- Japanese headline and underlying inflation is slowing quickly

- A sustained increase in inflation will likely require stronger Japanese household spending

- Little evidence the weaker yen is flowing through to sustainably higher prices

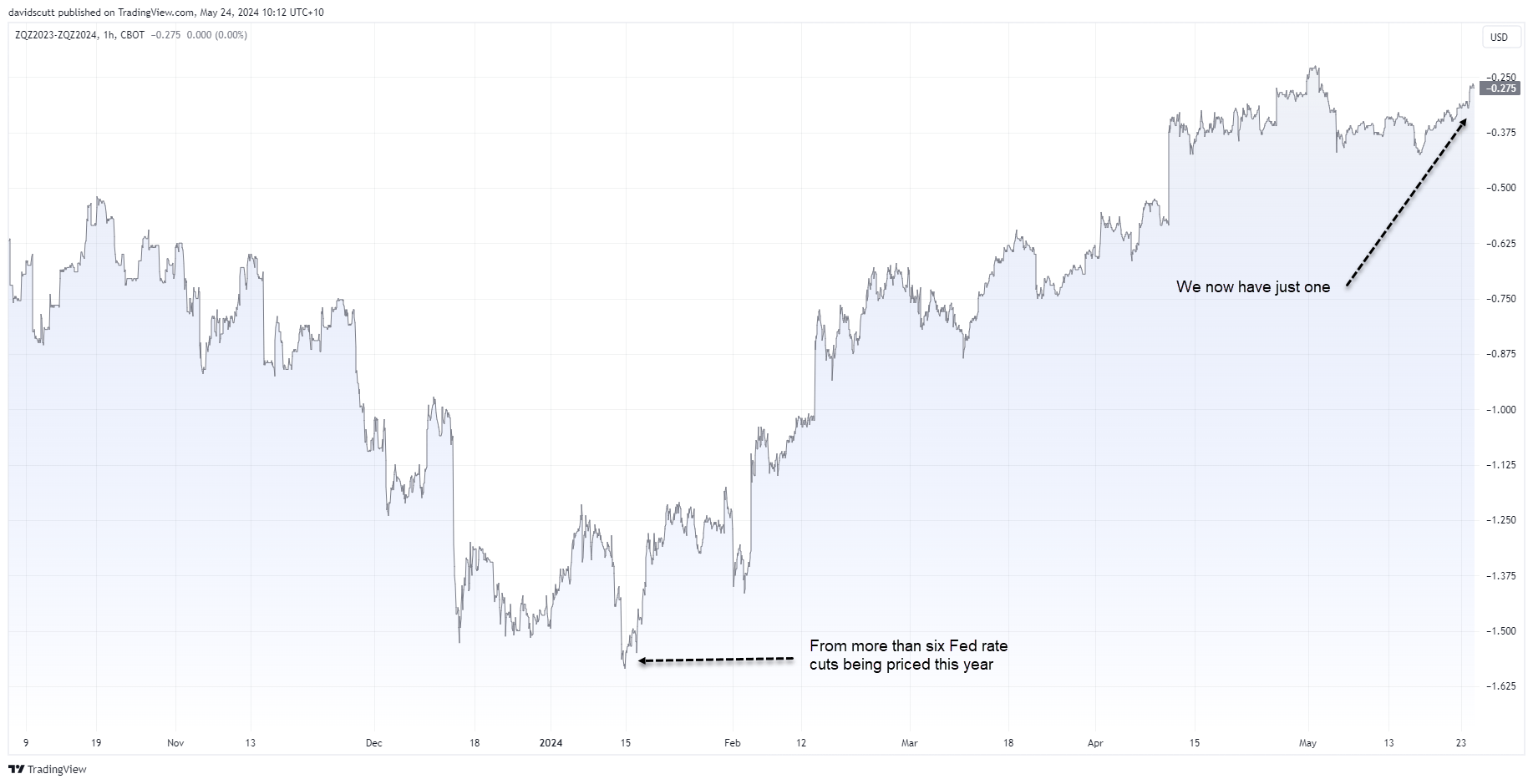

- Markets pare Fed rate cut bets in 2024, encouraging USD/JPY dip buying

Inflation not moving in the right direction for BOJ

Prospects for a sustained lift in inflationary pressures in Japan looks to be slowly slipping away, unless large wage increases from employers can permanently boost aggregate demand. Because looking at the trajectory for price pressures right now, it’s difficult to see the virtuous cycle between higher wages and inflation continuing beyond the short-term. Be it headline or underlying price pressures, both are experiencing deep disinflation, casting doubt over the ability for the Bank of Japan to deliver more than the one rate hike already delivered.

Japanese disinflation intensifies

Consumer price inflation slowed to 2.5% in the year to April, according to data released by the Japanese government, down from 2.7% reported in the 12 months to March. Core inflation which excludes fresh food prices was even softer, easing to 2.2% from 2.6%. That’s important as it’s the inflation figure targeted by the BOJ.

While the core reading was in line with expectation and remains above the BOJ's 2% target, it’s now down a two full percentage points from the highs hit in early 2023 and is trending lower. It’s a similar story for CPI ex-energy and food which slowed sharply in the past year, coming in at 2.4% from 2.9% in March.

Source: Refinitiv

With the Japanese economy shrinking in the first three months of the year, hopes for a sustained lift in inflation rest largely on the household sector, with positive real wages growth set to provide tailwinds for flagging household spending. If it doesn't, it's incredibly difficult to see the BOJ delivering further rate hikes. Even with the weaker Japanese yen, there’s little evidence in upstream price measures to suggest that’s flowing through to broadly higher consumer prices.

That’s problematic for the BOJ and markets who still have around 15 basis points of hikes priced from the bank over the next year. With resilient US economic data seeing Fed rate cut bets dwindle to less than 30 basis points this year, yield differentials between the two nations remain at historically elevated levels, incentivising traders to continue buying dips in USD/JPY.

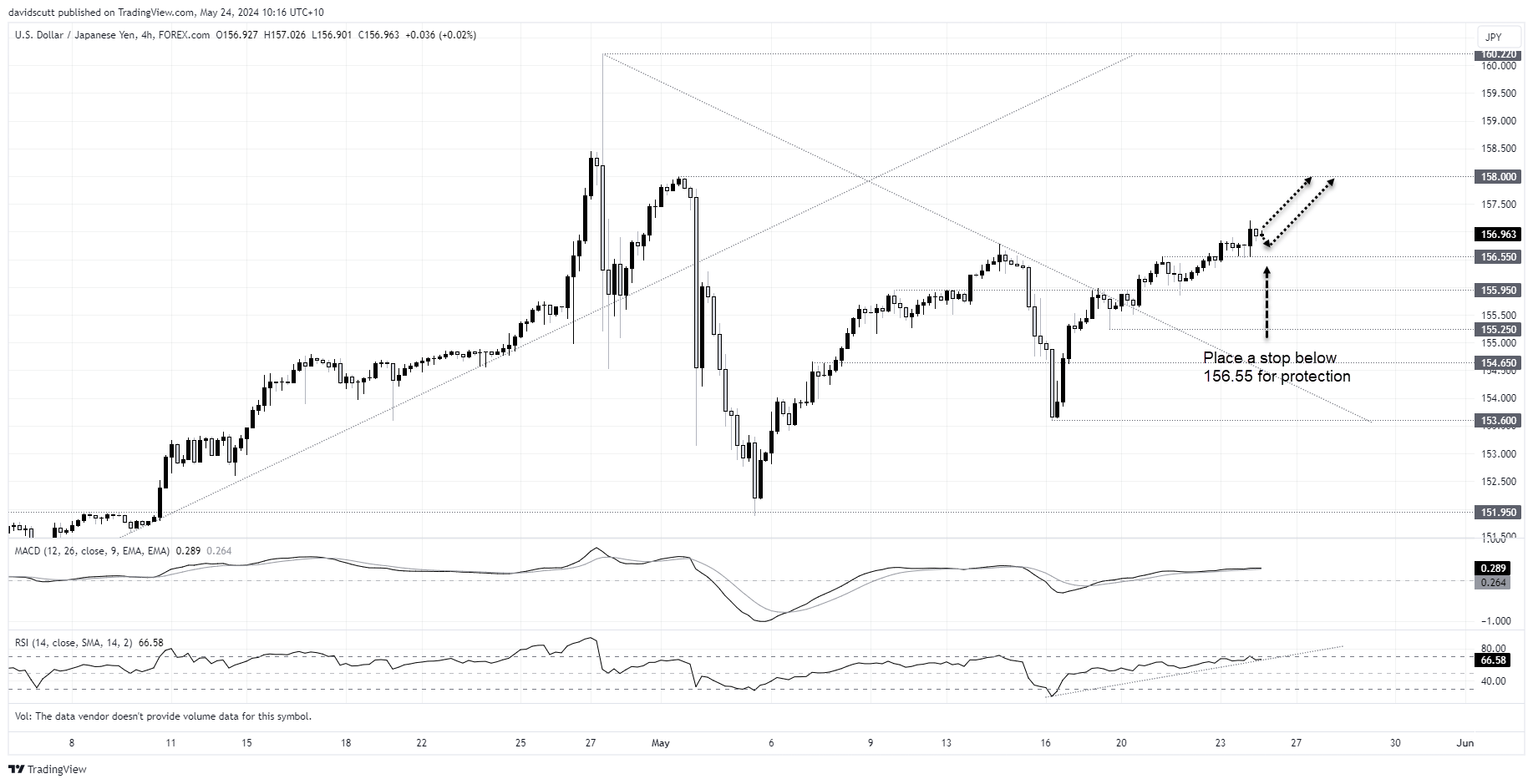

USD/JPY grinding towards 158

Having managed to clear resistance at 156.55 and the high of 156.78 on Thursday, USD/JPY looks like it may retest the high of 158 set at the start of May. One trade option would be to initiate longs here with a stop below 156.55, providing a risk-reward of two to one for those targeting 158. In a perfect world, the trade would be more appealing if we saw a dip back towards 156.55, improving the risk reward of the trade.

One thing for traders to consider is the likelihood that market activity will slow today given the proximity to Memorial Day in the US on Monday. While lower volumes often encourage a risk-on environment, something that would usually assist USD/JPY gains, it can also amplify volatility. Make sure you have stops in place.

-- Written by David Scutt

Follow David on Twitter @scutty