US futures

Dow futures -0.60% at 33840

S&P futures -1.17% at 4130

Nasdaq futures -2% at 12533

In Europe

FTSE +0.41% at 7856

Dax -0.95% at 153e69

517k jobs added in January!!

US futures are heading southwards as investors continue digesting disappointing big tech earnings from after yesterday’s close, in addition to a blowout jobs report.

The non-farm payroll report showed that the US saw 517k jobs created in January, well above the 260k jobs added in December and the 190k forecast. Meanwhile, the unemployment rate defied forecasts of rising and ticked lower to 3.4% while average wages rose on 0.3% MoM.

Job creation smashed forecasts suggesting that employers are still feeling the need to hire workers. However, this isn’t having the effect of pushing up wages. Even so, the strong labour , market suggests that the economy may not be cooling as much as hoped.

The initial market reaction is one that reflects a more hawkish stance from the Fed. The USD has jumped, while US stocks and Gold have fallen sharply lower.

Looking ahead, US ISM services PMI data is still due to be released and is expected to show that activity returned to growth in January, rising to 50.4, up from 49.6 in December. More strong data could unnerve the markets further.

Corporate news

Amazon trades 5% lower pre-market after reporting Q4 results. The e-commerce giant posted EPS of $0.03, well below estimates of $0.17. Meanwhile, revenue was $149.2 billion, up 8.5% from the same period last year and ahead of estimates of $145.64 billion.

Apple is trading lower premarket after Q on APS came in below forecasts at $1.88. Revenue 5% to $117.2 billion, missing expectations of $121.88 billion and marking the biggest quarterly drop in revenue since 2016.

Alphabet trades over 3.3% lower ahead of the open after EPS came in at $1.05, below estimates of $1.18. Revenue was also weaker than expected at $76.05 billion against $76.07 billion forecast.

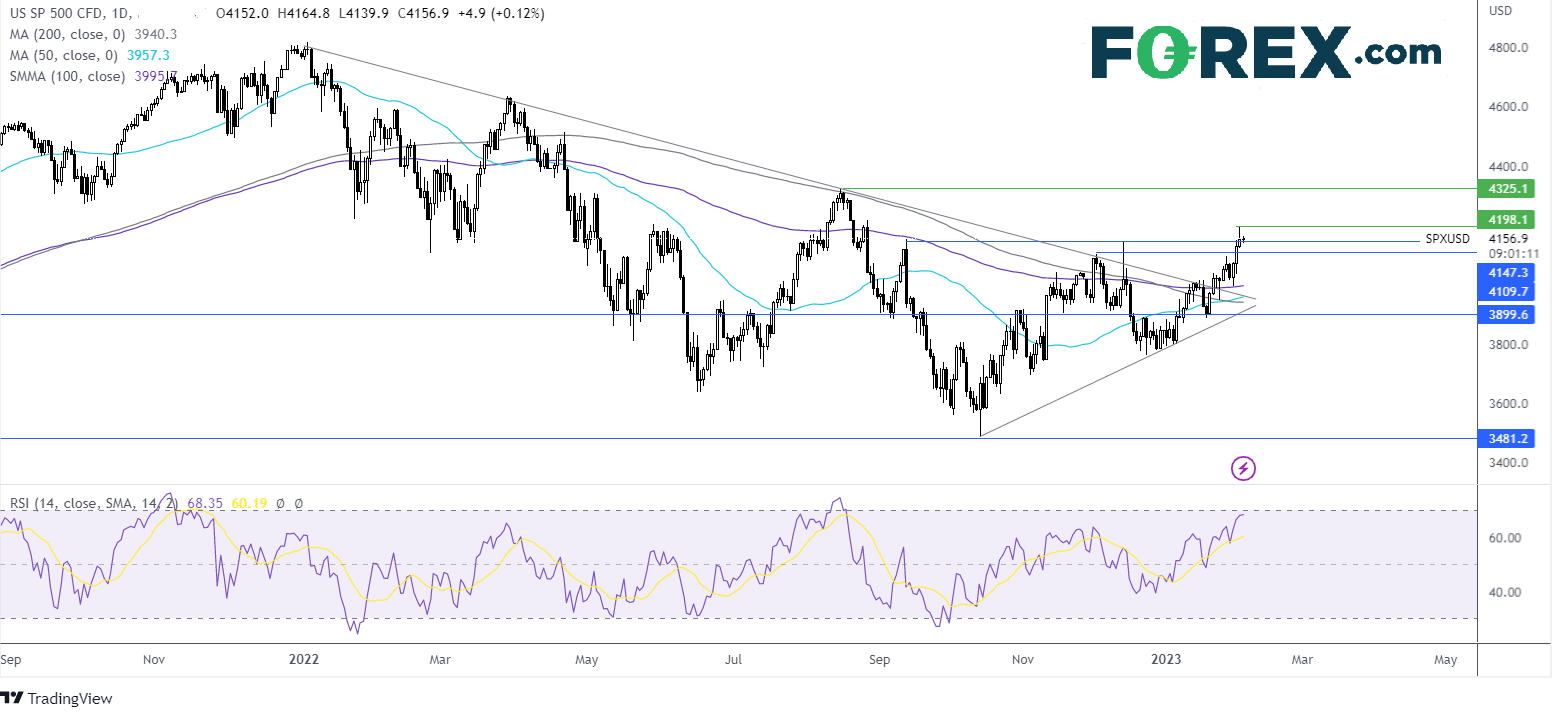

Where next for the S&P500?

The S&P500 rebounded off the 100 sma at 3995 and extended gains to 4195, the 2023 high, taking out some key resistance on the way. The RSI is over 50 but below 70, supporting further upside and the 50 sma has crossed above the 200 sma in a golden cross bullish signal. Buyers could look for a move over 4195, the 2023 high to extend the bullish run-up to 4325 the August high. Immediate support can be seen at 4155 the September high, ahead of 4100 round number and 3995 the 100 sma.

FX markets – USD rises, GBP falls

The USD is rising firmly after the stronger-than-expected jobs report. The huge job creation figures, points to a very strong labour market and potentially more hiking action from the Fed.

GBP/USD is slumping on USD strength, adding to losses from the previous session after the BoE hiked rates by 25 basis points but also sounded less hawkish than expected. Adding support to the pound, UK business activity slowed further in January to 48.5, down from 49 in December and the slowest rate for 2 years, which could keep the lid on GBP gains.

EUR/USD has dropped below 1.09 on USD strength and after mixed data earlier today. Investors digested hotter-than-expected PPI inflation and data showing that eurozone business activity returned to growth in January. The composite PMI was 50.3, up from 49.3 in December and ahead of the 50.2 forecast. PPI was 24.6% YoY in December, down from 27% but ahead of the 22.5% forecast.

GBP/USD -0.9% at 1.2110

EUR/USD -0.7% at 1.0833

Oil is set for weekly losses

Oil prices are holding steady on Friday but is set to lose over 4.5% across the week marking the second straight week of losses, as investors weigh up a slew of central bank rate hikes this week and as investors eye developments surrounding an EU ban on Russian refined products.

EU countries are looking to agree on a deal to set price caps on Russian oil products. This comes after the European Commission last week proposed that the EU apply a price cap of $100 per barrel on Russian oil products like diesel.

The price cap needs to be approved by all 27 EU members, which failed to reach an agreement on Wednesday. The International Energy Agency doesn’t consider that the move would have a major impact on the oil market.

WTI crude trades -0.2% at $75.86

Brent trades at -0.2% at $81.96

Looking ahead

14:45 US Composite PMI

15:00 ISM services PMI

15:00 Baker Hughes oil rig count