- Trump tweets that China’s Vice Premier Liu He is coming to the US “to make a deal,” boosting hopes of a potential trade deal this week (and by extension, risk assets). That said, traders are cautious after a Reuters report that China backtracked on all of its previous trade commitments. See why the outcome of this week’s trade talks may be a binary event for pairs like AUD/JPY and USD/CNH.

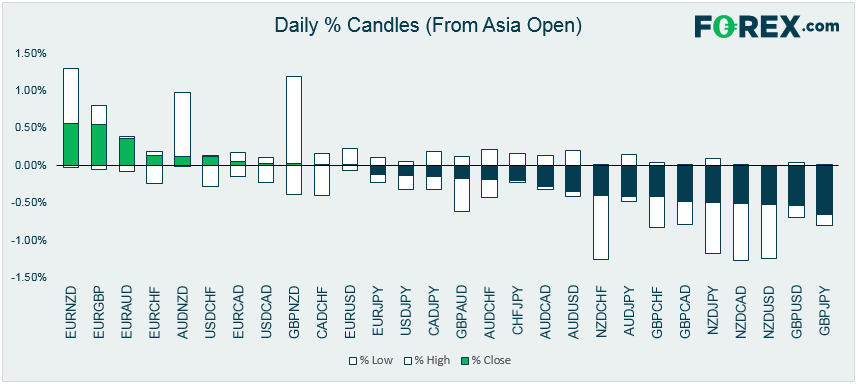

- The Japanese yen was the strongest major currency for the second consecutive day, with USD/JPY peeking below 110.00 before stabilizing just above that level through today’s US session.

- The pound (ongoing Brexit uncertainty) and kiwi (RBNZ rate cut) were the weakest major currencies on the day.

- Gold closed roughly flat on the day but could be a big beneficiary if US-China trade talks fail to reach an agreement.

- Chinese inflation figures for April (CPI and PPI) will be the major economic data to watch in today’s Asian session trade.

Latest market news

December 20, 2024 04:14 PM

December 20, 2024 02:45 PM

December 19, 2024 10:26 PM

December 19, 2024 05:22 PM

December 19, 2024 02:23 PM

December 19, 2024 01:56 PM