Japan’s economy looks to be thriving as others begin to splutter, suggesting there may be more downside to come for USD/JPY after its recent sharp reversal.

Weak PMIs warn of global recession risk

Weak manufacturing and services sector PMIs for Europe and US have dominated markets over the past 24 hours, delivering a reality check to traders getting carried away with what Jerome Powell may or may not say during his Jackson Hole speech on Friday. The UK figures were horrendous, the Eurozone’s not much better. Germany, the bloc’s manufacturing powerhouse, is probably in recession. Even the United States, an economy that was apparently on track to post a rollicking 6% annualized growth rate for the September quarter, looks to be struggling, including its mammoth services sector.

It’s little wonder we saw a meaningful reversal in real and nominal bond yields given these numbers suggests the main risk facing markets is not a reacceleration in inflationary pressures but rather a global recession, especially given the economic chills already blowing through the Chinese economy.

Japan’s economy looks comparatively better

But in contrast, Japan’s economy – still the world’s third largest worldwide – looks to humming.

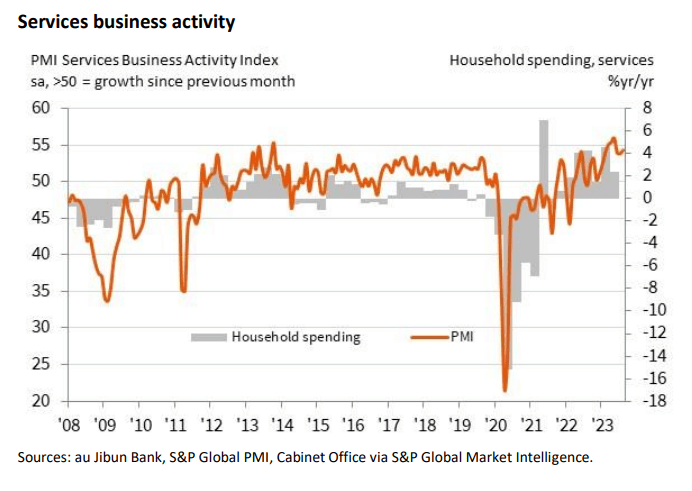

Its PMI numbers were solid, especially the services sector whose reading rose to 54.3 from 53.8, indicating a broadening improvement in activity levels. Commentary from S&P Global, who compile the PMI reports, reflected how stark Japan’s performance was relative to other developed markets.

“The reading pointed to a solid monthly expansion in services activity, with output now having risen on a monthly basis throughout the past year,” it said. “Growth of activity was supported by a solid rise in new orders, with new business from abroad also up. Companies responded to higher new orders by expanding employment, following a fractional reduction in July.”

Of note, it said input costs rose by the most in six months on the back of higher gasoline prices, leading to firmer prices for customers. For markets obsessed with relative inflation outlooks and how central banks may respond to them, that’s important.

Divergent economic performance to fuel further USD/JPY downside?

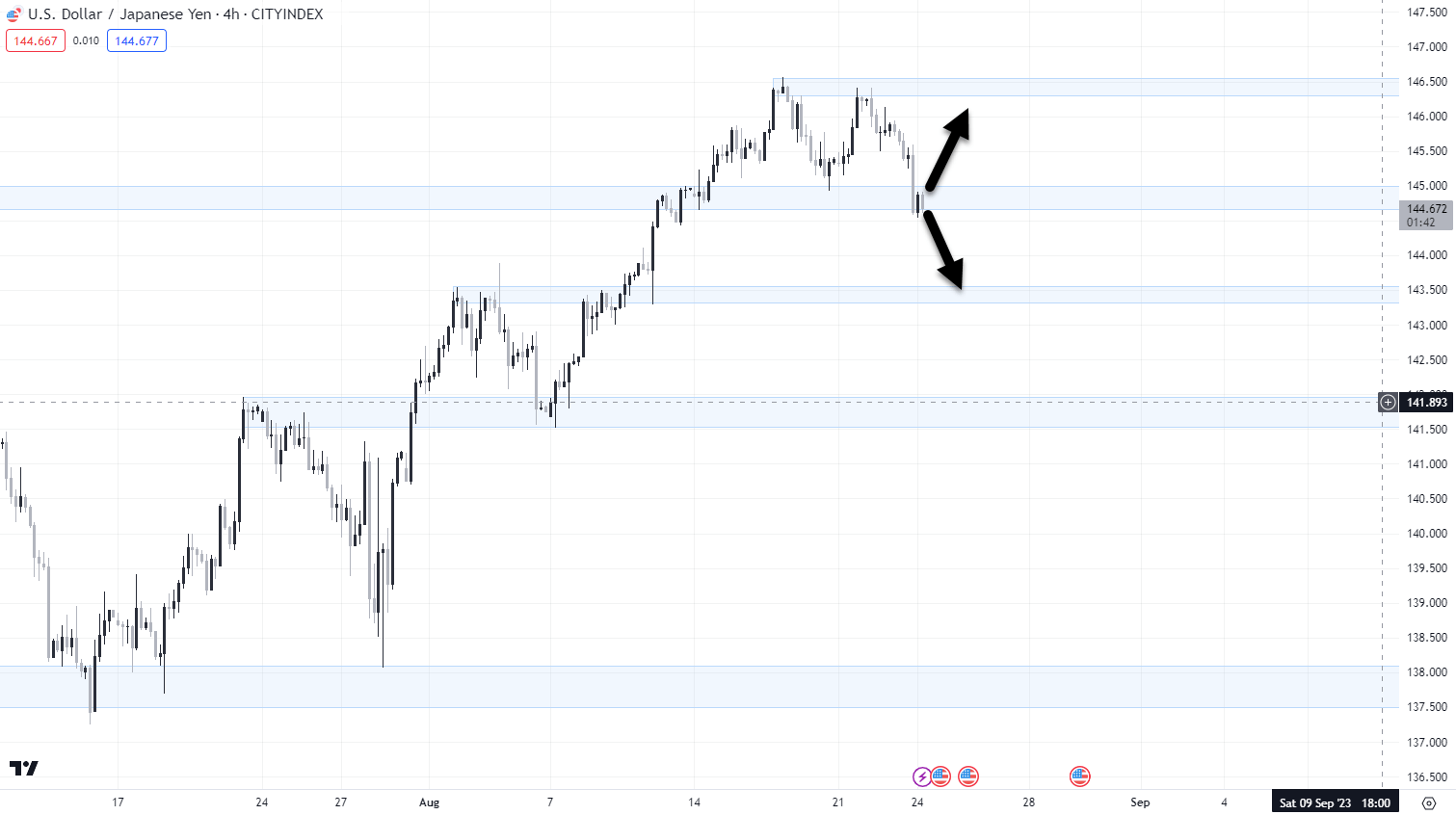

It’s also extremely important for markets where yield differentials are influential on relative valuations, such as USD/JPY. It fell like a stone following the US PMI miss, dropping close to a big figure within the space of minutes. Curiously, there was no meaningful bounce despite an improvement in broader risk appetite, something which often contributes to upside in the pair. No, the yen held firm, suggesting there may be more USD/JPY downside to come in the near-term.

USD/JPY is now testing the bottom of a supply-demand zone below 145.00. A break to the downside may open a move to the next zone starting at 143.50 and again at 142.00. Should the uptrend resume, sellers above 146.30 successfully repelled multiple probes last week. Looking ahead, Jerome Powell’s Jackson Hole speech looms as the only known macro event that dictate near-term direction.

-- Written by David Scutt

Follow David on Twitter @scutty