US futures

Dow futures +0.22% at 32075

S&P futures +0.5% at 3954

Nasdaq futures +1% at 12685

In Europe

FTSE -0.58% at 7515

Dax -0.32% at 15175

- Fed hikes rates by 25 bps

- The market still expects a rate cut this year

- GBP rises after the BE hikes rates by 25 bps

- Oil is steady after a strong rebound

The market still expects a rate cut

US futures are set to rebound as the markets continue to digest the Federal Reserve’s interest rates decision.

As expected, the Fed raised rates by 25 basis points taking the rate range to 4.75-5%, in line with expectations. Federal Reserve chair Jerome Powell said that policymakers had considered putting rate hikes on pause as the central bank considered the two risks at play.

Firstly inflation remains elevated at 6%, three times the Fed’s target level. Secondly, the banking crisis has been unfolding over the past ten days. The Fed doesn’t know to what extent the banking crisis could slow the economy or whether it has now been contained. This means that unknowns have increased, making the Fed’s job that bit harder to decide the right course of action to rein in inflation, making a hard landing more likely. The Fed also downwardly revised its growth forecast for this year.

While the Fed pushed back against rate cut expectations, this has fallen on deaf ears. The market reaction suggests that investors are still expecting a rate cut this year. According to the CME Fedwatch, the market is currently pricing in a 96 probability of at least one at 25 basis point cut and an 80% probability of at least 50 basis point cut by the end of the year.

As a result, stocks are rebounding from yesterday’s losses, and the US dollar remains depressed around a seven-week low.

In addition to the interest rate decision, investors are also digesting the latest U S jobs data. Initial jobless claims showed that the labor market remains strong, with initial jobless claims unexpectedly falling to 191,000 from 192,000 the previous week.

Corporate news

First Republic Bank and other regional U.S. banks are climbing higher, clawing back losses from yesterday after Treasury Secretary Yellen said that there wouldn’t be blanket support across banks deposits.

General Mills is rising 1.7% premarket after the food processing giant upwardly revised its annual sales forecast thanks to price increases and strong demand for cereals and pet foods.

Ford is rising pre-market as the giant automobile change the way that it reports results from regional to per business unit. Ford predicted its electric vehicle business unit will lose $3 billion this year as the firm transitions to EV.

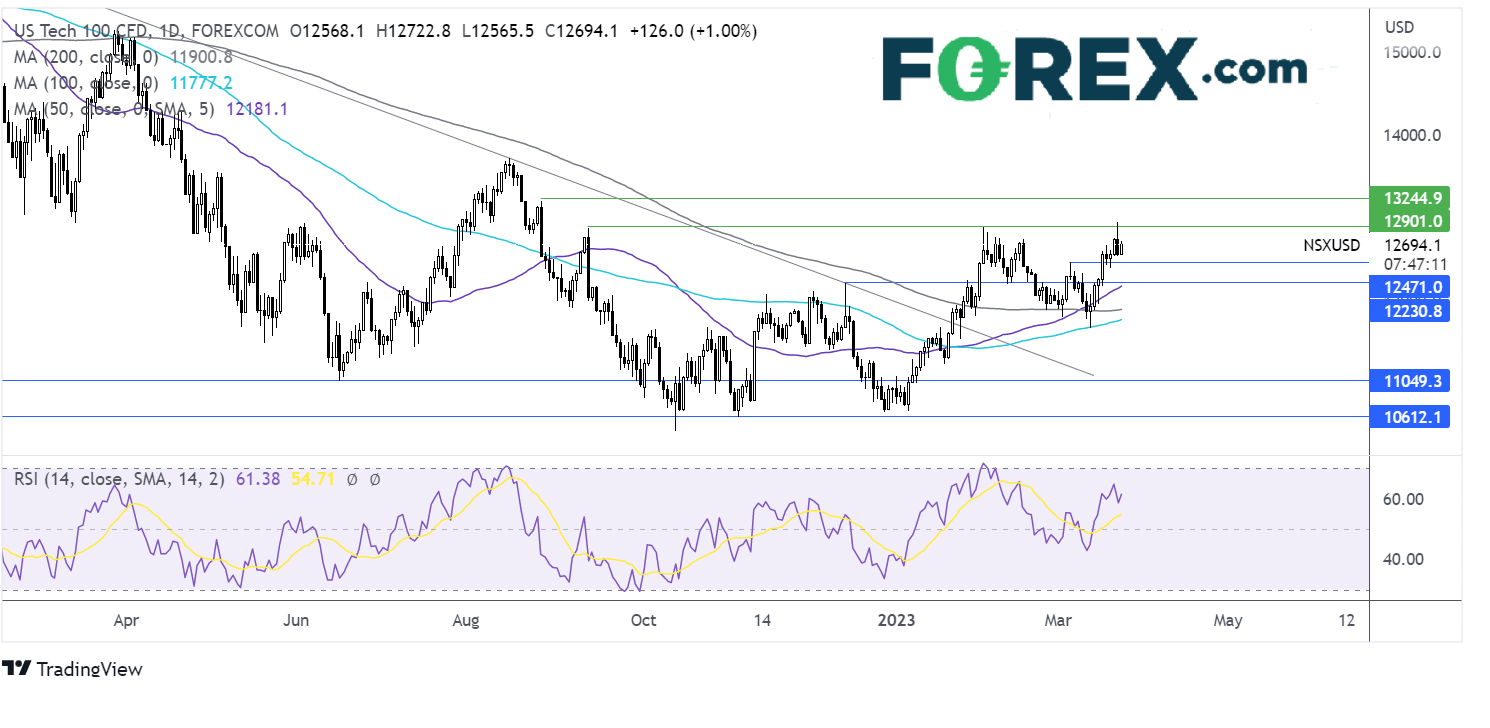

Where next for the Nasdaq ?

12950 proved to be a difficult level to cross again and the NASDAQ has eased back to current levels around 12700. The rise above resistance at 12465, in addition to the bullish RSI and the golden cross signal with the 50 sma crossing above the 200 sma, keep buyers hopeful of further gains. Buyers need to rise above 12950 to create a higher high and bring 13200, the August 26 high, into play. Sellers could look for a move below 12460 to expose the December high at 12215.

FX markets – USD falls, GBP rises

The USD is falling for a sixth straight day as investors continue to digest the latest fed meeting. With the Fed failing to squash expectations of rate cuts this year, the US dollar is falling against its major peers.

EUR/USD is rising on growing central bank divergence. The ECB is expected to continue hiking rates in order to address stickier-than-expected inflation. ECB president Christine Lagarde has warned that with inflation at current levels, more hikes will be needed.

GBP/USD is rising after the Bank of England voted 2 raise interest rates by 25 basis points, in line with expectations taking the rate to 4.25%, the highest level since 2008. in the absence of a press conference, the focus was on the vote split, which showed 7:2 in favor of a hike. The fact that no more policymakers joined Tenreyo and Dhngra despite the banking crisis could be construed as slightly more hawkish.

EUR/USD +0.28% at 1.0791

GBP/USD +0.45% at 1.2272

Oil steadies after 3-days of gains

Oil prices are holding steady after three straight days of gains. Prices pushed back over $70 the barrel, having fallen to a 15-month low earlier in the week.

Oil gains are being limited by concerns over the health of the US economy after Fed chair Jerome Powell said that the banking industry stress could trigger a credit crunch and downwardly revised US economic growth this year. Meanwhile, the USD dropped to a seven-week low, underpinning the oil price as a weaker dollar makes oil cheaper for buyers with other currencies.

Separately US crude inventories rose by 1.1 million barrels taking crude stockpiles to 481.2 million barrels, the highest since May 2021. expectations had been for a 1.6-million-barrel decline.

WTI crude trades -0.3% at $70.45

Brent trades at -0.4% at $76.16