Hope springs eternal into the fall

An often-repeated theme of the global stock market’s current trade headline-driven phase is that shares are just a tweet away from their next sell-off. But the converse also applies. Days before the U.S. launches the first of several planned hikes of import duties on China with a 15% rise on around $110bn-worth of agricultural, antique, clothing, foot ware and kitchenware products, U.S. futures saw an early-session dip. That came after Treasury Secretary Steven Mnuchin declined to confirm that a meeting between top Chinese and U.S. officials mooted in September was still going ahead. “Conversations” continue though, Mnuchin noted. Whilst signalling that China was holding off from retaliation for the time being, the Commerce Minister’s spokesman also noted “discussions” around a possible meeting next month continued.

Well despite global shares rounding off their worst month since May, MSCI’s World Index shows stocks are posting their best week since June. A solid end to this month was possibly sealed by U.S. President Donald Trump pointing to “a talk scheduled for today (Thursday) at a different level”. Yet the only concrete development that appears to be reliable is that distant communications are continuing. There's no corroboration that material trade talks are scheduled. And key points in the current backdrop and looming in coming weeks and months ahead increase the urgency for a more committed re-engagement.

- The U.S. has reportedly opened new enquiries into alleged instances of intellectual property theft by Huawei. Both Beijing and Washington have sought to portray their stand-off over the group as unconnected to the trade dispute. But markets continue to react to moves like a mooted ban on Huawei from doing business in the States, or developments related to its CFO, who awaits trial in Canada, as if the group is an inextricable part of the trade war

- China’s renminbi is set to close August with its biggest monthly dip in 25 years, according to Bloomberg data, which shows the yuan down approaching 4% this month. Beijing continues to manage the currency’s depreciation but following its cross over the symbolic but widely acknowledged seven yuan per dollar threshold earlier in August, it has remained above it. This eloquently conveys that the PBOC’s yuan path will continue lower so long as trade remains unresolved

- The U.S.’s staged round of escalation in coming months is well on track. The first of a two-leg set that kicks in on Sunday on £110bn of Chinese goods, at 15%, will be followed on 1st October by another 5% tariff raise from 25% to 30%, whilst a set of products currently taxed at 5%, 10% and 35% will all see 5% hikes on 15th December

- The outlook for China’s all-important manufacturing sector is becoming even more critical as signs that the trade war is hurting the economy become clear. Should an official Manufacturing PMI out on Saturday, and a private version by Caixin due next week, show signs of a deepening slowdown, the pressure that Beijing is resisting to retaliate, will increase

For now, the key takeaway for investors looking to reallocate back into riskier plays on an improving view of the trade dispute, is that reasons for increased confidence remain ambiguous. U.S. stocks, which are leading a strong global weekly close, remain pivotal as they maintain their lead over principal Western markets despite fractured ties with China.

Chart thoughts

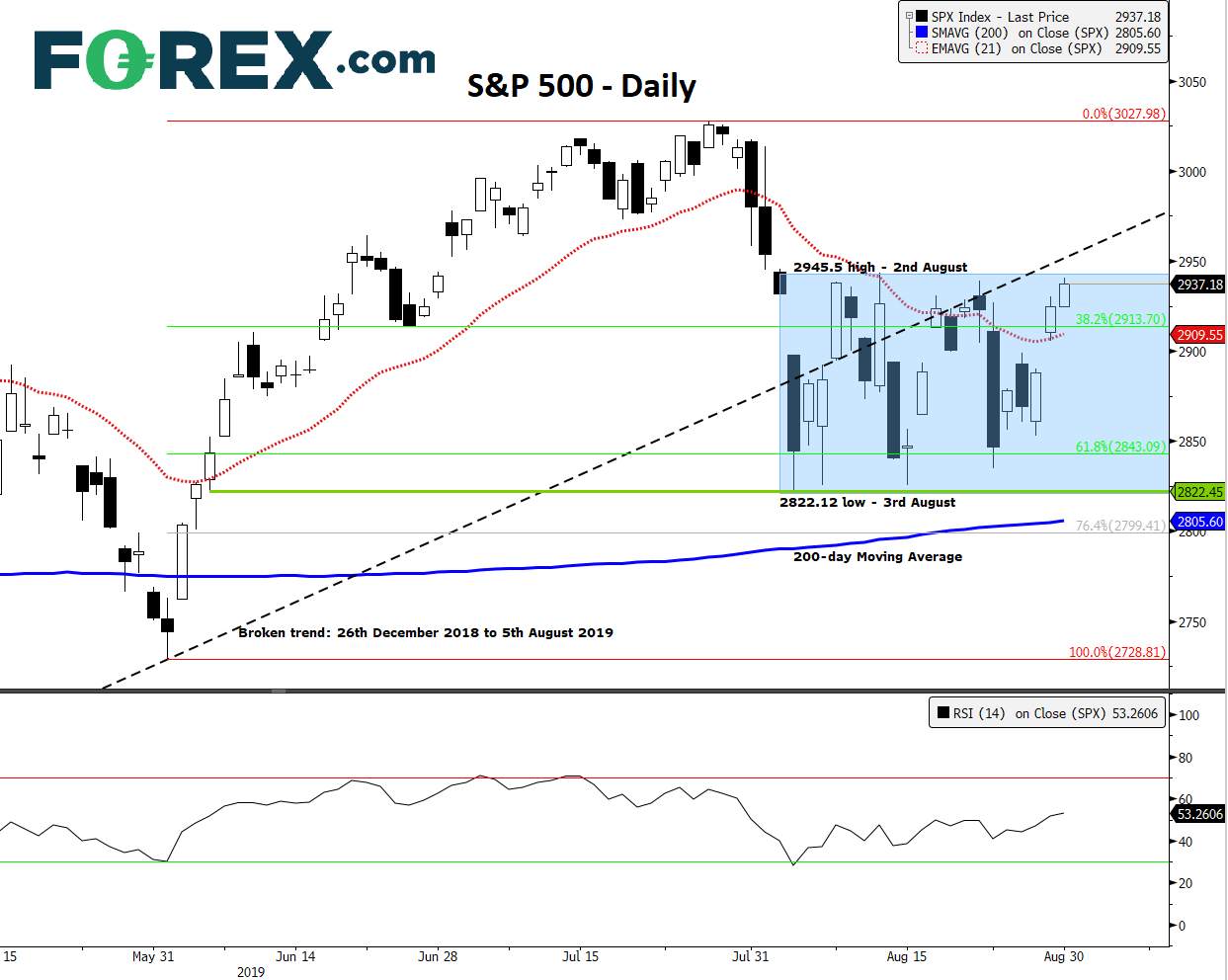

S&P 500’s August consolidation range remains in focus. It is demarcated between the 2945.50 high of 2nd August and 2822.12 low a day later. Since then, price has narrowly avoided going lower on at least three clear occasions, but it has not managed to get higher either. With its late-month upswing, SPX is challenging the upper bound of the range, having spun over the 21-day exponential average, a good gauge of contemporaneous sentiment. Some support may now be shown from the 38.2% interval of the June-to-late-July move that topped at 3027. But to escape this critical band, the index also faces a challenge from the underside of the solid rising trend line that began at last year’s correction bottom on Boxing Day. An evidently optimistic rebound of sentiment is reflected in SPX’s chart as well as fundamentals. The index’s break out from its tight range could signify that genuine progression is in sight. Failure at key levels would back our suspicion that recent hopes aren’t well-founded.

S&P 500 – Daily

Source: Bloomberg/FOREX.com