The USD/JPY has started the new on the front-foot, driven by a stronger US dollar amid expectations of a slower pace for Fed rate cuts. Risk appetite was strong, with European and US indices rising ahead of corporate earnings results. The S&P 500 hit a new record high above 5850, even as bond yields continued to press higher. The 10-year bond yield was at 4.15%, after a sharp recovery last week. Rising US bond yields usually undermines the low-yielding Japanese yen and this time was no different as nearly all JPY crosses posted gains. The USD/JPY was now just a spitting distance away from reaching 150.00, a level last seen at the start of August when the carry trade unwind was at full throttle. Two and a half months later, the USD/JPY looks in a strong shape as Japanese authorities have successfully talked down the prospects of policy normalisation and expectations of any further rate increases in the near term. So, the USD/JPY forecast remains bullish for now, especially with rates also breaking above a key resistance zone circa 149.40 this week.

US dollar extends advance

The US dollar was also rising against other major currencies, with the EUR/USD nearing the low 1.09s again and GBP/USD closing in on the 1.30 handle ahead of UK wages and inflation data this week.

Last week's data revealed that US consumer inflation eased to 2.4%, while producer price inflation stood at 1.8% in September. With both measures of inflation above expectations, this helped to keep the dollar supported following a rather strong US jobs report the week. However weaker consumer confidence and manufacturing data meant traders were no longer expecting another outsized rate cut by the Fed, not after the Fed Chairman Jay Powell himself ruling such a move out.

Unless incoming data suggests otherwise, the Fed is now expected to deliver a 25-basis-point rate cut in November and another one in December. Fed officials are shifting their attention from inflation to maintaining a healthy labour market, aligning with the dual mandate. However, there are no employment data out this week. In fact, the US economic calendar looks quite quiet this week, with the exception of the retail sales and jobless claims on Thursday and a couple of state-level manufacturing indices here and there.

It would take something big to turn the trend, especially for the USD/JPY, given the renewed strength in bond yields.

USD/JPY forecast: technical analysis and trade ideas

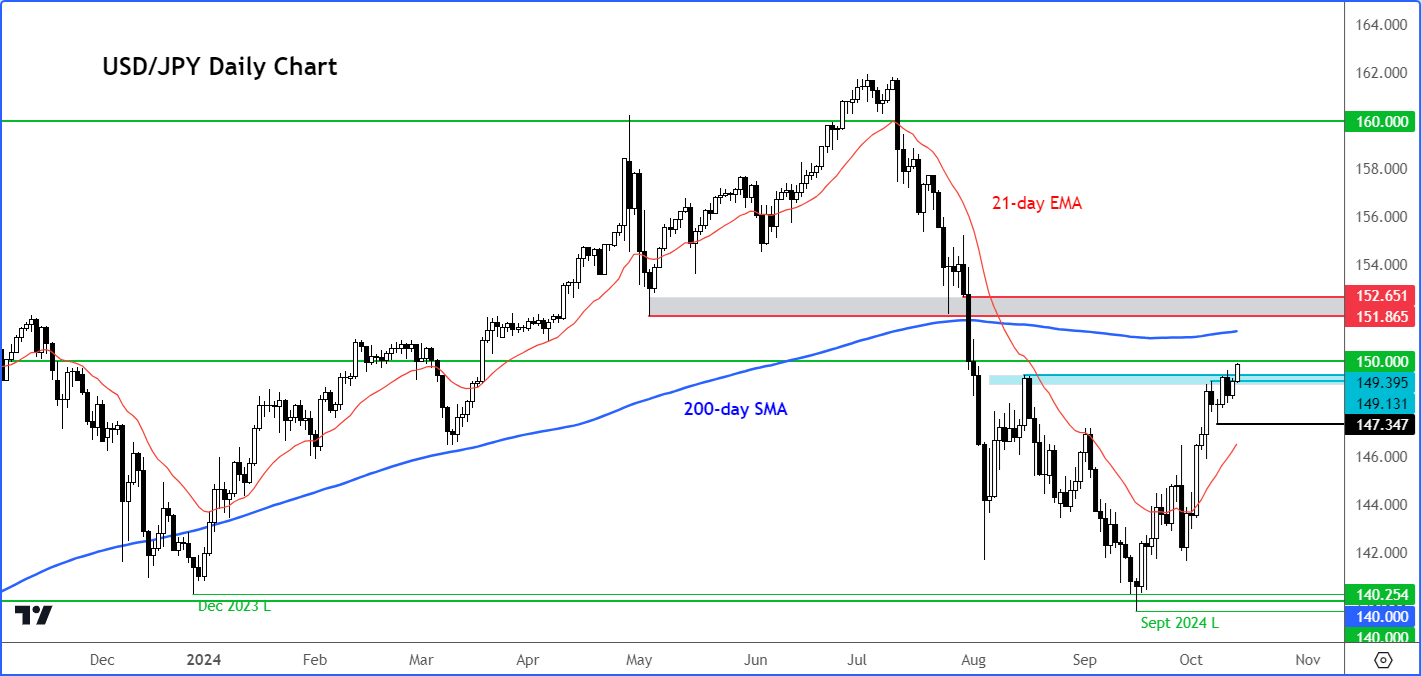

Source: TradingView.com

The USD/JPY is almost at 150.00 again. A potential break above this level makes technical sense given the underlying bullish price structure over the last several weeks, when the USD/JPY has been printing interim higher highs and higher lows, ever since reclaiming the 21-day exponential average. The 200-day simple average is now in sight at 151.20. The key area of potential resistance is seen around 151.85 to 152.65. This zone marks the last major support before rates plunged back in July. I would expect some resistance from the bears should we get to that area in the next couple of weeks.

In terms of support, well we have a clean area between 149.10 to 149.40 to watch now. This area had been resistance until this week’s breakout. A potential re-test of this area could provide a tradable bounce. However, if rates go back below this zone, especially on a closing basis, then that would raise some alarm bells, especially if rates go on to take out the most recent low at 147.35.

But for now, the USD/JPY forecast and path of least resistance remains to the upside.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R