USD/JPY and Yen Crosses Remain in Sharp Focus

The spotlight is on the USD/JPY and other yen crosses right now, with a particular focus on the ongoing unwind of carry trades that continues to make waves across financial markets. This USD/JPY analysis follows last week’s hawkish Bank of Japan meeting and recent US economic data that showed some signs of weakness, raising recession alarm bells. The stronger services PMI data helped to alleviate those concerns somewhat, but markets remain under pressure, nonetheless.

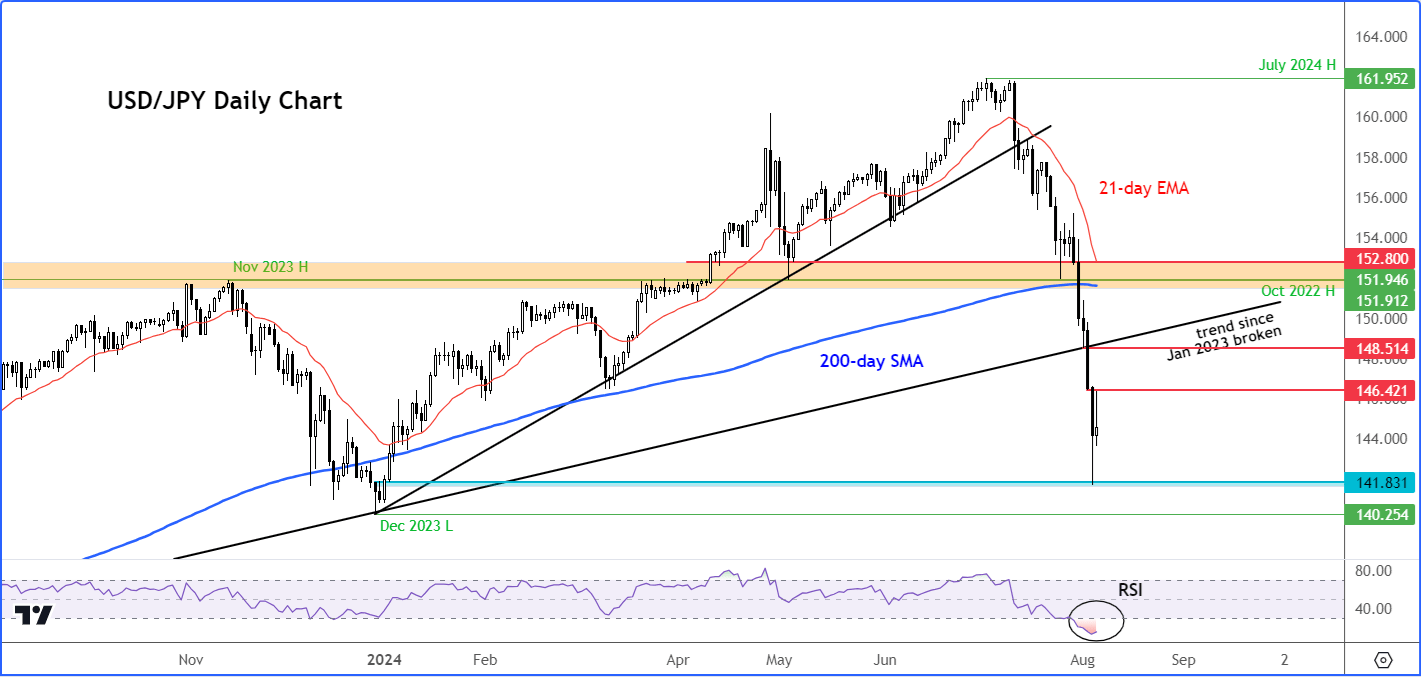

USD/JPY Reaches Extreme Oversold Levels

The USD/JPY is hitting extreme oversold levels following the big drop. The daily RSI indicator moved to below 15, marking a level that’s rarely seen. This suggests we might be due for a bounce and indeed we saw a bit of recovery on Monday. The USD/JPY surged from about 141.69 to eventually reach 146.37 overnight, which wiped out the losses from Monday before the selling pressure resumed at the Asian open. We’re now hovering in the middle of Monday’s trading range.

USD/JPY Analysis: Key Levels to Watch

Source: TradingView.com

The big question is whether we’ll continue to see a downward trend or if the USD/JPY will start climbing again. There are a few key levels to watch:

- Resistance: The area round 146.40 to 146.50 is crucial. This zone had previously provided support and has now turned into resistance. If this resistance breaks, we might see a relief bounce towards a more significant resistance zone around 151.00, where the 200-day moving average and other technical indicators come into play.

- Tough ask: After the dramatic sell-off triggered by the Bank of Japan’s policy decision last week, we may not see too much of a recovery. Instead, a potential recovery might face stiff resistance near the broken bullish trend line, which had been intact since January 2023, around the 148.50 area. The breach of this trend line was a major bearish signal, so this area could act as strong resistance moving forward.

- Support: Keep an eye on the area around 141.80ish. This area marked the start of previous buying pressure at the start of this year, after a prolonged downtrend ended in late 2023. When this level was breached and rates climbed above the 200-day moving average, we saw a solid upward move in the first half of the year, only to face a sharp drop after the mid-way point of the year.

USD/JPY outlook hinges on US data

Moving forward, much will hinge on upcoming US macro pointers, although we don’t have much in the way of scheduled data to work with this week. The ISM Services PMI released yesterday came in slightly stronger than expected, easing recession fears and giving the USD/JPY a bounce while risk assets also showed some recovery from their lows. Nonetheless, the pressure is still on.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R