US futures

Dow futures -0.44% at 33393

S&P futures -0.38% at 4064

Nasdaq futures -0.15% at 12085

In Europe

FTSE +0.21% at 7789

Dax +0.43% at 15192

A hawkish Fed? ADP payrolls drop sharply

US futures are heading lower as investors await a barrage of data and the Federal Reserve interest rates decision.

The market, particularly growth stocks, has rallied hard across the start of the year on optimism that the Fed will slow the pace of rate hikes and then cut rates by the end of the year.

With inflation still over 3 times the Fed’s target, it is clear that the Fed still has more work to do. Any talk of a dovish pivot is still wishful thinking.

While the Fed is set to slow the pace of hikes to 25 basis points, there has been a clear disconnect between what the markets are pricing in and what the Federal Reserve has been saying. Federal Reserve Chair Powell use this press conference to try to set the record straight (again), but will the market take much notice? After the Fed’s errors in anticipating the rise in inflation, is there an expectation that similar errors are being made on the way down?

A hawkish-sounding Fed would typically pull stocks and gold lower and boost the USD.

Ahead of the meeting, US ADP data showed that private payrolls fell sharply in January to 106k, down from 253k in December and well below the 178k forecast, suggesting that weakness could be seeping into the jobs market.

Looking ahead, US JOLTS job opening data and ISM manufacturing data is due to come out later. Job openings are expected to ease slightly to 10.250 million, down from 10.458 million, highlighting ongoing tightness in the labour market.

Earnings continue to roll in with Snap dropping sharply on revenue disappointment. In previous earnings the stocks has proved to be a canary in the coal mine, raising concerns over sector peers. Facebook parent Meta is due to report after the close.

Corporate news

Peloton is rising pre-market after reporting a slower cash burn in Q2 as cost-cutting measure take effect. Cash burn was $94.4 million compared to $546.7 million a year earlier.

Snap falls 15% pre-market after the social media platform posted its slowest revenue growth since going public in 2017 and predicts that revenue will fall 10% this quarter, as changes to Apple’s privacy policies continue to disrupt its ability to tailor advertising to users.

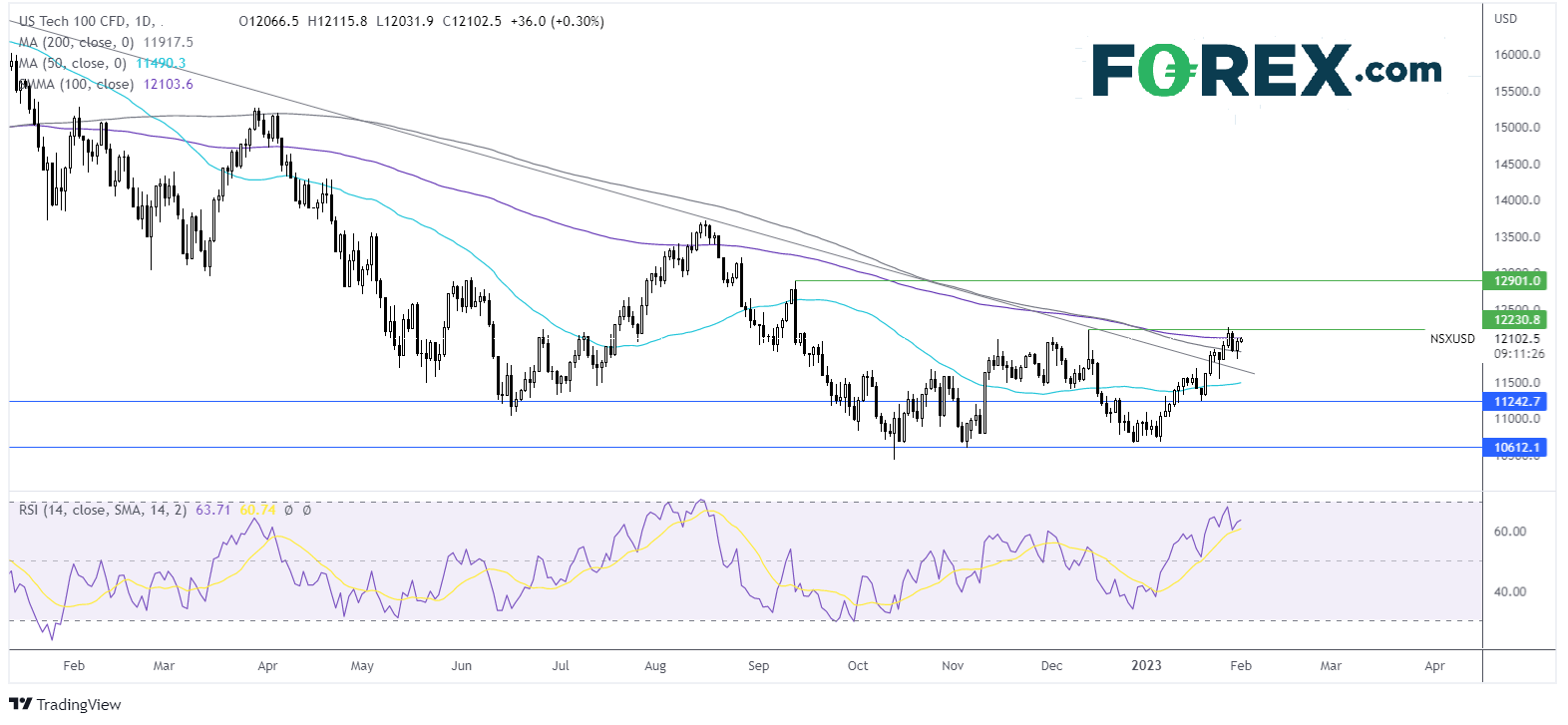

Where next for the Nasdaq?

After closing above the 200 sma in the previous session, the Nasdaq is testing resistance at the 100 sma at 12090. The RSI is above 50 and supports further upside while it remains out of oversold territory. Buyers will look for a rise over 12250, the 2023 high to extend the bullish run and create a higher high. From here 12900, the September high comes into play. On the flip side, should sellers successfully defend the 100 sma, and break below the 200 sma at 11900, bears could push the price lower towards 11700 the multi-month falling trend line.

FX markets – USD falls, EUR rises

The USD is falling for a second straight session after data yesterday showed that inflationary pressures were falling and consumer confidence stumbled. Today’s weaker-than-forecast ADP payroll data is adding press

GBP/USD is trading sideways, struggling to gain traction, despite the weaker USD. UK manufacturing data showed that output contracted in January at 47, an improvement on the preliminary reading of 46.7 and the 45.3 in December, a 31-month low. The data comes ahead of the BoE rate decision tomorrow and as the UK economy is set to fall into recession.

EUR/USD is rising after data showed that annual inflation fell sharply to 8.5% YoY in January, down from 9.2% in December and double digits in November. Usually, cooler inflation would drag on the currency but that isn’t hurting euro demand today. Data also showed that the manufacturing downturn in Europe was easing, as the PMI rose to 48.9 a seven-month high.

GBP/USD +0.06% at 1.2325

EUR/USD +0.3% at 1.0890

Oil looks to the Fed & OPEC+ meetings

Oil prices are holding steady ahead of the Fed and OPEC+ meeting and after solid gains yesterday.

Oil prices rose yesterday, boosted by US data which supported the view that inflationary pressures were easing, and by the IMF’s upward revision for global growth to 2.9%.

Oil prices also found support from a falling USD, as investors look ahead to the Federal Reserve rate decision later today.

Today attention is on OPEC+, which is expected to stick to current output levels.

EIA stockpile data is also due and comes after API data showed that stockpiles rose by a more than expected 6.3 million barrels in the week ending 27 January.

WTI crude trades +0.43% at $79.60

Brent trades at +0.3% at $85.05

Looking ahead

15:00 ISM manufacturing PMI

15:00 JOLTS job openings

15:30 EIA crude oil stockpiles

19:00 Fed rate decision

19:30 Fed Chair Powell’s press conference