- USD/CAD outlook: Despite softer Canadian CPI data, could the pair drop anyway?

- Fed officials maintain hawkish rhetoric amid sticky inflation signs but weakening data suggests Fed rate cuts could come in sooner

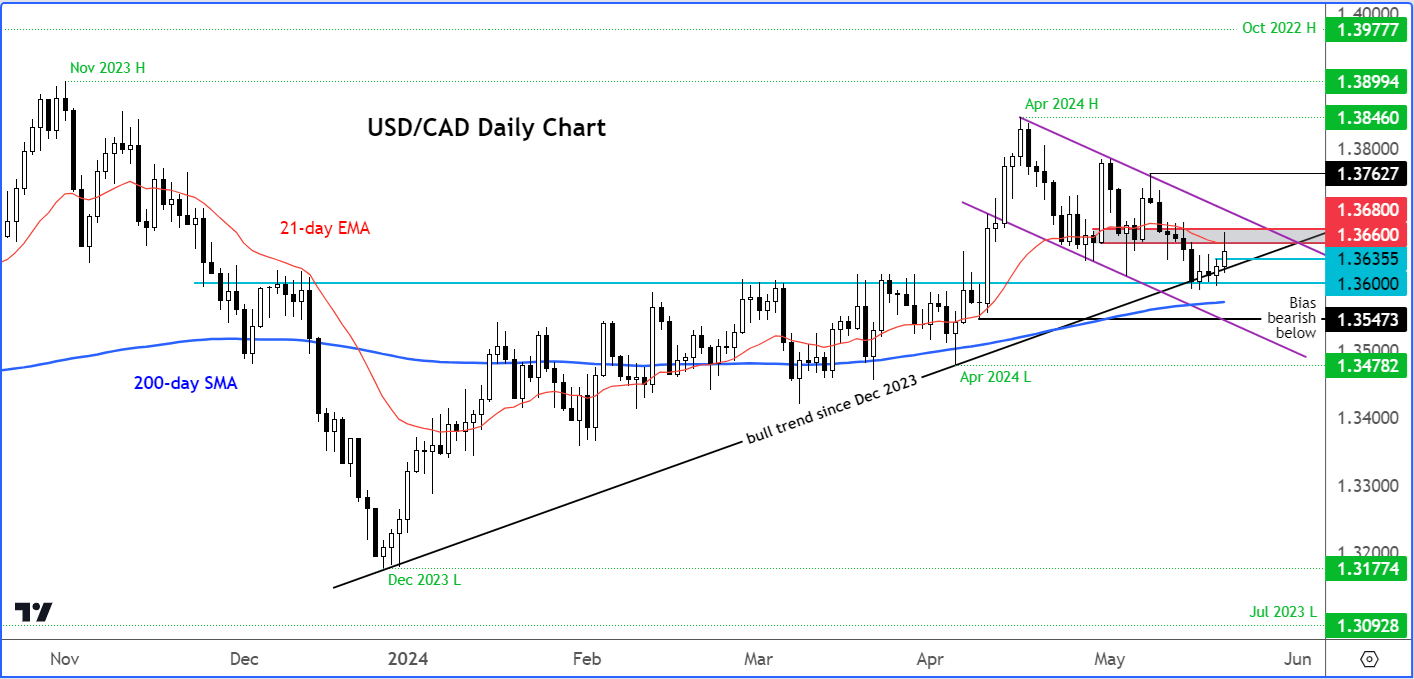

- USD/CAD inside bearish channel as bull trend supported for now

Today’s key macro highlight from North America was the release of Canadian CPI data, which came in slightly weaker, sending the USD/CAD higher, with the pair also helped along with some hawkish Fed comments. However, given the recent softening of US data, there is a possibility that interest rate cuts could come in sooner than expected in the US, after all, despite the warnings from the Fed. What’s more, the ongoing risk rally across global markets argue against a significant drop in risk-sensitive currencies like the Canadian dollar, even if inflation has slowed down in the North American nation faster than expected.

USD/CAD outlook: BOC set for June cut as CPI cools to 2.7%

Canada’s rate of inflation slowed to 2.7% in April, driven by slower growth in prices for food, services and durable goods. Although this was in line, several other measures of consumer inflation such as Median CPI (2.6%), Common CPI (2.6%) and Core CPI (1.6%) were all lower than expected. The data helped to increase the odds that the Bank of Canada will start cutting interest rates in June.

The drop in inflation is another welcome relief for the Canadian economy. We have seen improvement in data from Canada lately. April witnessed a surprisingly robust increase of 90,000 jobs and a steady 4.7% year-on-year wage growth. Additionally, the Canadian government has recently introduced stronger-than-expected stimulus measures. These factors suggests that any rate cuts by the BOC might be taken with caution and the cutting cycle could be a slow one, which could keep the CAD in favour against weaker currencies.

Hawkish Fedspeak keeps USD bears at bay

The US dollar, which has been stable in the last few days, following its data-driven sell-off last week, was supported further by hawkish Fedspeak. The central bank’s Raphael Bostic warned against expectations of an early rate cut and exuberance after the first cut. Meanwhile, Governor Christopher Waller said that inflation appears to be easing and that further interest rate increases will not be necessary. However, Waller warned that he will need some convincing in upcoming data before he backs rate cuts anytime soon. In fact, he wants to see “several more months of good inflation data” before being comfortable to support an easing policy, although he would react quicker if there were a “significant” weakening in the labour market.

The latest comments by the Fed officials suggests a rate cut before the end of the summer is unlikely. But this is something already expected by the markets, which is why we haven’t seen a massive rally in the dollar today.

USD/USD forecast: soft data reduces necessity to maintain a tight policy for extended period

While Fed officials have been quite cautious of late owing to sticky inflation signs, the US dollar has been hurt by softer-than-expected data anyway. This month, most of the data releases have surprised negatively, including the monthly jobs data, the forward-looking manufacturing and services PMIs, as well as data ranging from retail sales to building permits and housing starts. Even inflation data was a tad cooler. However, several Fed officials that have spoken this week, including Michael Ball and Philip Jefferson, have cautioned that inflation was not cooling as quickly as expected.

However, the Fed could be behind the curve. With the economy evidently weakening in the US, it is becoming increasingly difficult to justify maintaining a bullish view on the dollar following the latter’s gains in the first 4 months of the year against a basket of foreign currencies. This will be especially the case if the trend of disappointing data continues. If so, then one could assume that inflation may ease more rapidly moving forward, reducing the need to keep monetary policy tight for an extended period of time.

Despite the Fed officials' caution due to persistent inflation signs, the US dollar has suffered from weaker-than-expected data lately. This month's economic releases have mostly been disappointing, including monthly jobs reports, forward-looking manufacturing and services PMIs, and figures on retail sales, building permits, and housing starts. Even inflation data was slightly cooler. Nonetheless, several Fed officials have warned that inflation is not cooling as quickly as anticipated.

There is a risk that the Fed might be falling behind the curve. With the US economy clearly weakening, it is increasingly difficult to justify a bullish outlook on the dollar, especially following its gains in the first four months of the year against a basket of foreign currencies. If the trend of disappointing data continues, it could be assumed that inflation may ease more rapidly, reducing the necessity to maintain a tight monetary policy for an extended period.

USD/CAD outlook: technical levels to watch

Source: TradingView.com

The USD/CAD rallied to test the prior support area around 1.3660-1.3680 area following the Canadian CPI data. Could we see the Loonie head lower from here? Recent disappointing US data certainly point to a dimmer USD/CAD outlook, even if today’s Canadian CPI report challenges that view.

The USD/CAD managed to bounce back from around key 1.3600 support area following last Wednesday’s drop. This level was formerly a major resistance level until we broke higher in early April. In addition, the bullish trend line that has been in place since December, also provided some support here.

For us to turn tactically bearish on the USD/CAD, the abovementioned 1.3600 support needs to give way. Interim support now comes in at 1.3635, the high from Monday.

A potential break of 1.3600 support would also push the USD/CAD below the bullish trend line, providing some confirmation. The technical bias would completely flip to bearish in the event the most recent low at 1.3547 gets taken out, for that would also push rates below the 200-day average.

Meanwhile, the bulls will first need to push rates back above the 1.3660-80 resistance area to tip the short-term balance back in their favour. They will then need to lift rates out of the bear channel (see chart) to regain full control again and completely change the current USD/CAD outlook.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R