US Dollar Talking Points:

- It’s been a fast start to Q4 trade and already 61.8% of the 2024 bearish trend in the USD has been erased.

- Gold continues to stretch higher as markets appear to be pricing in a possible policy error from the FOMC.

- EUR/USD is now oversold on the daily and has held the 200-dma as resistance so far. But with Lagarde’s earlier comment regarding the labor market in the Eurozone, there’s justifiable bias for bearish continuation in EUR/USD as US data has shown with more strength.

- In the webinar I hit a total of 13 markets, including Silver, Bitcoin, GBP/USD, and AUD/USD amongst many others. To sign up for the next webinar, the following link can allow for registration: Click here for registration information.

Working with an overbought or oversold market can prove challenging. But, at its simplest, there’s really just three ways to go about it. And there are no wrong answers here as the interpretation and proper way forward will probably be subjective based on who you’re talking to. I have my way of treating such scenarios, but I also know that others prefer different paths, and that’s okay. I did my best to explain that during this webinar in a variety of venues as we’ve seen USD, EUR/USD and Gold all push to overbought/oversold extremes.

With price at an extreme on a relative basis, traders can either chase the move in that direction, they can fade the move looking for a reversal, or they can wait for a cleaner setup in the trend-side direction.

In the US Dollar, price has stretched up to the 104.07 Fibonacci level which has so far held the highs on the morning. RSI is overbought on the daily chart, making the prospect of chasing a bit more daunting. But, so far there’s been defense above the 200-day moving average and that can be construed as a positive sign for bulls.

Pullbacks so far have remained shallow, with the resistance looked at in last week’s webinar coming into play late last week and holding through this week’s open, currently showing as a higher-low. There’s a few points of reference above that, such as the 103.87 prior high or a swing at 103.70 that remain of interest for bullish continuation scenarios.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

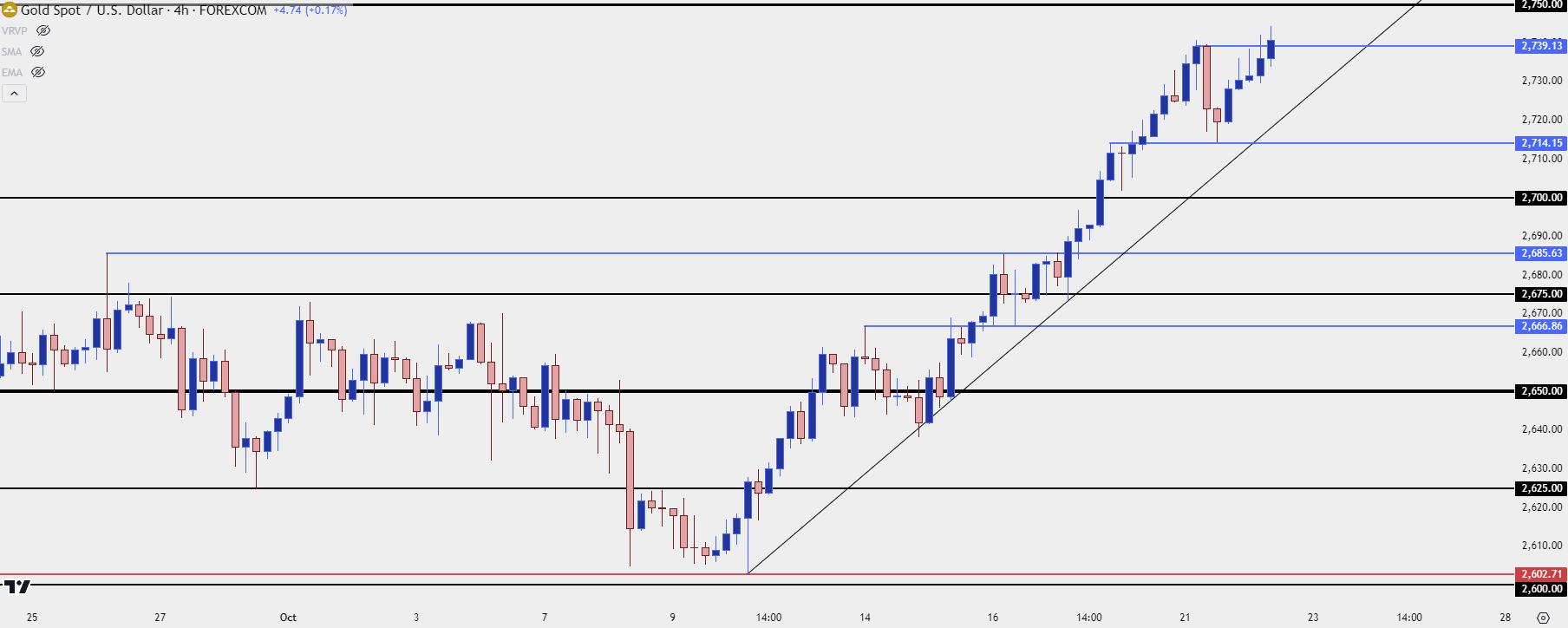

Gold

The trend in gold continues to impress and this has been a recurring theme for much of 2024 trade. But – there have been pullbacks, such as we saw with the build of the bull flag that was broken-through two weeks ago, and before that, a pullback from the 2600 level after the FOMC announcement of a 50 bp cut.

It seems that markets are pricing in a possible policy error here as the Fed remains dovish, rate cut expectations remain in-place for 2025 and US economic data, by and large, has been pretty positive.

Gold has been bullish to varying degrees since Q1 of this year when the metal began its current breakout, and there’s little reason to question that now given the fresh ATHs the printed again this morning. The question at this point is strategy, as the options of chasing or fading the move can both be seen as unattractive.

Last week showed support at prior resistance of 2685, and there hasn’t yet been much for testing around the 2700 handle. If we can see resistance play at or inside of 2750, that becomes a spot of interest to gauge bulls’ resolve while looking for a higher-low.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

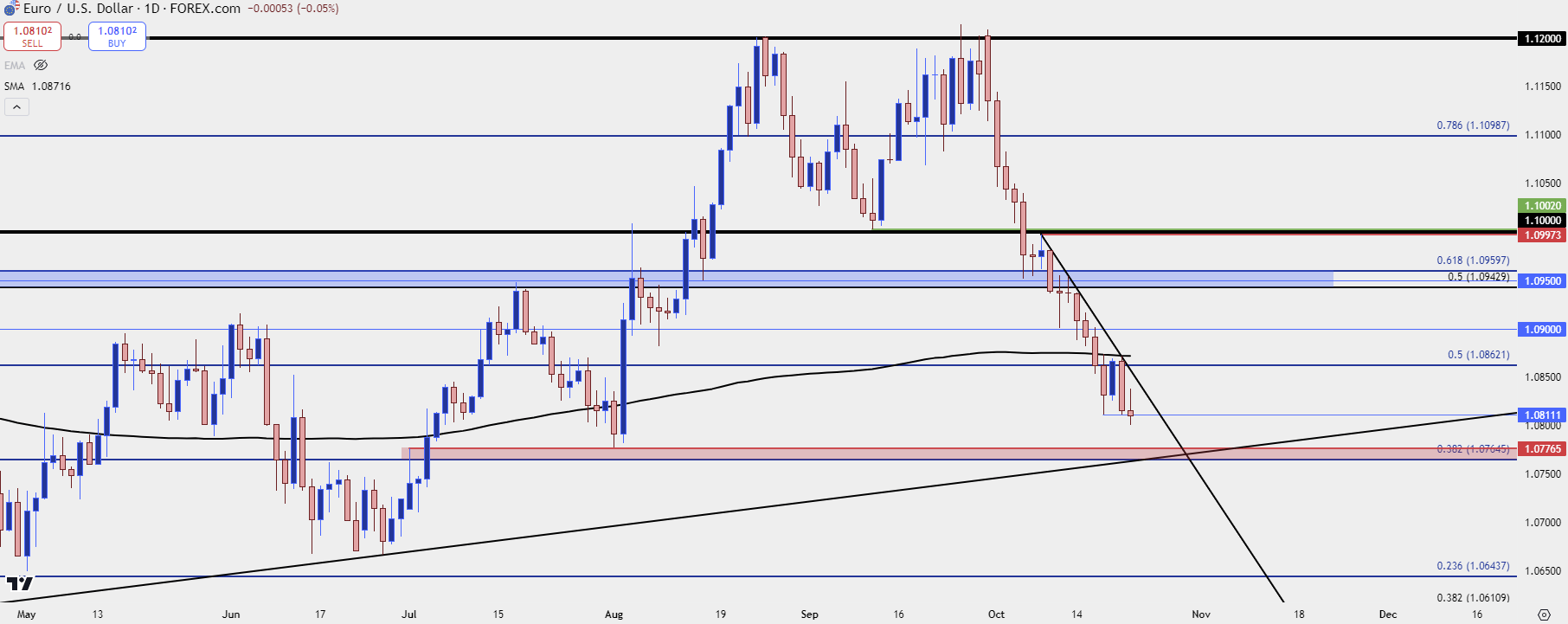

EUR/USD

It’s been a fast and heavy change for EUR/USD so far in Q4, and there’s still no sign of bears letting up. Price has pushed into oversold territory on the daily but the only recent bounce that showed last Friday brought fresh sellers into the mix with a test of the 200-day moving average to open this week.

There is a confluent spot of support below, however, plotted from around 1.0765-1.0777. Something like that could assist with a bounce into a lower-high and, at this point, the current support around 1.0811 could be an area of interest for that scenario.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist