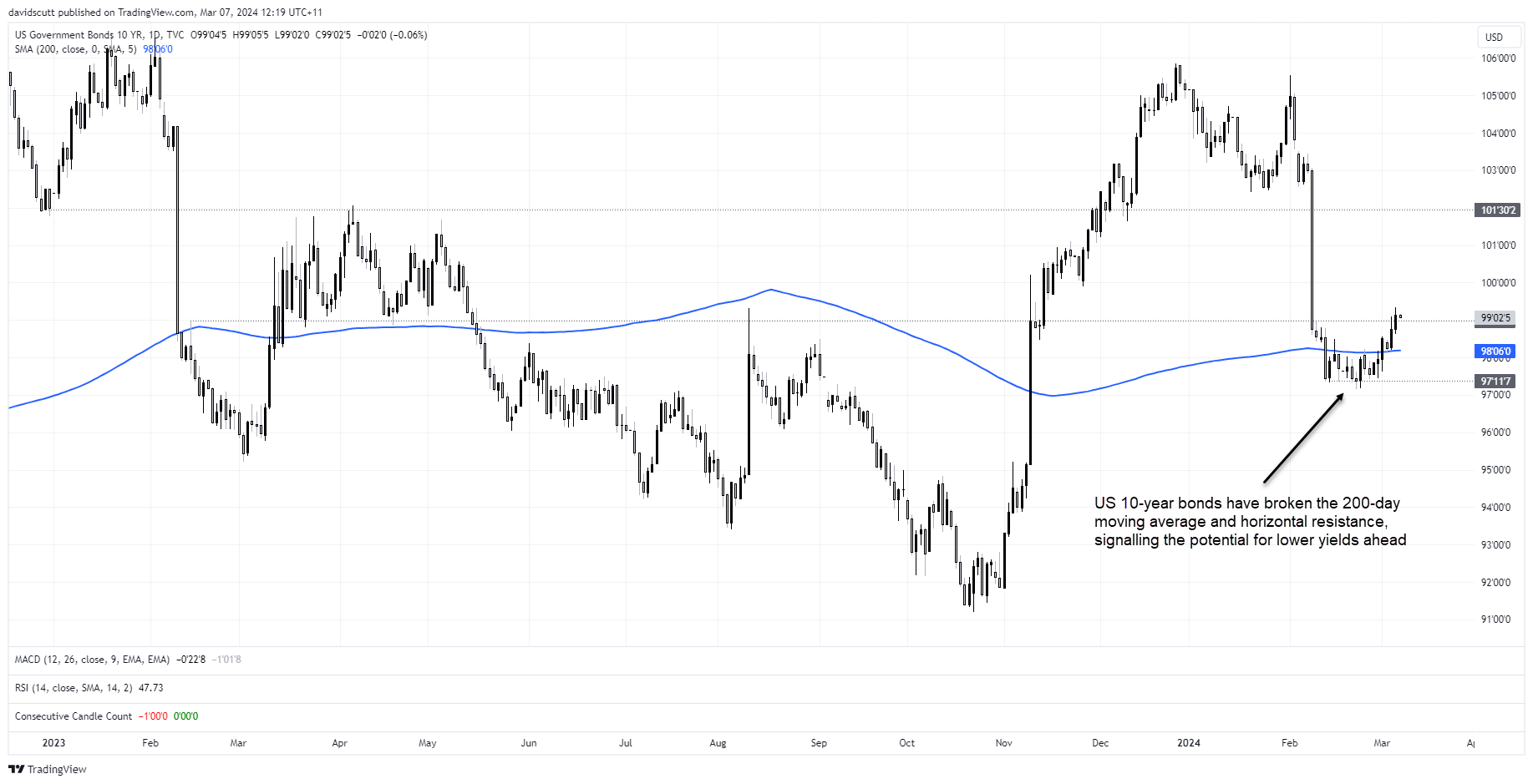

US bonds may be breaking higher

Based on recent price action, the first domino may be starting to fall with the price for US 10-year Treasury notes breaking through a trend line that has acted both as support and resistance dating back over a year. As mentioned at the top, for all the chatter about sticky inflation and record US dollar debt issuance recently, traders have not needed a second excuse to buy long bonds over the past couple of weeks, sending the price for benchmark debt back above the 200-day moving average. Should move extend, there’s little major resistance evident until above 101, implying significantly lower yields if the price gets there.

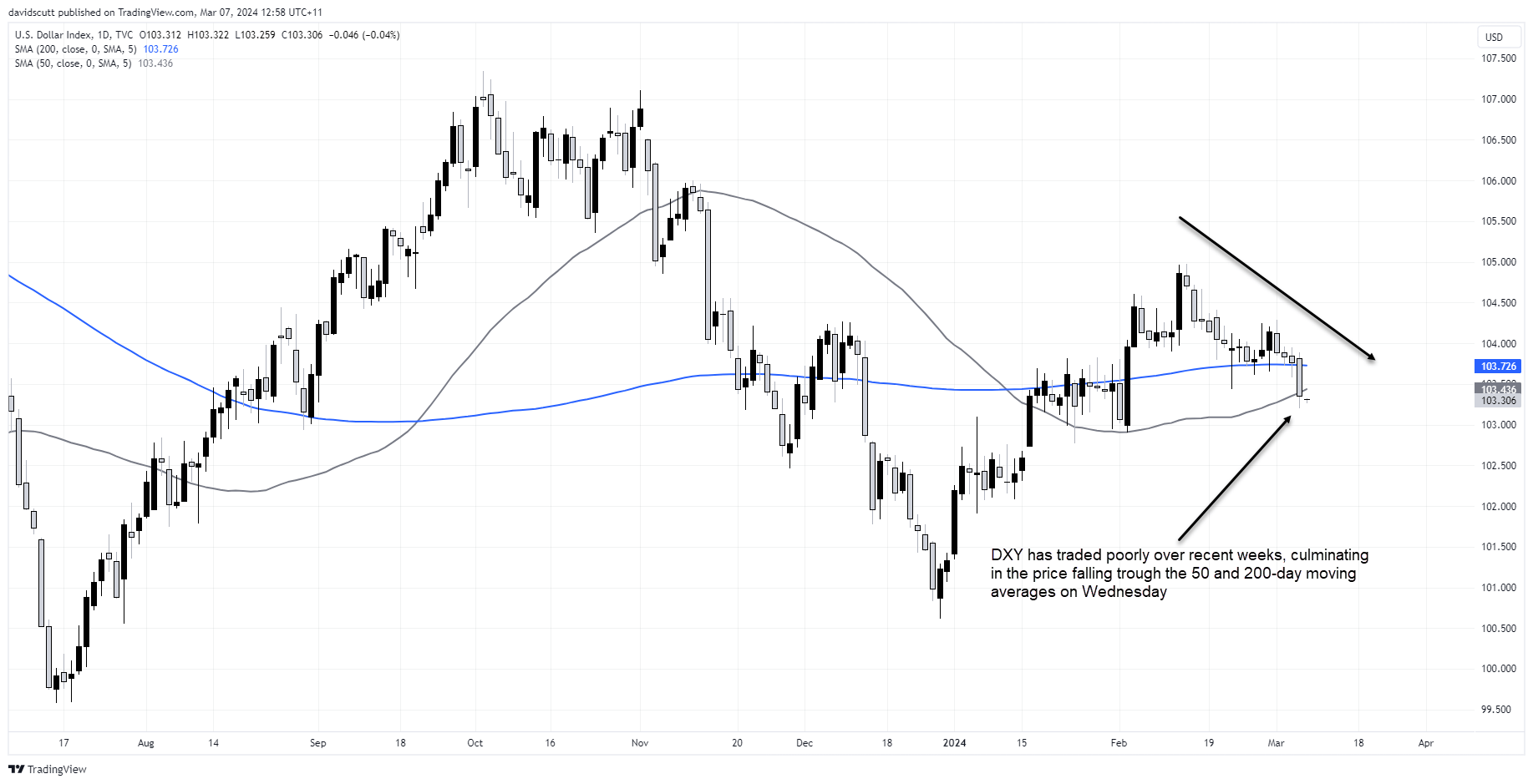

DXY has traded poorly

While yield differentials are not the only driver of the US dollar, it’s obvious that as US bond yields have eased lower so too has the dollar index, sending it through its 50 and 200-day moving averages.

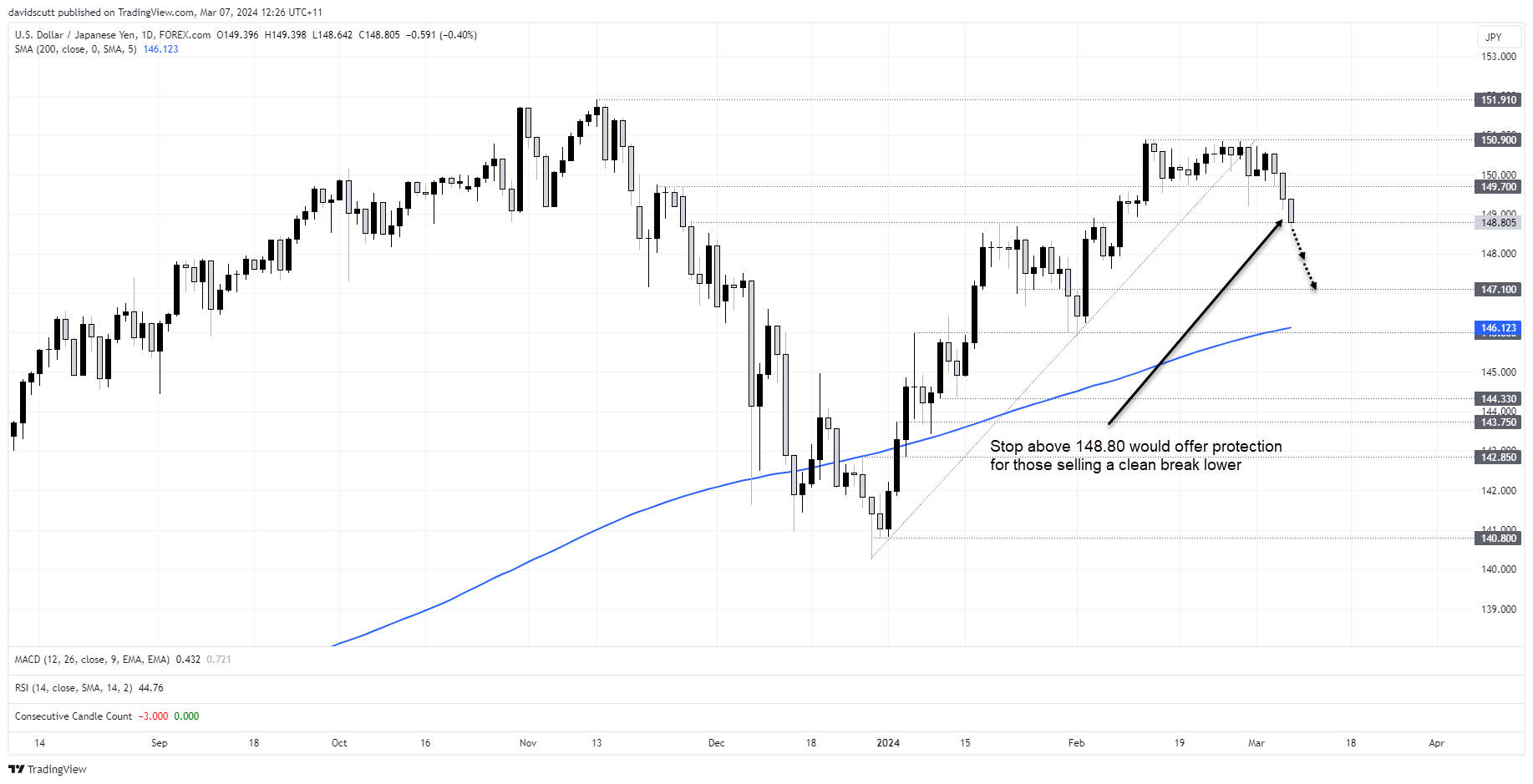

USD/JPY has tumbled

The decline in US bond yields, combined with growing speculation the BOJ will abandon negative interest rates following a big upside surprise in Japanese wages data released on Thursday, has not been lost on USD/JPY which has started rolling over, initially below 150 before extending the move to below 149 in Asia.

Should support at 148.80 break there’s little visible major support evident until 147.10. A break and hold below 148.80 allows traders to set shorts with a stop above for protection. Some buying may be evident at 147.60 where USD/JPY bounced on February 7. The trade could also be reversed should US bond yields begin to bounce.

Nikkei next?

Having initially ignored the yen rally by setting a new intraday record high at the start of the session, Nikkei futures are now starting to catch on to the move in FX and rates, reversing noticeably as the USD/JPY has declined.

While the trend remains higher, at some point the wind must come out of the rally in Japanese equities. It might as well be the yen that sparks it. Those considering shorts could use the high set overnight as a location for a stop loss order, targeting a move lower. Supports indicated on the chart have not been truly tested yet given the relentless nature of the rally, although a break of the uptrend running from early January could generate concerns about the longevity of the bullish trend.

-- Written by David Scutt

Follow David on Twitter @scutty