- USD/JPY range tightens as higher yield differentials counter BOJ intervention threat

- Speculation surrounding the BOJ tweaking or abandoning yield curve control is growing

- Such a move would likely generate downside for USD/JPY and Nikkei 225

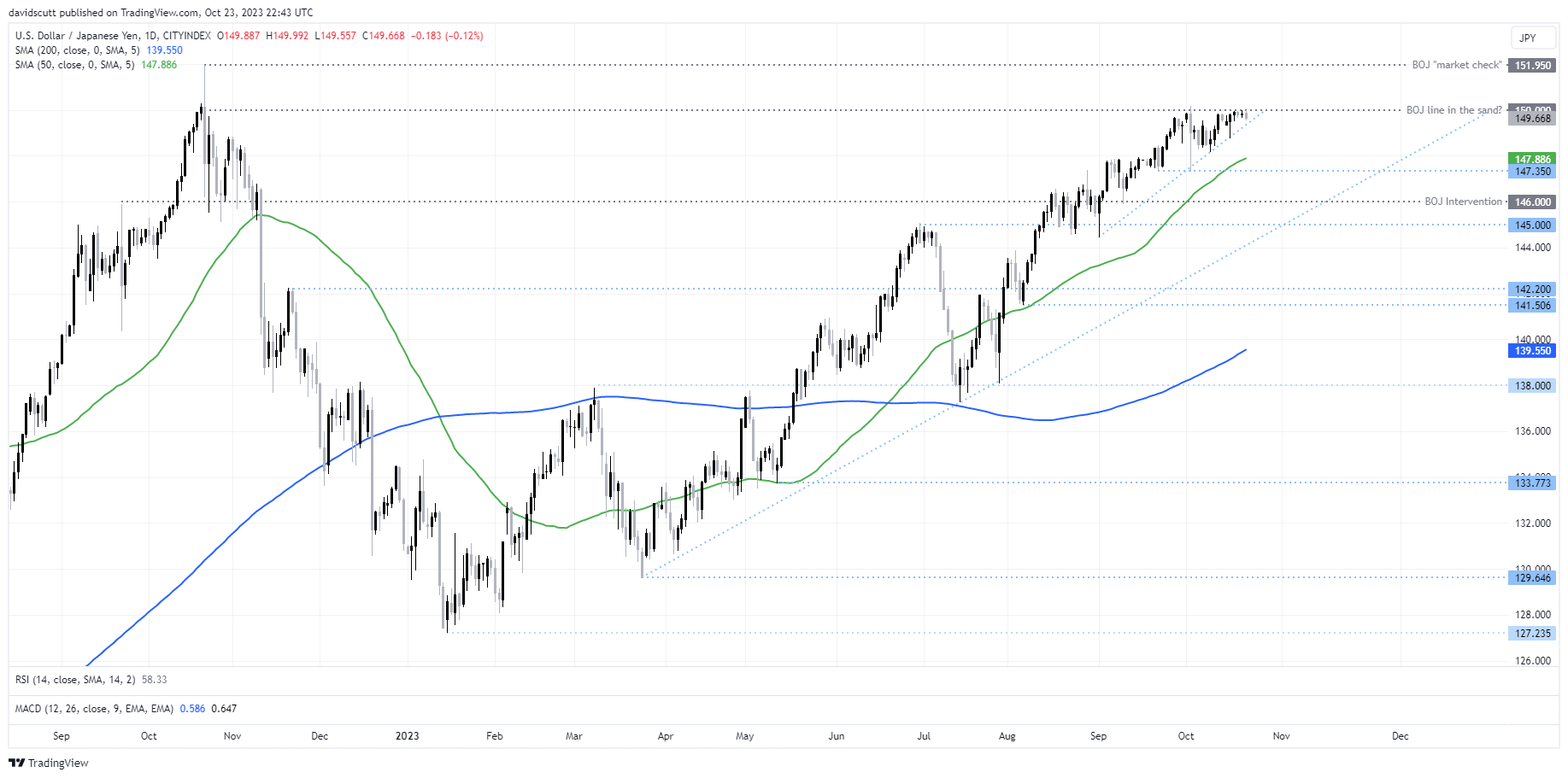

Speculation surrounding the future of the Bank of Japan’s (BoJ) yield curve control program continues to thwart attempts to push USD/JPY higher, combining with the threat of intervention from the BOJ to cap on rallies in the pair despite a continued widening in interest rate differentials between Japan and the United States.

While the odd story speculating what a central bank may or may not do is not unusual, and should not be treated as gospel, the frequency of yarns discussing a normalisation in Japanese monetary policy is now such that it’s hard to ignore. Perhaps where there is smoke there’s fire, making the BOJ’s October policy decision next week a potential blockbuster for traders.

A brief history of BOJ monetary policy

For newbies to Japanese monetary policy, the BOJ remains the undisputed titleholder as the most dovish central bank in the world, courtesy of the nation’s battle against deflation for more than 30 years. Right now, the BOJ has two key policy pillars it’s utilizing to help boost economic activity and wages, the ingredients it believes will be necessary to foster inflation and defeat the deflationary mindset entrenched in the minds of many Japanese people.

The first pillar is negative interest rates, keeping its key overnight borrowing rate at -0.1% since 2016. Relative to where policy rates are in the rest of the developed world, it remains intentionally low. The second is known as ‘yield curve control’, the process whereby the BOJ buys sufficient Japanese government bonds (JGBs) to keep yields on 10-year debt anchored near 0%. It’s deliberately interventionist, pinning yields at artificially low levels. The BOJ knows it needs flexibility on YCC to account for changing market conditions, gradually widening the trading range 10-year yields can deviate from 0% to as much as 100 basis points.

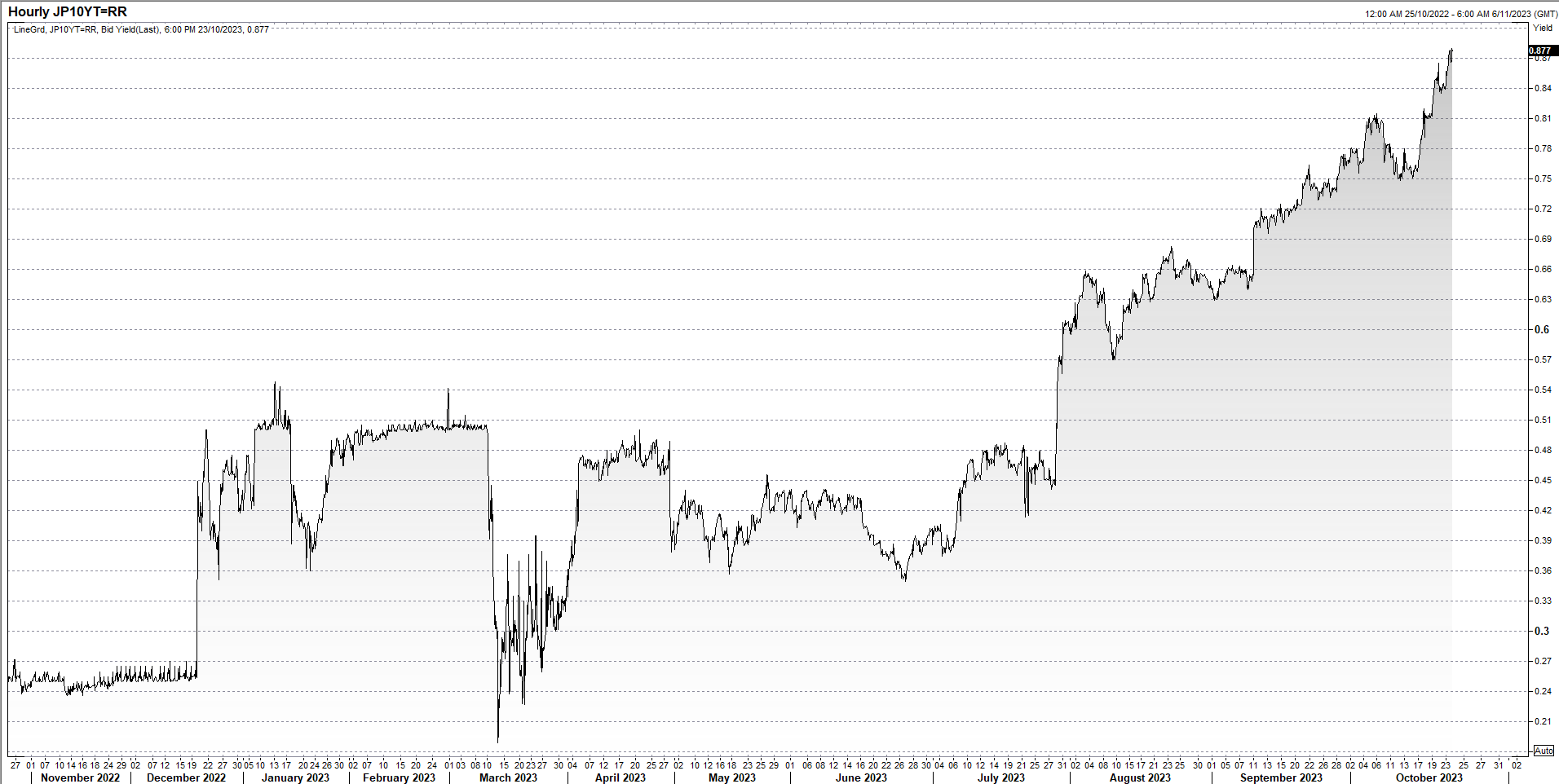

The hourly chart of benchmark JGB yields over the past year acts as a perfect timeline for when the trading band for YCC has been widened.

Source: Refinitiv

Higher Japanese yields on the way?

Right now, the latest speculation suggests the YCC trading band may be widened further, or potentially abandoned all together. Over the weekend, Japan’s influential Nikkei newspaper, without citing any sources, suggested changes to YCC may be discussed as soon as the bank’s next meeting at the end of October.

While my personal view is that preemptively normailsing policy before inflationary forces have become entrenched would be a policy error, undermining what the BOJ has been trying to achieve for decades, for a FX pair that largely reflects shifts in interest rate differentials, the ongoing speculation cannot be ignored by USD/JPY traders.

Put simply, if the BOJ allows market forces to play a greater role in determining where Japanese government bond yields trade, it’s likely to compress yield differentials, sending USD/JPY lower in response.

BOJ YCC tweak may generate USD/JPY downside risks

Looking at USD/JPY on the daily chart, should speculation surrounding YCC prove accurate, it would likely see the pair break of the triangle pattern it’s been trading in since September, carrying the potential for an abrupt move lower based on the reaction to unconfirmed reports in the leadup to the BOJ’s October meeting. On the downside, 147.35, 145.00 and long-running uptrend support currently found around 144.00 are the initial levels to watch. A stop above 145.00 would offer protection for those positioning for a potential policy shift.

Stronger JPY a likely headwind for Nikkei 225

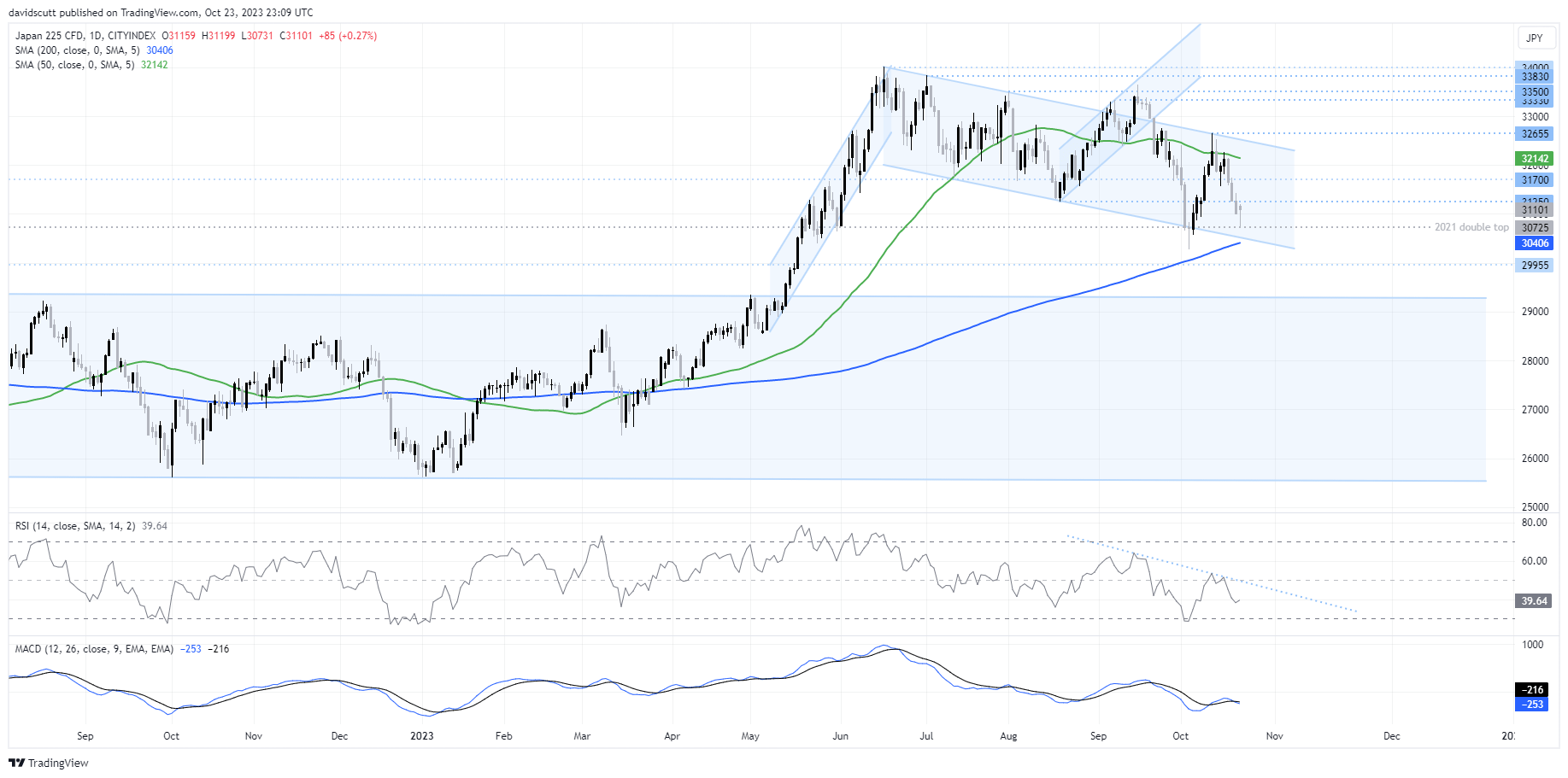

Should we see a sustained shift in direction for the Japanese yen, the impact would likely flow through to Japanese exporter earnings, likely creating headwinds for the Nikkei 225. Ahead of the BOJ decision on October 31, it’s located towards the bottom of the descending channel it’s been stuck in since June, finding solid buying on tests of 30725, including on Monday as signified by the formation of a hammer candle on the daily.

Under a scenario where we see a sustained strengthening in the Japanese yen, buying support at this level would likely be put to the test, opening the door for a potential push towards the Nikkei’s 200-day MA and support located just below 30000 should it fail. RSI and MACD continue to suggest that momentum remains to the downside. On the upside, 31250, 31700 and the top of the channel around 32500 are the resistance levels to watch.

-- Written by David Scutt

Follow David on Twitter @scutty