US futures

Dow futures +0.1% at 32535

S&P futures +0.06% at 3984

Nasdaq futures +0.01% at 12630

In Europe

FTSE +1.76% at 7530

Dax +1.85% at 15200

- Fed to hike rates 25 bpds

- Banks remain supported

- Nike falls after warning on margins

- GBP jumps on hot inflation

- Oil is steady after a strong rebound

Learn more about trading indices

25 bps points priced in

US futures are steady as investors look ahead to the FOMC rate decision, a decision where the central is caught between high inflation and stresses in the banking sector.

The market is almost fully pricing in a 25 basis point rate hike taking the rate to the 4.75-5% range, although this has been significantly downwardly revised in just two weeks, owing to the banking crisis. Prior to cracks appearing in the financial system the market had been pricing in a 50 basis point hike. Still inflation is 3 times the Fed’s target rate and proving to be stickier than expected.

A 25 bps seems like a good compromise between targeting inflation while not going so aggressively to spook the market. Similarly if the Fed didn’t raise rates the market may interpret that as a lack of confidence in the banking sector and fuel more volatility in the sector.

In addition to the rate hike. Investors will be looking towards quarterly projections which should give further clues as to the path of future interest rates and whether the market is right in pricing a 50 basis point cut before the end of the year.

Banking stocks will remain in focus and are expected to be supported, extending gains from yesterday after Treasury Secretary Janet Yellen promised more help from the government if it was needed.

Corporate news

First Republic Bank is falling ahead of the Federal Reserve right decision even as further government support to stabilise the regional lender is discussed.

Nike falls premarket after the sportswear retailer beat revenue and earnings estimate but warned on margin pressures owing to access inventery. 1000 China also disappointed.

GameStop jumps 50% video game retailer surprise the market by posting a profit in Q4, its first profit since early 2021 boosted by reduced costs and job cuts.

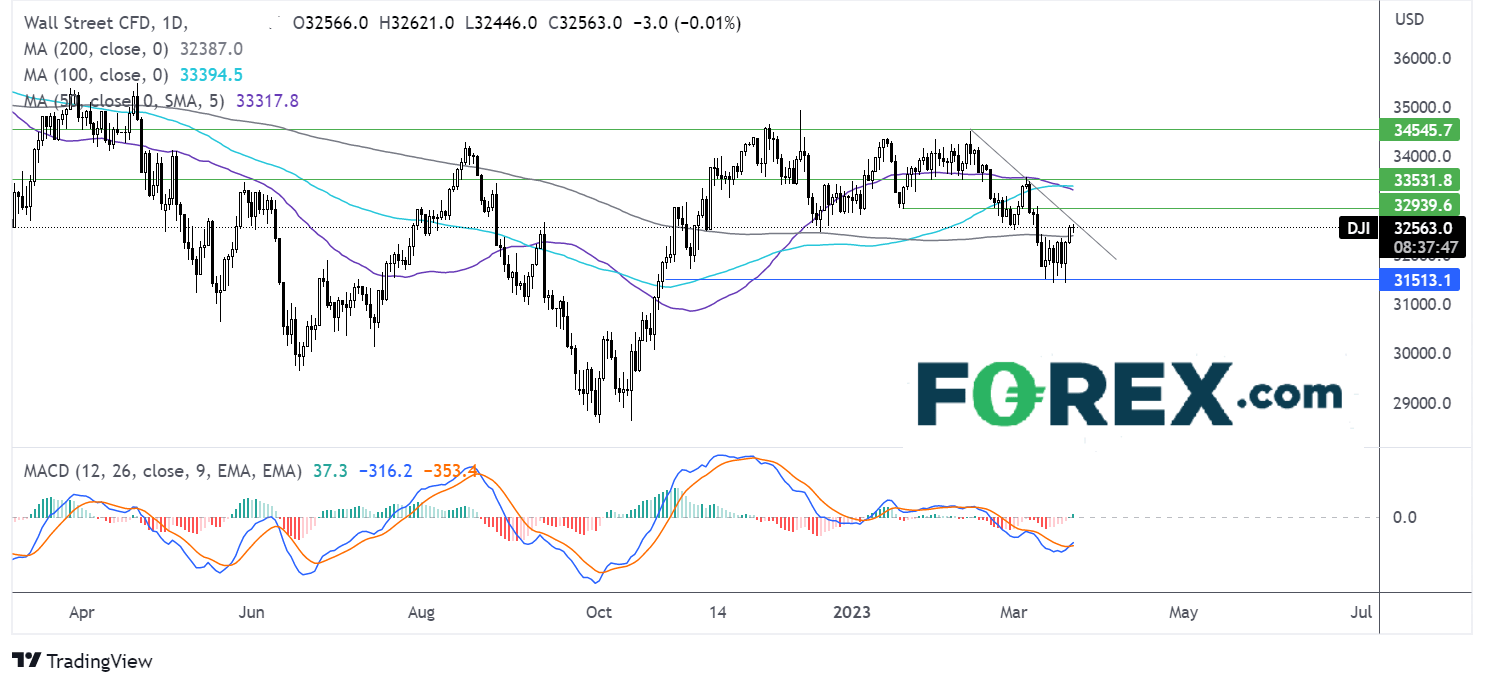

Where next for the Dow Jones ?

After finding support at 31400 the Dow Jones rebounded higher, closing above the 200 sma, which together with the long lower wicks on last week’s candles and the bullish crossover on the MACD help keep buyers hopeful of further gains and a rise above the 5-week falling trendline towards 32940 the January 20 low. A rise above here exposes the 50 sma at 33300. Immediate support can be seen at the 200 sma at 32360 with a break below here opening the door to 31400.

FX markets – USD falls, GBP rises

The USD is falling for a fifth straight session after central banks acted to shore up the banking sector earlier in the week and as investors look ahead to the Federal Reserve interest rate announcement.

EUR/USD is rising for a fifth straight session add worries surrounding the European banking sector is and after hawkish comments from ECB president Christine Lagarde yesterday he said that inflation at its current levels warrants further rate hikes. there is no eurozone data due today Christine Lagarde will be speaking this afternoon.

GBP/USD is rising after you can inflation came in hotter than expected at 10.4%. This was well above 10.1% in January undefined expectations of a full two 9.9%. core inflation also rose two 6.2% up from 5.8%. data piles pressure on the Bank of England to raise interest rates by have further 25 basis points tomorrow despite recent stress in the banking sector.

EUR/USD +0.28% at 1.0791

GBP/USD +0.45% at 1.2272

Oil steadies in cautious trade

Oil is holding steady after two straight days of strong gains as investors sit on the side lines ahead of the FOMC rate decision.

oil has rallied over 4% across the past two sessions as fears surrounding the banking crisis fade and risk sentiment improves.

Oil markets are showing some signs of cation today ahead of the Fed, but also after API data showed that US create and venture is unexpectedly rose last week raising questions over oil demand.

Investors well look to EIA oil stockpile data June this afternoon

WTI crude trades -0.3% at $69.45

Brent trades at -0.4% at $74.88

Learn more about trading oil here.

Looking ahead

18:00 FOMC rate decision