Earlier this month, I noted that the USD/JPY decline from July's high might be overdone. Despite a near -14% drop erasing all YTD gains before the FOMC meeting, the 50bp cut didn't satisfy USD/JPY bears. Instead, we saw a bullish engulfing candle signalling a potential countertrend move.

It's notable that USD/JPY prices remain in the upper quarter of last week's bullish engulfing candle, indicating growing demand for the potentially oversold pair. The key question is how much of a rebound we can anticipate from this point. Afterall, every downtrend requires occasional corrections.

USD/JPY futures market positioning (CME futures from the COT report)

Both large speculators and asset managers remained net-long JPY futures for at their highest level since 2021 last week. While their bullish exposure is hardly at a sentiment extreme by historical standards, it could be over recent history. But we did see a slight de-risking among both sets of traders, given they trimmed both gross longs and gross longs. However, the standout metrics involve a plunge in overall open interest (OI).

- Open interest fell -47% at its fastest weekly pace on record

- The -177k contracts closed equates is just under half of total open interest, at -47%

- Open interest stood at 376.5k contracts the week prior, which was its second highest level on record

I cannot account for the cause behind the plunge, but the fact is we saw an extended move higher on yen futures (lower on USD/JPY) alongside the spike on OI accompanied and engulfing week should not be ignored. It could signal a sentiment extreme and key inflection point.

For any bonce to have any leg, US data needs to outperform expectations and the BOJ disappoint hawks. Neither of these scenarios are an impossibility. Still, traders will need to remain vigilant, and prices are also at an inflection point over the near term.

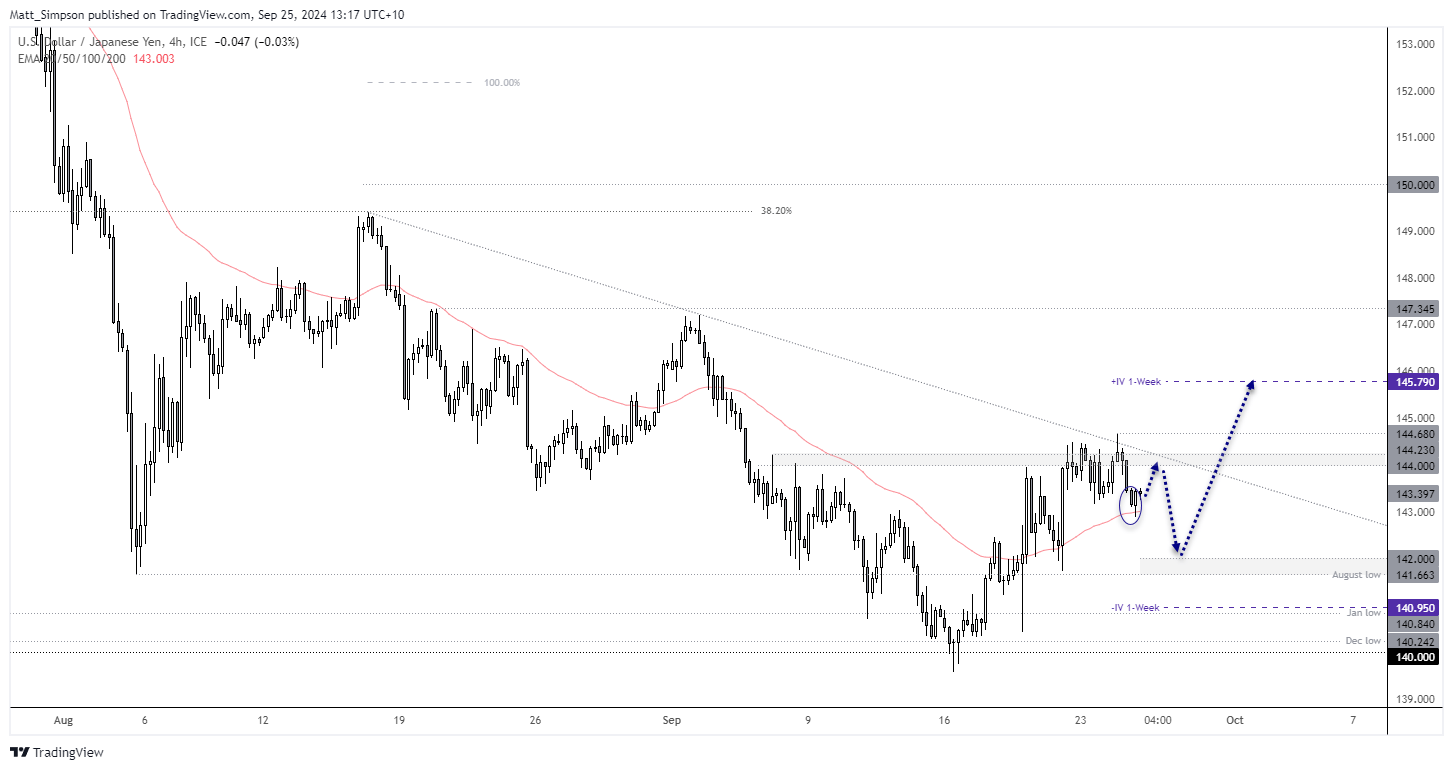

USD/JPY technical analysis:

We’ve now seen a 5% rally from the September lot to high, although we’re yet to see a daily close above the 144 handle and yesterday’s shooting star (and outside day) respected trend resistance. Assuming last week’s bullish engulfing week was significant, perhaps the market is priming itself for a pullback within last week’s range before its next leg higher.

I’m not looking for a huge retracement, and for prices to hold above the August high (141.66) and low of Friday’s bullish outside day. Bulls could seek to enter above such support levels, or bears could seek shows on lower timeframes.

However, a bullish engulfing candle has formed on the 4-hour chart around the 50-bar EMA, which suggest a potential swing low on this timeframe.

- From here I am now looking for prices to head towards the 144 – 144.23 resistance zone, although my bias remains for another leg lower if this anticipated upswing is complete.

- Bears could seek evidence of a swing high around trend resistance / 144 resistance zone for a move towards 142

- Bulls could reconsider longs if evidence of a swing low above or around 142 forms

- A break above 144.68 assumed bullish continuation

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge