- US Treasury yields are driving USD/JPY

- Japanese factors remain a distant secondary consideration, unless there’s a major policy shift from the BoJ or the government

- Thursday’s US jobless claims and retail sales reports are key

- Directional risks lean slightly to the downside based on fundamentals and

Overview

USD/JPY continues to track US Treasury yields closely, while Japanese domestic factors remain largely irrelevant in the absence of a major monetary policy shift. Thursday’s US jobless claims and retail sales reports are the key events, carrying the potential to meaningfully alter the US interest rate outlook. Directional risks appear slightly skewed to the downside, especially if US labour market data weakens.

US rates outlook remains highly influential

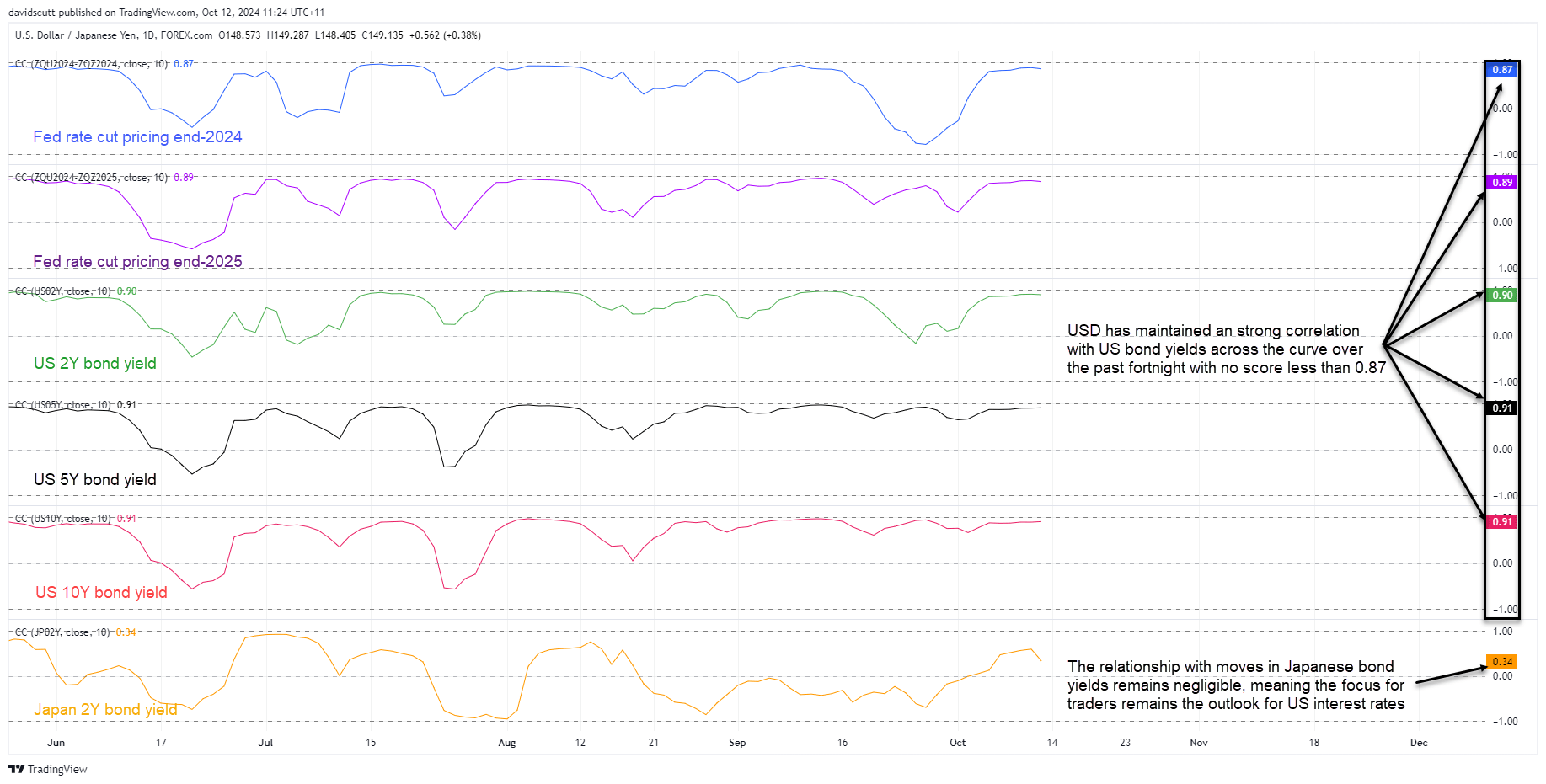

The US rates outlook remains the primary driver of USD/JPY movements with the rally from the September lows coinciding with a rebound in US Treasury yields. The relationship has remained strong over the past fortnight with correlation coefficient scores across the US Treasury curve ranging from 0.87 to 0.91. This suggests that where US bond yields move, USD/JPY tends to follow.

In contrast, the relationship with Japanese bond yields remains negligible. Outside an occasional inflation report, the only times USD/JPY has reacted to Japanese domestic factors recently has been when Bank of Japan or government officials have openly discussed potential changes to the monetary policy outlook.

US claims, retail sales key events

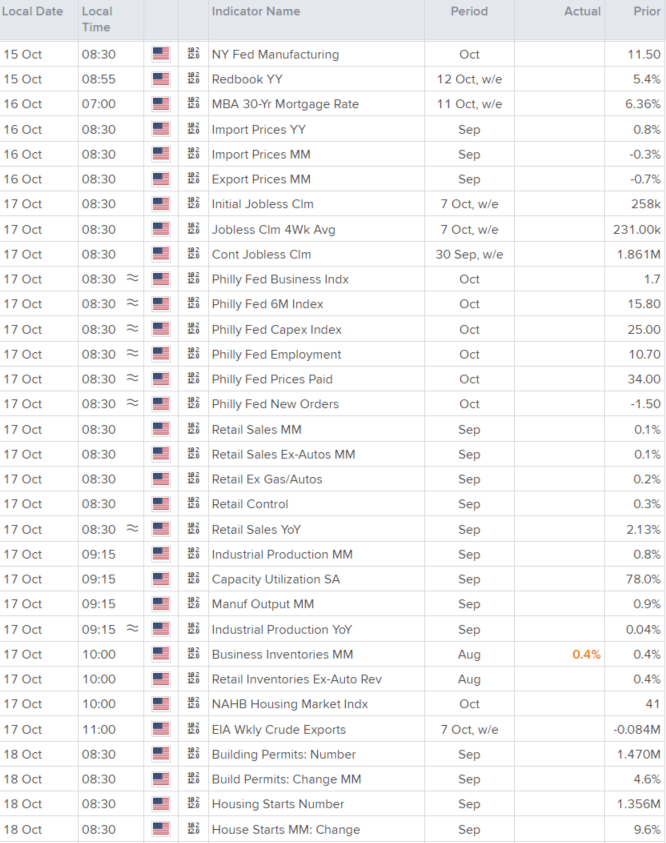

With the US rates outlook in the driving seat, it means traders need to focus on the events that could meaningfully shift thinking among Federal Reserve officials. In contrast to earlier in the month, the US calendar is relatively quiet until the latter parts of the week.

As I discussed previously, disruptions caused by Hurricane Milton could easily deliver another ugly initial jobless claims report, something that could easily lead to a decline in US bond yields and probable bearish reversal in USD/JPY. To offset the risk of such an outcome, we’d likely need to see a strong retail sales report, so keep an eye on both when they’re released simultaneously on Thursday.

Volatility generated by any other data point should be treated as noise rather than signal, potentially allowing for outsized moves to be faded. It’s not that they’re not important, but unless there’s an obvious and observable trend that has implications for the Fed, you cannot place too much weight on the information.

All times and dates listed below are US EDT.

Source: Refinitiv

The same can be said about much of the Japanese calendar, although the inflation report on Friday should be deemed a risk event, especially if we see a big deviation on the 2.3% core rate forecast. Aside from commentary from fiscal and monetary policymakers, that’s the only Japanese release that carries the potential to move USD/JPY.

Source: Refinitiv

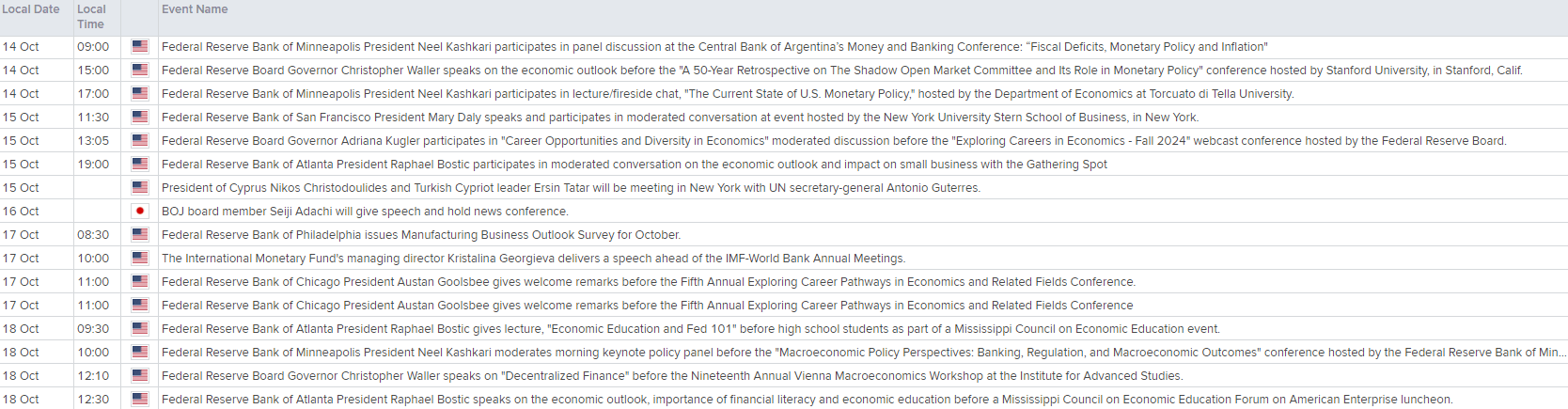

It’s also a busy week for Federal Reserve officials, although it’s noteworthy that Jerome Powell is not among the speakers. Based on his tone and actions from the FOMC since his appearance at the Jackson Hole economic symposium, the Fed chairs appears to especially influential when it comes to near-term policy direction right now.

That makes me question how influential these appearances will be without a concerted and obvious effort to influence monetary policy expectations. The tone from early speakers will be instructive on that front.

Source: Refinitiv

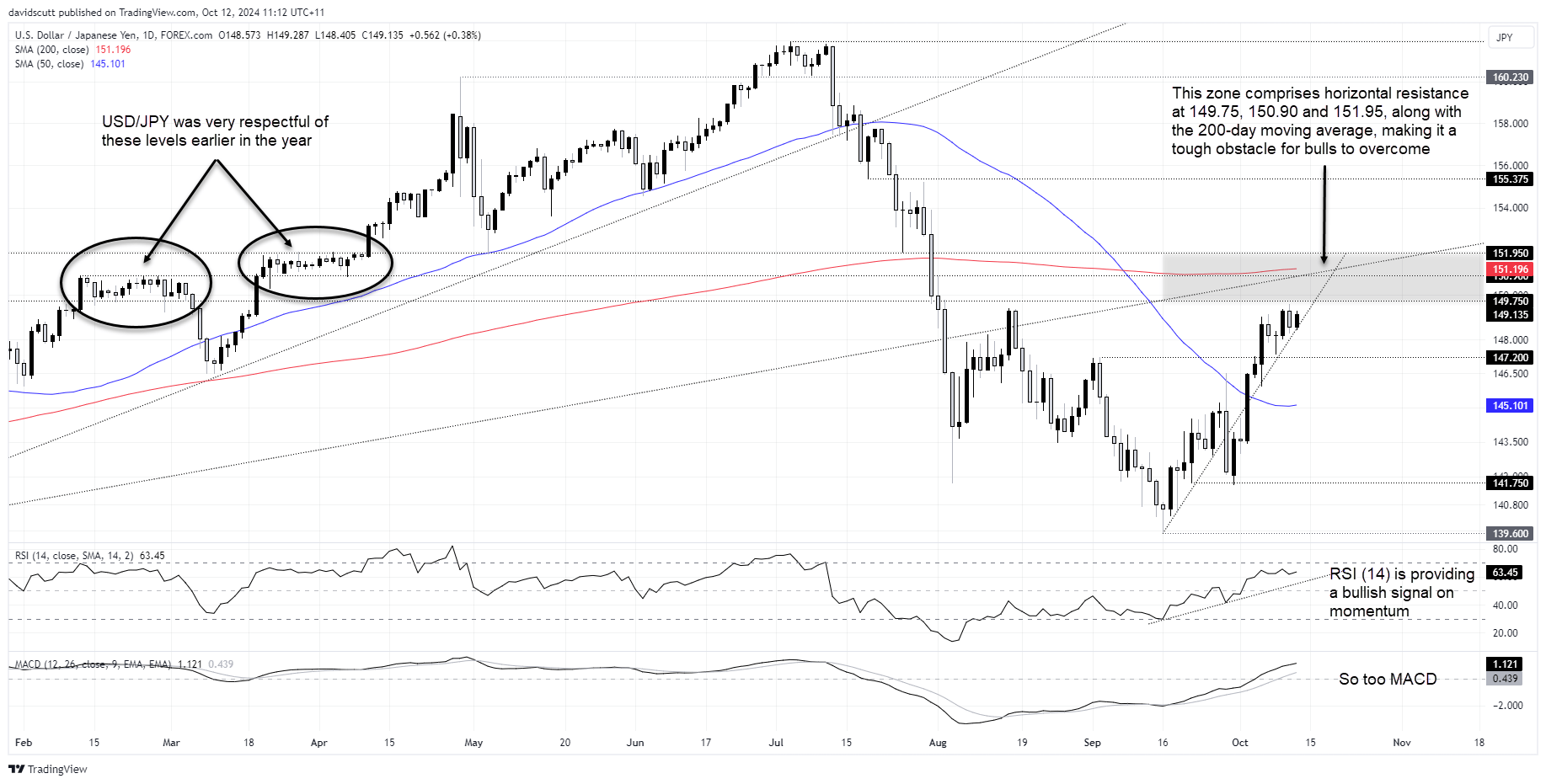

USD/JPY: Easy gains have been won

As I alluded to in the outlook report last Monday, the easy upside for USD/JPY has already occurred with the rapid rally from the September lows slowing to a crawl last week. Sandwiched between a major resistance zone and uptrend support, we may receive a definitive price signal early in the week as the price coils in an ever-narrowing range.

For the first time in a while, directional risks appear slightly skewed to the downside. Not only could we see further weakness in US labour market data which we know the Fed is watching closely, but USD/JPY also sits just below a major resistance zone which may be difficult to crack without a meaningful hawkish recalibration of the US rates outlook. I just don’t see that happening this week, putting a potential break of uptrend support on the radar.

If the uptrend were to give way, 147.20 and the 50-day moving average located at 145.10 are the first downside levels of note. On the topside, the resistance zone mentioned earlier comprises of multiple horizontal levels at 149.75, 150.90 and 151.95, along with the 200-day moving average. A break above would undoubtedly see traders start thinking about a retest of the multi-decade highs set in July.

-- Written by David Scutt

Follow David on Twitter @scutty